Like everyone else, elite investors make mistakes. Some of their top consensus picks, such as Amazon, Facebook and Alibaba, have not done well in Q4 due to various reasons. Nevertheless, the data show elite investors’ consensus picks have done well on average over the long-term. The top 20 stocks among hedge funds beat the S&P 500 Index ETF by more than 6 percentage points so far this year. Because their consensus picks have done well, we pay attention to what elite funds think before doing extensive research on a stock. In this article, we take a closer look at FLIR Systems, Inc. (NASDAQ:FLIR) from the perspective of those elite funds.

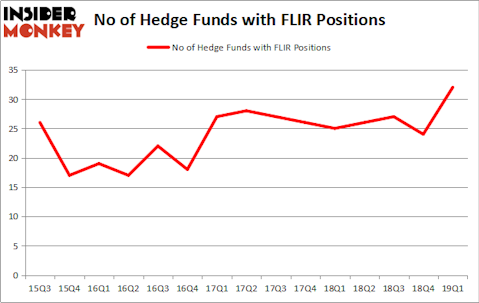

Is FLIR Systems, Inc. (NASDAQ:FLIR) a buy right now? Prominent investors are turning bullish. The number of bullish hedge fund bets improved by 8 in recent months. Our calculations also showed that FLIR isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s analyze the latest hedge fund action surrounding FLIR Systems, Inc. (NASDAQ:FLIR).

What does the smart money think about FLIR Systems, Inc. (NASDAQ:FLIR)?

Heading into the second quarter of 2019, a total of 32 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 33% from the fourth quarter of 2018. The graph below displays the number of hedge funds with bullish position in FLIR over the last 15 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, AQR Capital Management was the largest shareholder of FLIR Systems, Inc. (NASDAQ:FLIR), with a stake worth $103.5 million reported as of the end of March. Trailing AQR Capital Management was Arrowstreet Capital, which amassed a stake valued at $83.6 million. Royce & Associates, D E Shaw, and Millennium Management were also very fond of the stock, giving the stock large weights in their portfolios.

As industrywide interest jumped, key hedge funds were breaking ground themselves. Alyeska Investment Group, managed by Anand Parekh, created the largest position in FLIR Systems, Inc. (NASDAQ:FLIR). Alyeska Investment Group had $29.2 million invested in the company at the end of the quarter. Matthew Hulsizer’s PEAK6 Capital Management also initiated a $5.2 million position during the quarter. The following funds were also among the new FLIR investors: Matthew Tewksbury’s Stevens Capital Management, Paul Tudor Jones’s Tudor Investment Corp, and Jeffrey Talpins’s Element Capital Management.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as FLIR Systems, Inc. (NASDAQ:FLIR) but similarly valued. We will take a look at Commerce Bancshares, Inc. (NASDAQ:CBSH), Galapagos NV (NASDAQ:GLPG), Hubbell Incorporated (NYSE:HUBB), and LATAM Airlines Group S.A. (NYSE:LTM). This group of stocks’ market valuations are closest to FLIR’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CBSH | 13 | 48426 | 2 |

| GLPG | 16 | 131126 | 1 |

| HUBB | 21 | 357892 | -3 |

| LTM | 8 | 21281 | 0 |

| Average | 14.5 | 139681 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14.5 hedge funds with bullish positions and the average amount invested in these stocks was $140 million. That figure was $537 million in FLIR’s case. Hubbell Incorporated (NYSE:HUBB) is the most popular stock in this table. On the other hand LATAM Airlines Group S.A. (NYSE:LTM) is the least popular one with only 8 bullish hedge fund positions. Compared to these stocks FLIR Systems, Inc. (NASDAQ:FLIR) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on FLIR as the stock returned 2.9% during the same period and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.