The Insider Monkey team has completed processing the quarterly 13F filings for the March quarter submitted by the hedge funds and other money managers included in our extensive database. Most hedge fund investors experienced strong gains on the back of a strong market performance, which certainly propelled them to adjust their equity holdings so as to maintain the desired risk profile. As a result, the relevancy of these public filings and their content is indisputable, as they may reveal numerous high-potential stocks. The following article will discuss the smart money sentiment towards FirstEnergy Corp. (NYSE:FE).

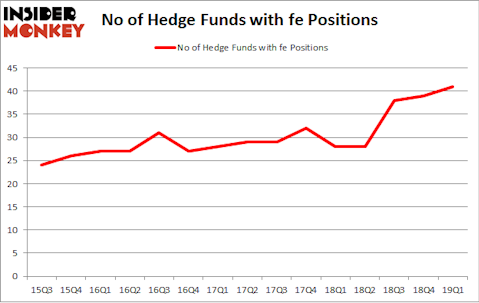

FirstEnergy Corp. (NYSE:FE) investors should pay attention to an increase in activity from the world’s largest hedge funds lately. FE was in 41 hedge funds’ portfolios at the end of the first quarter of 2019. There were 39 hedge funds in our database with FE positions at the end of the previous quarter. Our calculations also showed that fe isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a lot of methods stock market investors can use to size up their stock investments. A duo of the most underrated methods are hedge fund and insider trading sentiment. Our researchers have shown that, historically, those who follow the best picks of the top investment managers can trounce the market by a significant margin (see the details here).

Let’s check out the latest hedge fund action surrounding FirstEnergy Corp. (NYSE:FE).

Hedge fund activity in FirstEnergy Corp. (NYSE:FE)

At Q1’s end, a total of 41 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 5% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards FE over the last 15 quarters. With the smart money’s sentiment swirling, there exists a few key hedge fund managers who were increasing their stakes considerably (or already accumulated large positions).

More specifically, Zimmer Partners was the largest shareholder of FirstEnergy Corp. (NYSE:FE), with a stake worth $1228.4 million reported as of the end of March. Trailing Zimmer Partners was Elliott Management, which amassed a stake valued at $1042.1 million. Renaissance Technologies, Luminus Management, and Fir Tree were also very fond of the stock, giving the stock large weights in their portfolios.

With a general bullishness amongst the heavyweights, specific money managers have been driving this bullishness. Wexford Capital, managed by Charles Davidson and Joseph Jacobs, initiated the biggest position in FirstEnergy Corp. (NYSE:FE). Wexford Capital had $5.2 million invested in the company at the end of the quarter. Chris Rokos’s Rokos Capital Management also initiated a $4.2 million position during the quarter. The other funds with new positions in the stock are Paul Marshall and Ian Wace’s Marshall Wace LLP, Jeffrey Talpins’s Element Capital Management, and Noam Gottesman’s GLG Partners.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as FirstEnergy Corp. (NYSE:FE) but similarly valued. These stocks are Centene Corp (NYSE:CNC), Verisk Analytics, Inc. (NASDAQ:VRSK), M&T Bank Corporation (NYSE:MTB), and IHS Markit Ltd. (NASDAQ:INFO). This group of stocks’ market caps resemble FE’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CNC | 58 | 2067914 | 2 |

| VRSK | 20 | 494091 | -10 |

| MTB | 36 | 1236608 | -6 |

| INFO | 30 | 1154869 | 3 |

| Average | 36 | 1238371 | -2.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 36 hedge funds with bullish positions and the average amount invested in these stocks was $1238 million. That figure was $3728 million in FE’s case. Centene Corp (NYSE:CNC) is the most popular stock in this table. On the other hand Verisk Analytics, Inc. (NASDAQ:VRSK) is the least popular one with only 20 bullish hedge fund positions. FirstEnergy Corp. (NYSE:FE) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on FE, though not to the same extent, as the stock returned -0.7% during the same time frame and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.