Investing in small cap stocks has historically been a way to outperform the market, as small cap companies typically grow faster on average than the blue chips. That outperformance comes with a price, however, as there are occasional periods of higher volatility. The last 12 months is one of those periods, as the Russell 2000 ETF (IWM) has underperformed the larger S&P 500 ETF (SPY) by more than 10 percentage points. Given that the funds we track tend to have a disproportionate amount of their portfolios in smaller cap stocks, they have seen some volatility in their portfolios too. Actually their moves are potentially one of the factors that contributed to this volatility. In this article, we use our extensive database of hedge fund holdings to find out what the smart money thinks of Global Net Lease, Inc. (NYSE:GNL).

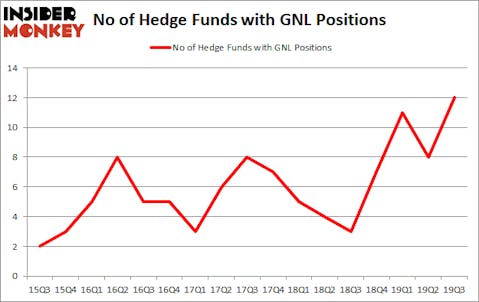

Is Global Net Lease, Inc. (NYSE:GNL) worth your attention right now? The best stock pickers are taking a bullish view. The number of bullish hedge fund bets went up by 4 in recent months. Our calculations also showed that GNL isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the Russell 2000 ETFs by 40 percentage points since May 2014 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.8% through November 21, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Jim Simons of Renaissance Technologies

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We also rely on the best performing hedge funds‘ buy/sell signals. Let’s take a look at the latest hedge fund action surrounding Global Net Lease, Inc. (NYSE:GNL).

How have hedgies been trading Global Net Lease, Inc. (NYSE:GNL)?

At Q3’s end, a total of 12 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 50% from one quarter earlier. On the other hand, there were a total of 3 hedge funds with a bullish position in GNL a year ago. With hedge funds’ positions undergoing their usual ebb and flow, there exists an “upper tier” of notable hedge fund managers who were boosting their holdings meaningfully (or already accumulated large positions).

Among these funds, Renaissance Technologies held the most valuable stake in Global Net Lease, Inc. (NYSE:GNL), which was worth $28.2 million at the end of the third quarter. On the second spot was Marshall Wace which amassed $17.3 million worth of shares. Citadel Investment Group, Balyasny Asset Management, and Millennium Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Marshall Wace allocated the biggest weight to Global Net Lease, Inc. (NYSE:GNL), around 0.14% of its 13F portfolio. Balyasny Asset Management is also relatively very bullish on the stock, earmarking 0.06 percent of its 13F equity portfolio to GNL.

Consequently, some big names were breaking ground themselves. Millennium Management, managed by Israel Englander, established the most outsized position in Global Net Lease, Inc. (NYSE:GNL). Millennium Management had $4.1 million invested in the company at the end of the quarter. Paul Tudor Jones’s Tudor Investment Corp also initiated a $1 million position during the quarter. The other funds with new positions in the stock are Benjamin A. Smith’s Laurion Capital Management, Michael Gelband’s ExodusPoint Capital, and Steve Cohen’s Point72 Asset Management.

Let’s now take a look at hedge fund activity in other stocks similar to Global Net Lease, Inc. (NYSE:GNL). These stocks are Dillard’s, Inc. (NYSE:DDS), Mobile Mini Inc (NASDAQ:MINI), Gray Television, Inc. (NYSE:GTN), and Livongo Health, Inc. (NASDAQ:LVGO). This group of stocks’ market valuations match GNL’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DDS | 20 | 266166 | 0 |

| MINI | 20 | 194376 | 5 |

| GTN | 23 | 206495 | -2 |

| LVGO | 15 | 48907 | 15 |

| Average | 19.5 | 178986 | 4.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19.5 hedge funds with bullish positions and the average amount invested in these stocks was $179 million. That figure was $74 million in GNL’s case. Gray Television, Inc. (NYSE:GTN) is the most popular stock in this table. On the other hand Livongo Health, Inc. (NASDAQ:LVGO) is the least popular one with only 15 bullish hedge fund positions. Compared to these stocks Global Net Lease, Inc. (NYSE:GNL) is even less popular than LVGO. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. A small number of hedge funds were also right about betting on GNL, though not to the same extent, as the stock returned 7.5% during the fourth quarter (through 11/30) and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.