The Insider Monkey team has completed processing the quarterly 13F filings for the March quarter submitted by the hedge funds and other money managers included in our extensive database. Most hedge fund investors experienced strong gains on the back of a strong market performance, which certainly propelled them to adjust their equity holdings so as to maintain the desired risk profile. As a result, the relevancy of these public filings and their content is indisputable, as they may reveal numerous high-potential stocks. The following article will discuss the smart money sentiment towards INTL Fcstone Inc (NASDAQ:INTL).

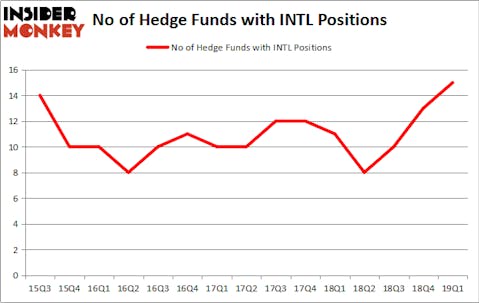

INTL Fcstone Inc (NASDAQ:INTL) was in 15 hedge funds’ portfolios at the end of the first quarter of 2019. INTL has experienced an increase in activity from the world’s largest hedge funds lately. There were 13 hedge funds in our database with INTL holdings at the end of the previous quarter. Our calculations also showed that INTL isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to take a look at the key hedge fund action surrounding INTL Fcstone Inc (NASDAQ:INTL).

How have hedgies been trading INTL Fcstone Inc (NASDAQ:INTL)?

At Q1’s end, a total of 15 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 15% from the previous quarter. On the other hand, there were a total of 11 hedge funds with a bullish position in INTL a year ago. With the smart money’s positions undergoing their usual ebb and flow, there exists a few key hedge fund managers who were adding to their holdings substantially (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Gregg J. Powers’s Private Capital Management has the most valuable position in INTL Fcstone Inc (NASDAQ:INTL), worth close to $27.5 million, comprising 4.1% of its total 13F portfolio. The second largest stake is held by Jeffrey Bronchick of Cove Street Capital, with a $22 million position; the fund has 2.7% of its 13F portfolio invested in the stock. Some other professional money managers that are bullish consist of Brian Bares, Russell Mollen, and James Bradshaw’s Nine Ten Partners, Chuck Royce’s Royce & Associates and Jim Simons’s Renaissance Technologies.

As one would reasonably expect, specific money managers were breaking ground themselves. Millennium Management, managed by Israel Englander, created the most outsized position in INTL Fcstone Inc (NASDAQ:INTL). Millennium Management had $0.7 million invested in the company at the end of the quarter. David Harding’s Winton Capital Management also made a $0.4 million investment in the stock during the quarter. The only other fund with a brand new INTL position is Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as INTL Fcstone Inc (NASDAQ:INTL) but similarly valued. These stocks are Verso Corporation (NYSE:VRS), Laredo Petroleum Inc (NYSE:LPI), Winmark Corporation (NASDAQ:WINA), and Covia Holdings Corporation (NYSE:CVIA). This group of stocks’ market values are closest to INTL’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| VRS | 24 | 142939 | 2 |

| LPI | 18 | 187141 | 4 |

| WINA | 7 | 101640 | -1 |

| CVIA | 5 | 61568 | 0 |

| Average | 13.5 | 123322 | 1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.5 hedge funds with bullish positions and the average amount invested in these stocks was $123 million. That figure was $78 million in INTL’s case. Verso Corporation (NYSE:VRS) is the most popular stock in this table. On the other hand Covia Holdings Corporation (NYSE:CVIA) is the least popular one with only 5 bullish hedge fund positions. INTL Fcstone Inc (NASDAQ:INTL) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately INTL wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on INTL were disappointed as the stock returned -6.8% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.