Last year’s fourth quarter was a rough one for investors and many hedge funds, which were naturally unable to overcome the big dip in the broad market, as the S&P 500 fell by about 4.8% during 2018 and average hedge fund losing about 1%. The Russell 2000, composed of smaller companies, performed even worse, trailing the S&P by more than 6 percentage points, as investors fled less-known quantities for safe havens. Luckily hedge funds were shifting their holdings into large-cap stocks. The 20 most popular hedge fund stocks actually generated an average return of 37.4% in 2019 (through the end of November) and outperformed the S&P 500 ETF by 9.9 percentage points. We are done processing the latest 13F filings and in this article we will study how hedge fund sentiment towards Evofem Biosciences, Inc. (NASDAQ:EVFM) changed during the first quarter.

Is Evofem Biosciences, Inc. (NASDAQ:EVFM) worth your attention right now? Money managers are betting on the stock. The number of long hedge fund bets inched up by 3 lately. Our calculations also showed that EVFM isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the eyes of most shareholders, hedge funds are viewed as worthless, old investment tools of years past. While there are more than 8000 funds with their doors open at present, Our experts choose to focus on the masters of this club, about 750 funds. These investment experts control most of the smart money’s total asset base, and by tailing their highest performing equity investments, Insider Monkey has brought to light many investment strategies that have historically defeated Mr. Market. Insider Monkey’s flagship short hedge fund strategy beat the S&P 500 short ETFs by around 20 percentage points a year since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

Israel Englander of Millennium Management

We leave no stone unturned when looking for the next great investment idea. For example Discover is offering this insane cashback card, so we look into shorting the stock. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We even check out this option genius’ weekly trade ideas. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock already gained 20 percent. Now we’re going to analyze the latest hedge fund action encompassing Evofem Biosciences, Inc. (NASDAQ:EVFM).

How have hedgies been trading Evofem Biosciences, Inc. (NASDAQ:EVFM)?

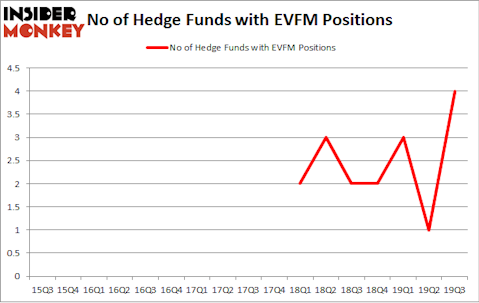

Heading into the fourth quarter of 2019, a total of 4 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 300% from the previous quarter. The graph below displays the number of hedge funds with bullish position in EVFM over the last 17 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Woodford Investment Management, managed by Neil Woodford, holds the most valuable position in Evofem Biosciences, Inc. (NASDAQ:EVFM). Woodford Investment Management has a $63 million position in the stock, comprising 20.3% of its 13F portfolio. The second largest stake is held by Julian Baker and Felix Baker of Baker Bros. Advisors, with a $0.5 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Remaining professional money managers that are bullish consist of Anand Parekh’s Alyeska Investment Group, Israel Englander’s Millennium Management and Renaissance Technologies. In terms of the portfolio weights assigned to each position Woodford Investment Management allocated the biggest weight to Evofem Biosciences, Inc. (NASDAQ:EVFM), around 20.31% of its 13F portfolio. Alyeska Investment Group is also relatively very bullish on the stock, dishing out 0.01 percent of its 13F equity portfolio to EVFM.

With a general bullishness amongst the heavyweights, specific money managers have been driving this bullishness. Baker Bros. Advisors, managed by Julian Baker and Felix Baker, established the largest position in Evofem Biosciences, Inc. (NASDAQ:EVFM). Baker Bros. Advisors had $0.5 million invested in the company at the end of the quarter. Israel Englander’s Millennium Management also made a $0.1 million investment in the stock during the quarter. The only other fund with a new position in the stock is Renaissance Technologies.

Let’s also examine hedge fund activity in other stocks similar to Evofem Biosciences, Inc. (NASDAQ:EVFM). We will take a look at FS Bancorp, Inc. (NASDAQ:FSBW), ChromaDex Corporation (NASDAQ:CDXC), NuCana plc (NASDAQ:NCNA), and Safeguard Scientifics, Inc (NYSE:SFE). This group of stocks’ market values resemble EVFM’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FSBW | 5 | 19145 | -2 |

| CDXC | 4 | 982 | 3 |

| NCNA | 6 | 11658 | 5 |

| SFE | 10 | 26279 | 4 |

| Average | 6.25 | 14516 | 2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 6.25 hedge funds with bullish positions and the average amount invested in these stocks was $15 million. That figure was $64 million in EVFM’s case. Safeguard Scientifics, Inc (NYSE:SFE) is the most popular stock in this table. On the other hand ChromaDex Corporation (NASDAQ:CDXC) is the least popular one with only 4 bullish hedge fund positions. Compared to these stocks Evofem Biosciences, Inc. (NASDAQ:EVFM) is even less popular than CDXC. Hedge funds clearly dropped the ball on EVFM as the stock delivered strong returns, though hedge funds’ consensus picks still generated respectable returns. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. A small number of hedge funds were also right about betting on EVFM as the stock returned 21.2% during the fourth quarter (through the end of November) and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.