At Insider Monkey, we pore over the filings of nearly 750 top investment firms every quarter, a process we have now completed for the latest reporting period. The data we’ve gathered as a result gives us access to a wealth of collective knowledge based on these firms’ portfolio holdings as of December 31. In this article, we will use that wealth of knowledge to determine whether or not Falcon Minerals Corporation (NASDAQ:FLMN) makes for a good investment right now.

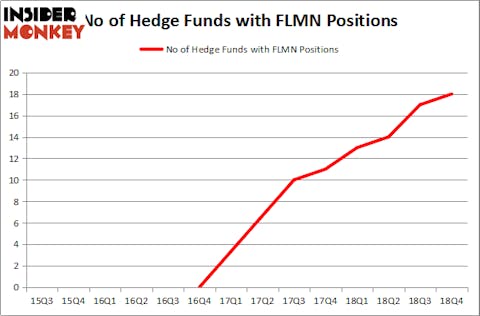

Falcon Minerals Corporation (NASDAQ:FLMN) has seen an increase in enthusiasm from smart money of late. FLMN was in 18 hedge funds’ portfolios at the end of the fourth quarter of 2018. There were 17 hedge funds in our database with FLMN positions at the end of the previous quarter. Our calculations also showed that FLMN isn’t among the 30 most popular stocks among hedge funds.

If you’d ask most traders, hedge funds are perceived as unimportant, old financial tools of years past. While there are greater than 8000 funds with their doors open at present, Our experts hone in on the masters of this group, around 750 funds. These money managers manage most of the hedge fund industry’s total asset base, and by following their finest picks, Insider Monkey has figured out a number of investment strategies that have historically outstripped the market. Insider Monkey’s flagship hedge fund strategy outpaced the S&P 500 index by nearly 5 percentage points a year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

Let’s take a peek at the key hedge fund action regarding Falcon Minerals Corporation (NASDAQ:FLMN).

Hedge fund activity in Falcon Minerals Corporation (NASDAQ:FLMN)

Heading into the first quarter of 2019, a total of 18 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 6% from one quarter earlier. By comparison, 13 hedge funds held shares or bullish call options in FLMN a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Jon Bauer’s Contrarian Capital has the number one position in Falcon Minerals Corporation (NASDAQ:FLMN), worth close to $60.2 million, amounting to 5.6% of its total 13F portfolio. Sitting at the No. 2 spot is Robert Pohly of Samlyn Capital, with a $34.1 million position; 0.8% of its 13F portfolio is allocated to the company. Some other peers that are bullish include John M. Angelo and Michael L. Gordon’s Angelo Gordon & Co, Israel Englander’s Millennium Management and Wilmot B. Harkey and Daniel Mack’s Nantahala Capital Management.

As one would reasonably expect, some big names were breaking ground themselves. Contrarian Capital, managed by Jon Bauer, created the biggest position in Falcon Minerals Corporation (NASDAQ:FLMN). Contrarian Capital had $60.2 million invested in the company at the end of the quarter. Steve Cohen’s Point72 Asset Management also initiated a $2.6 million position during the quarter. The other funds with brand new FLMN positions are Barry Rosenstein’s JANA Partners, Michael Gelband’s ExodusPoint Capital, and Karim Abbadi and Edward McBride’s Centiva Capital.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Falcon Minerals Corporation (NASDAQ:FLMN) but similarly valued. These stocks are H&E Equipment Services, Inc. (NASDAQ:HEES), Ehi Car Services Ltd (NYSE:EHIC), General American Investors, Inc. (NYSE:GAM), and Malibu Boats Inc (NASDAQ:MBUU). All of these stocks’ market caps resemble FLMN’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HEES | 15 | 36756 | 2 |

| EHIC | 6 | 73106 | 0 |

| GAM | 6 | 25452 | 1 |

| MBUU | 22 | 93302 | 4 |

| Average | 12.25 | 57154 | 1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12.25 hedge funds with bullish positions and the average amount invested in these stocks was $57 million. That figure was $188 million in FLMN’s case. Malibu Boats Inc (NASDAQ:MBUU) is the most popular stock in this table. On the other hand Ehi Car Services Ltd (NYSE:EHIC) is the least popular one with only 6 bullish hedge fund positions. Falcon Minerals Corporation (NASDAQ:FLMN) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately FLMN wasn’t nearly as popular as these 15 stock and hedge funds that were betting on FLMN were disappointed as the stock returned 9.5% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.