After several tireless days we have finished crunching the numbers from nearly 750 13F filings issued by the elite hedge funds and other investment firms that we track at Insider Monkey, which disclosed those firms’ equity portfolios as of June 28. The results of that effort will be put on display in this article, as we share valuable insight into the smart money sentiment towards Generac Holdings Inc. (NYSE:GNRC).

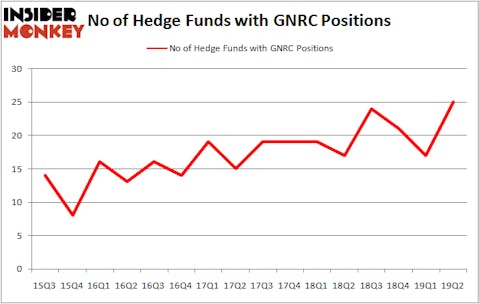

Is Generac Holdings Inc. (NYSE:GNRC) undervalued? The best stock pickers are becoming hopeful. The number of long hedge fund bets improved by 8 recently. Our calculations also showed that GNRC isn’t among the 30 most popular stocks among hedge funds (view the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Today there are tons of signals investors can use to value publicly traded companies. A pair of the best signals are hedge fund and insider trading activity. We have shown that, historically, those who follow the top picks of the best fund managers can outperform their index-focused peers by a solid amount (see the details here).

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s view the latest hedge fund action surrounding Generac Holdings Inc. (NYSE:GNRC).

What does smart money think about Generac Holdings Inc. (NYSE:GNRC)?

At the end of the second quarter, a total of 25 of the hedge funds tracked by Insider Monkey were long this stock, a change of 47% from the previous quarter. By comparison, 17 hedge funds held shares or bullish call options in GNRC a year ago. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Impax Asset Management, managed by Ian Simm, holds the number one position in Generac Holdings Inc. (NYSE:GNRC). Impax Asset Management has a $93.9 million position in the stock, comprising 1.2% of its 13F portfolio. The second largest stake is held by Arrowstreet Capital, led by Peter Rathjens, Bruce Clarke and John Campbell, holding a $39.4 million position; the fund has 0.1% of its 13F portfolio invested in the stock. Other hedge funds and institutional investors that hold long positions encompass John W. Rogers’s Ariel Investments, Chuck Royce’s Royce & Associates and Dmitry Balyasny’s Balyasny Asset Management.

With a general bullishness amongst the heavyweights, specific money managers were leading the bulls’ herd. Royce & Associates, managed by Chuck Royce, assembled the largest position in Generac Holdings Inc. (NYSE:GNRC). Royce & Associates had $13.5 million invested in the company at the end of the quarter. Steve Cohen’s Point72 Asset Management also made a $7.7 million investment in the stock during the quarter. The other funds with brand new GNRC positions are Richard Driehaus’s Driehaus Capital, Mike Ogborne’s Ogborne Capital, and Philip Hempleman’s Ardsley Partners.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Generac Holdings Inc. (NYSE:GNRC) but similarly valued. We will take a look at Pinnacle Financial Partners, Inc. (NASDAQ:PNFP), Tetra Tech, Inc. (NASDAQ:TTEK), Littelfuse, Inc. (NASDAQ:LFUS), and Assured Guaranty Ltd. (NYSE:AGO). This group of stocks’ market caps are closest to GNRC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PNFP | 18 | 78507 | 3 |

| TTEK | 22 | 101584 | -1 |

| LFUS | 15 | 268202 | 2 |

| AGO | 36 | 613916 | 2 |

| Average | 22.75 | 265552 | 1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 22.75 hedge funds with bullish positions and the average amount invested in these stocks was $266 million. That figure was $229 million in GNRC’s case. Assured Guaranty Ltd. (NYSE:AGO) is the most popular stock in this table. On the other hand Littelfuse, Inc. (NASDAQ:LFUS) is the least popular one with only 15 bullish hedge fund positions. Generac Holdings Inc. (NYSE:GNRC) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on GNRC as the stock returned 12.9% during the third quarter and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.