Is Cypress Semiconductor Corporation (NASDAQ:CY) a good stock to buy right now? We at Insider Monkey like to examine what billionaires and hedge funds think of a company before spending days of research on it. Given their 2 and 20 payment structure, hedge funds have more incentives and resources than the average investor. The funds have access to expert networks and get tips from industry insiders. They also have numerous Ivy League graduates and MBAs. Like everyone else, hedge funds perform miserably at times, but their consensus picks have historically outperformed the market after risk adjustments.

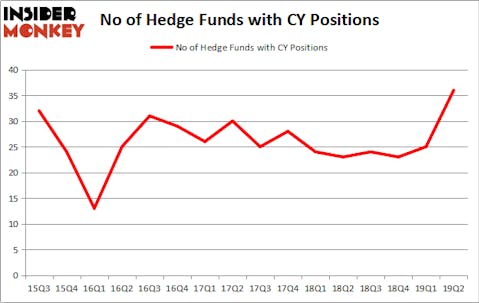

Cypress Semiconductor Corporation (NASDAQ:CY) has experienced an increase in enthusiasm from smart money recently. Our calculations also showed that CY isn’t among the 30 most popular stocks among hedge funds (view the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are several signals stock market investors employ to appraise stocks. A couple of the most useful signals are hedge fund and insider trading interest. Our researchers have shown that, historically, those who follow the best picks of the best hedge fund managers can beat the broader indices by a solid margin (see the details here).

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to take a look at the recent hedge fund action surrounding Cypress Semiconductor Corporation (NASDAQ:CY).

What does smart money think about Cypress Semiconductor Corporation (NASDAQ:CY)?

At the end of the second quarter, a total of 36 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 44% from the first quarter of 2019. On the other hand, there were a total of 23 hedge funds with a bullish position in CY a year ago. With hedge funds’ positions undergoing their usual ebb and flow, there exists an “upper tier” of key hedge fund managers who were increasing their holdings considerably (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Pentwater Capital Management, managed by Matthew Halbower, holds the most valuable position in Cypress Semiconductor Corporation (NASDAQ:CY). Pentwater Capital Management has a $227.3 million position in the stock, comprising 2.4% of its 13F portfolio. Sitting at the No. 2 spot is Magnetar Capital, led by Alec Litowitz and Ross Laser, holding a $189.3 million position; the fund has 3.8% of its 13F portfolio invested in the stock. Remaining professional money managers with similar optimism encompass D. E. Shaw’s D E Shaw, Robert Emil Zoellner’s Alpine Associates and Carl Tiedemann and Michael Tiedemann’s TIG Advisors.

Now, some big names have jumped into Cypress Semiconductor Corporation (NASDAQ:CY) headfirst. Pentwater Capital Management, managed by Matthew Halbower, assembled the most valuable position in Cypress Semiconductor Corporation (NASDAQ:CY). Pentwater Capital Management had $227.3 million invested in the company at the end of the quarter. Alec Litowitz and Ross Laser’s Magnetar Capital also initiated a $189.3 million position during the quarter. The other funds with new positions in the stock are D. E. Shaw’s D E Shaw, Robert Emil Zoellner’s Alpine Associates, and Carl Tiedemann and Michael Tiedemann’s TIG Advisors.

Let’s also examine hedge fund activity in other stocks similar to Cypress Semiconductor Corporation (NASDAQ:CY). These stocks are Caesars Entertainment Corp (NASDAQ:CZR), Pearson PLC (NYSE:PSO), News Corp (NASDAQ:NWS), and Spirit AeroSystems Holdings, Inc. (NYSE:SPR). This group of stocks’ market values match CY’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CZR | 48 | 3654846 | -9 |

| PSO | 4 | 7111 | 0 |

| NWS | 9 | 40127 | -1 |

| SPR | 31 | 2042908 | 2 |

| Average | 23 | 1436248 | -2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23 hedge funds with bullish positions and the average amount invested in these stocks was $1436 million. That figure was $1307 million in CY’s case. Caesars Entertainment Corp (NASDAQ:CZR) is the most popular stock in this table. On the other hand Pearson PLC (NYSE:PSO) is the least popular one with only 4 bullish hedge fund positions. Cypress Semiconductor Corporation (NASDAQ:CY) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on CY, though not to the same extent, as the stock returned 5.4% during the third quarter and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.