Insider Monkey has processed numerous 13F filings of hedge funds and successful value investors to create an extensive database of hedge fund holdings. The 13F filings show the hedge funds’ and successful investors’ positions as of the end of the third quarter. You can find articles about an individual hedge fund’s trades on numerous financial news websites. However, in this article we will take a look at their collective moves over the last 4 years and analyze what the smart money thinks of Extra Space Storage, Inc. (NYSE:EXR) based on that data.

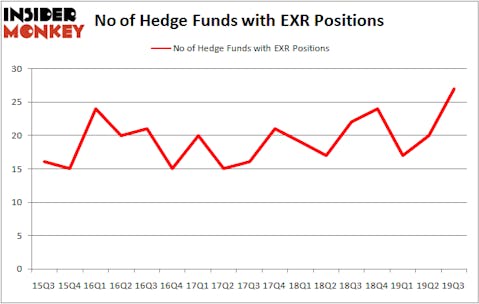

Extra Space Storage, Inc. (NYSE:EXR) has experienced an increase in hedge fund interest lately. Our calculations also showed that EXR isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the Russell 2000 ETFs by 40 percentage points since May 2014 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.8% through November 21, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Paul Marshall of Marshall Wace

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. We’re going to take a look at the fresh hedge fund action regarding Extra Space Storage, Inc. (NYSE:EXR).

How have hedgies been trading Extra Space Storage, Inc. (NYSE:EXR)?

Heading into the fourth quarter of 2019, a total of 27 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 35% from one quarter earlier. By comparison, 22 hedge funds held shares or bullish call options in EXR a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Israel Englander’s Millennium Management has the number one position in Extra Space Storage, Inc. (NYSE:EXR), worth close to $88.3 million, accounting for 0.1% of its total 13F portfolio. On Millennium Management’s heels is Marshall Wace, managed by Paul Marshall and Ian Wace, which holds a $42.9 million position; the fund has 0.3% of its 13F portfolio invested in the stock. Some other professional money managers that hold long positions encompass David E. Shaw’s D E Shaw, Ken Griffin’s Citadel Investment Group and Phill Gross and Robert Atchinson’s Adage Capital Management. In terms of the portfolio weights assigned to each position Waterfront Capital Partners allocated the biggest weight to Extra Space Storage, Inc. (NYSE:EXR), around 0.91% of its portfolio. Gillson Capital is also relatively very bullish on the stock, dishing out 0.52 percent of its 13F equity portfolio to EXR.

As industrywide interest jumped, key hedge funds were leading the bulls’ herd. Marshall Wace, managed by Paul Marshall and Ian Wace, initiated the biggest position in Extra Space Storage, Inc. (NYSE:EXR). Marshall Wace had $42.9 million invested in the company at the end of the quarter. Stuart J. Zimmer’s Zimmer Partners also initiated a $11.7 million position during the quarter. The other funds with brand new EXR positions are Eduardo Abush’s Waterfront Capital Partners, Daniel Johnson’s Gillson Capital, and Benjamin A. Smith’s Laurion Capital Management.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Extra Space Storage, Inc. (NYSE:EXR) but similarly valued. We will take a look at Hasbro, Inc. (NASDAQ:HAS), Akamai Technologies, Inc. (NASDAQ:AKAM), Twilio Inc. (NYSE:TWLO), and Conagra Brands, Inc. (NYSE:CAG). This group of stocks’ market values match EXR’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HAS | 29 | 431855 | 5 |

| AKAM | 27 | 810658 | -6 |

| TWLO | 59 | 2259864 | -4 |

| CAG | 27 | 681948 | 3 |

| Average | 35.5 | 1046081 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 35.5 hedge funds with bullish positions and the average amount invested in these stocks was $1046 million. That figure was $329 million in EXR’s case. Twilio Inc. (NYSE:TWLO) is the most popular stock in this table. On the other hand Akamai Technologies, Inc. (NASDAQ:AKAM) is the least popular one with only 27 bullish hedge fund positions. Compared to these stocks Extra Space Storage, Inc. (NYSE:EXR) is even less popular than AKAM. Hedge funds dodged a bullet by taking a bearish stance towards EXR. Our calculations showed that the top 20 most popular hedge fund stocks returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Unfortunately EXR wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); EXR investors were disappointed as the stock returned -9.2% during the fourth quarter (through the end of November) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 70 percent of these stocks already outperformed the market so far in Q4.

Disclosure: None. This article was originally published at Insider Monkey.