Looking for stocks with high upside potential? Just follow the big players within the hedge fund industry. Why should you do so? Let’s take a brief look at what statistics have to say about hedge funds’ stock picking abilities to illustrate. The Standard and Poor’s 500 Index returned approximately 26% in 2019 (through November 22nd). Conversely, hedge funds’ 20 preferred S&P 500 stocks generated a return of nearly 35% during the same period, with the majority of these stock picks outperforming the broader market benchmark. Coincidence? It might happen to be so, but it is unlikely. Our research covering the last 18 years indicates that hedge funds’ consensus stock picks generate superior risk-adjusted returns. That’s why we believe it is wise to check hedge fund activity before you invest your time or your savings on a stock like Diodes Incorporated (NASDAQ:DIOD).

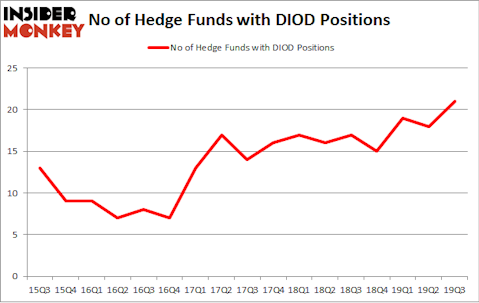

Is Diodes Incorporated (NASDAQ:DIOD) a cheap stock to buy now? Money managers are getting more bullish. The number of bullish hedge fund bets rose by 3 lately. Our calculations also showed that DIOD isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings). DIOD was in 21 hedge funds’ portfolios at the end of the third quarter of 2019. There were 18 hedge funds in our database with DIOD holdings at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

To the average investor there are tons of tools stock market investors have at their disposal to assess stocks. Two of the less utilized tools are hedge fund and insider trading interest. Our experts have shown that, historically, those who follow the best picks of the top hedge fund managers can trounce their index-focused peers by a superb amount (see the details here).

Joel Greenblatt of Gotham Asset Management

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. We’re going to check out the recent hedge fund action encompassing Diodes Incorporated (NASDAQ:DIOD).

How are hedge funds trading Diodes Incorporated (NASDAQ:DIOD)?

At the end of the third quarter, a total of 21 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 17% from the previous quarter. The graph below displays the number of hedge funds with bullish position in DIOD over the last 17 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Royce & Associates was the largest shareholder of Diodes Incorporated (NASDAQ:DIOD), with a stake worth $19.8 million reported as of the end of September. Trailing Royce & Associates was Fisher Asset Management, which amassed a stake valued at $14.2 million. Renaissance Technologies, Gotham Asset Management, and AQR Capital Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Algert Coldiron Investors allocated the biggest weight to Diodes Incorporated (NASDAQ:DIOD), around 1.21% of its 13F portfolio. Zebra Capital Management is also relatively very bullish on the stock, dishing out 0.77 percent of its 13F equity portfolio to DIOD.

As one would reasonably expect, key hedge funds were leading the bulls’ herd. Holocene Advisors, managed by Brandon Haley, initiated the most valuable position in Diodes Incorporated (NASDAQ:DIOD). Holocene Advisors had $1.2 million invested in the company at the end of the quarter. Ira Unschuld’s Brant Point Investment Management also made a $1.2 million investment in the stock during the quarter. The other funds with new positions in the stock are Matthew Hulsizer’s PEAK6 Capital Management, Thomas Bailard’s Bailard Inc, and Minhua Zhang’s Weld Capital Management.

Let’s now review hedge fund activity in other stocks similar to Diodes Incorporated (NASDAQ:DIOD). These stocks are Renasant Corporation (NASDAQ:RNST), LTC Properties Inc (NYSE:LTC), WesBanco, Inc. (NASDAQ:WSBC), and Casella Waste Systems Inc. (NASDAQ:CWST). All of these stocks’ market caps resemble DIOD’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RNST | 8 | 22648 | -3 |

| LTC | 9 | 15502 | -3 |

| WSBC | 10 | 54038 | 0 |

| CWST | 12 | 166863 | 0 |

| Average | 9.75 | 64763 | -1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 9.75 hedge funds with bullish positions and the average amount invested in these stocks was $65 million. That figure was $71 million in DIOD’s case. Casella Waste Systems Inc. (NASDAQ:CWST) is the most popular stock in this table. On the other hand Renasant Corporation (NASDAQ:RNST) is the least popular one with only 8 bullish hedge fund positions. Compared to these stocks Diodes Incorporated (NASDAQ:DIOD) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Hedge funds were also right about betting on DIOD as the stock returned 14.9% during the first two months of Q4 and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.