The financial regulations require hedge funds and wealthy investors that crossed the $100 million equity holdings threshold to file a report that shows their positions at the end of every quarter. Even though it isn’t the intention, these filings to a certain extent level the playing field for ordinary investors. The latest round of 13F filings disclosed the funds’ positions on June 28th. We at Insider Monkey have made an extensive database of nearly 750 of those established hedge funds and famous value investors’ filings. In this article, we analyze how these elite funds and prominent investors traded IAA, Inc. (NYSE:IAA) based on those filings.

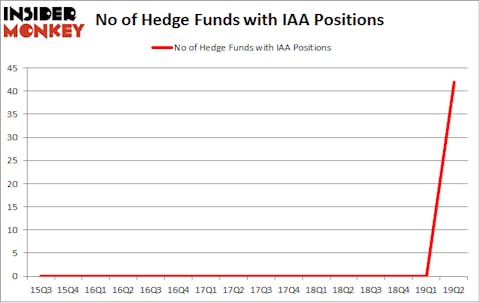

IAA, Inc. (NYSE:IAA) was in 42 hedge funds’ portfolios at the end of the second quarter of 2019. IAA investors should be aware of an increase in activity from the world’s largest hedge funds of late. There were 0 hedge funds in our database with IAA positions at the end of the previous quarter. Our calculations also showed that IAA isn’t among the 30 most popular stocks among hedge funds.

To most shareholders, hedge funds are seen as unimportant, old financial vehicles of years past. While there are greater than 8000 funds with their doors open at the moment, Our researchers choose to focus on the upper echelon of this group, around 750 funds. These investment experts handle most of all hedge funds’ total capital, and by keeping an eye on their top stock picks, Insider Monkey has found numerous investment strategies that have historically outperformed the market. Insider Monkey’s flagship hedge fund strategy exceeded the S&P 500 index by around 5 percentage points annually since its inception in May 2014. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 25.7% since February 2017 (through September 30th) even though the market was up more than 33% during the same period. We just shared a list of 10 short targets in our latest quarterly update .

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to take a peek at the latest hedge fund action encompassing IAA, Inc. (NYSE:IAA).

How are hedge funds trading IAA, Inc. (NYSE:IAA)?

At Q2’s end, a total of 42 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 42 from one quarter earlier. By comparison, 0 hedge funds held shares or bullish call options in IAA a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in IAA, Inc. (NYSE:IAA) was held by Gates Capital Management, which reported holding $124.8 million worth of stock at the end of March. It was followed by Cardinal Capital with a $100.7 million position. Other investors bullish on the company included D E Shaw, Scopia Capital, and Maverick Capital.

As one would reasonably expect, key hedge funds were leading the bulls’ herd. Gates Capital Management, managed by Jeffrey Gates, assembled the largest position in IAA, Inc. (NYSE:IAA). Gates Capital Management had $124.8 million invested in the company at the end of the quarter. Amy Minella’s Cardinal Capital also made a $100.7 million investment in the stock during the quarter. The other funds with brand new IAA positions are D. E. Shaw’s D E Shaw, Matt Sirovich and Jeremy Mindich’s Scopia Capital, and Lee Ainslie’s Maverick Capital.

Let’s go over hedge fund activity in other stocks similar to IAA, Inc. (NYSE:IAA). These stocks are LATAM Airlines Group S.A. (NYSE:LTM), Quanta Services Inc (NYSE:PWR), Park Hotels & Resorts Inc. (NYSE:PK), and Grupo Financiero Galicia S.A. (NASDAQ:GGAL). All of these stocks’ market caps are similar to IAA’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LTM | 5 | 17929 | -3 |

| PWR | 29 | 539950 | 5 |

| PK | 25 | 374204 | 11 |

| GGAL | 12 | 109602 | -5 |

| Average | 17.75 | 260421 | 2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17.75 hedge funds with bullish positions and the average amount invested in these stocks was $260 million. That figure was $909 million in IAA’s case. Quanta Services Inc (NYSE:PWR) is the most popular stock in this table. On the other hand LATAM Airlines Group S.A. (NYSE:LTM) is the least popular one with only 5 bullish hedge fund positions. Compared to these stocks IAA, Inc. (NYSE:IAA) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks (view the video below) among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on IAA as the stock returned 7.6% during Q3 and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.