Hedge funds and other investment firms run by legendary investors like Israel Englander, Jeffrey Talpins and Ray Dalio are entrusted to manage billions of dollars of accredited investors’ money because they are without peer in the resources they use to identify the best investments for their chosen investment horizon. Moreover, they are more willing to invest a greater amount of their resources in small-cap stocks than big brokerage houses, and this is often where they generate their outperformance, which is why we pay particular attention to their best ideas in this space.

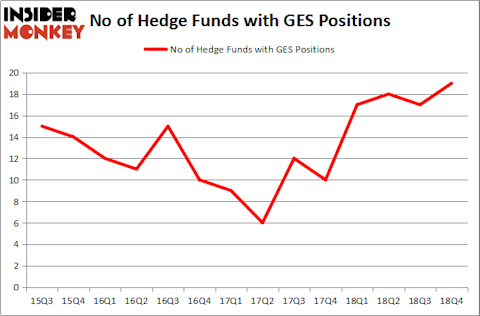

Is Guess’, Inc. (NYSE:GES) a buy here? Investors who are in the know are buying. The number of long hedge fund positions advanced by 2 lately. Our calculations also showed that GES isn’t among the 30 most popular stocks among hedge funds. GES was in 19 hedge funds’ portfolios at the end of December. There were 17 hedge funds in our database with GES holdings at the end of the previous quarter.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

Let’s take a glance at the latest hedge fund action surrounding Guess’, Inc. (NYSE:GES).

Hedge fund activity in Guess’, Inc. (NYSE:GES)

At Q4’s end, a total of 19 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 12% from one quarter earlier. On the other hand, there were a total of 17 hedge funds with a bullish position in GES a year ago. With hedge funds’ sentiment swirling, there exists a select group of notable hedge fund managers who were adding to their holdings substantially (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Maverick Capital, managed by Lee Ainslie, holds the biggest position in Guess’, Inc. (NYSE:GES). Maverick Capital has a $28.1 million position in the stock, comprising 0.4% of its 13F portfolio. Sitting at the No. 2 spot is Balyasny Asset Management, managed by Dmitry Balyasny, which holds a $20.1 million position; 0.1% of its 13F portfolio is allocated to the stock. Some other members of the smart money that are bullish include Ken Griffin’s Citadel Investment Group, Steven Baughman’s Divisar Capital and Paul Marshall and Ian Wace’s Marshall Wace LLP.

As one would reasonably expect, key hedge funds have jumped into Guess’, Inc. (NYSE:GES) headfirst. Divisar Capital, managed by Steven Baughman, established the biggest position in Guess’, Inc. (NYSE:GES). Divisar Capital had $11.9 million invested in the company at the end of the quarter. Ray Dalio’s Bridgewater Associates also made a $0.2 million investment in the stock during the quarter. The only other fund with a new position in the stock is Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Guess’, Inc. (NYSE:GES) but similarly valued. These stocks are iRhythm Technologies, Inc. (NASDAQ:IRTC), Eagle Bancorp, Inc. (NASDAQ:EGBN), Tellurian Inc. (NASDAQ:TELL), and Reata Pharmaceuticals, Inc. (NASDAQ:RETA). This group of stocks’ market caps resemble GES’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| IRTC | 23 | 285377 | 0 |

| EGBN | 12 | 22162 | -7 |

| TELL | 15 | 94826 | 1 |

| RETA | 17 | 158938 | 0 |

| Average | 16.75 | 140326 | -1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.75 hedge funds with bullish positions and the average amount invested in these stocks was $140 million. That figure was $107 million in GES’s case. iRhythm Technologies, Inc. (NASDAQ:IRTC) is the most popular stock in this table. On the other hand Eagle Bancorp, Inc. (NASDAQ:EGBN) is the least popular one with only 12 bullish hedge fund positions. Guess’, Inc. (NYSE:GES) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately GES wasn’t nearly as popular as these 15 stock and hedge funds that were betting on GES were disappointed as the stock returned -18.9% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.