The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. We at Insider Monkey have gone over 730 13F filings that hedge funds and well-known value investors are required to file by the SEC. The 13F filings show the funds’ and investors’ portfolio positions as of June 28th. In this article we look at what those investors think of Healthequity Inc (NASDAQ:HQY).

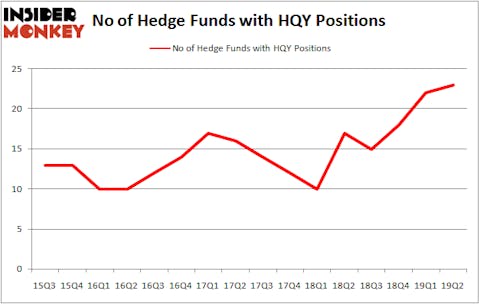

Healthequity Inc (NASDAQ:HQY) shareholders have witnessed an increase in enthusiasm from smart money of late. HQY was in 23 hedge funds’ portfolios at the end of June. There were 22 hedge funds in our database with HQY holdings at the end of the previous quarter. Our calculations also showed that HQY isn’t among the 30 most popular stocks among hedge funds (view the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

At the moment there are a lot of indicators shareholders have at their disposal to size up publicly traded companies. A pair of the most innovative indicators are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the elite money managers can trounce the market by a solid margin (see the details here).

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s take a glance at the key hedge fund action regarding Healthequity Inc (NASDAQ:HQY).

How are hedge funds trading Healthequity Inc (NASDAQ:HQY)?

Heading into the third quarter of 2019, a total of 23 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 5% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in HQY over the last 16 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Renaissance Technologies, holds the largest position in Healthequity Inc (NASDAQ:HQY). Renaissance Technologies has a $76 million position in the stock, comprising 0.1% of its 13F portfolio. On Renaissance Technologies’s heels is John Overdeck and David Siegel of Two Sigma Advisors, with a $42.9 million position; 0.1% of its 13F portfolio is allocated to the stock. Other peers that are bullish comprise Ken Griffin’s Citadel Investment Group, D. E. Shaw’s D E Shaw and Greg Poole’s Echo Street Capital Management.

As industrywide interest jumped, specific money managers have jumped into Healthequity Inc (NASDAQ:HQY) headfirst. Lucha Capital Management, managed by Marcelo Desio, assembled the most outsized position in Healthequity Inc (NASDAQ:HQY). Lucha Capital Management had $18.6 million invested in the company at the end of the quarter. Joel Greenblatt’s Gotham Asset Management also made a $4.4 million investment in the stock during the quarter. The following funds were also among the new HQY investors: Paul Tudor Jones’s Tudor Investment Corp, Matthew Tewksbury’s Stevens Capital Management, and Michael Gelband’s ExodusPoint Capital.

Let’s now review hedge fund activity in other stocks similar to Healthequity Inc (NASDAQ:HQY). We will take a look at Mattel, Inc. (NASDAQ:MAT), John Bean Technologies Corporation (NYSE:JBT), Mercury Systems Inc (NASDAQ:MRCY), and Lazard Ltd (NYSE:LAZ). This group of stocks’ market valuations are similar to HQY’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MAT | 16 | 650888 | -5 |

| JBT | 10 | 101572 | 1 |

| MRCY | 21 | 111111 | 6 |

| LAZ | 16 | 589512 | 0 |

| Average | 15.75 | 363271 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15.75 hedge funds with bullish positions and the average amount invested in these stocks was $363 million. That figure was $301 million in HQY’s case. Mercury Systems Inc (NASDAQ:MRCY) is the most popular stock in this table. On the other hand John Bean Technologies Corporation (NYSE:JBT) is the least popular one with only 10 bullish hedge fund positions. Compared to these stocks Healthequity Inc (NASDAQ:HQY) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately HQY wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on HQY were disappointed as the stock returned -12.6% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market in Q3.

Disclosure: None. This article was originally published at Insider Monkey.