The 700+ hedge funds and famous money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the second quarter, which unveil their equity positions as of June 28. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund portfolios. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards Cummins Inc. (NYSE:CMI).

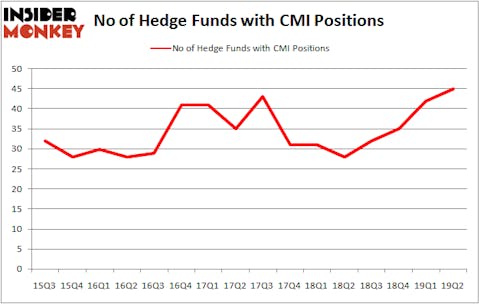

Is Cummins Inc. (NYSE:CMI) undervalued? Investors who are in the know are in an optimistic mood. The number of bullish hedge fund bets improved by 3 recently. Our calculations also showed that CMI isn’t among the 30 most popular stocks among hedge funds.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s take a peek at the recent hedge fund action regarding Cummins Inc. (NYSE:CMI).

How are hedge funds trading Cummins Inc. (NYSE:CMI)?

At the end of the second quarter, a total of 45 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 7% from one quarter earlier. By comparison, 28 hedge funds held shares or bullish call options in CMI a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Cliff Asness’s AQR Capital Management has the most valuable position in Cummins Inc. (NYSE:CMI), worth close to $400.4 million, amounting to 0.4% of its total 13F portfolio. On AQR Capital Management’s heels is Two Sigma Advisors, managed by John Overdeck and David Siegel, which holds a $190 million position; the fund has 0.5% of its 13F portfolio invested in the stock. Some other peers with similar optimism consist of Brandon Haley’s Holocene Advisors, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital and Noam Gottesman’s GLG Partners.

As aggregate interest increased, key hedge funds have jumped into Cummins Inc. (NYSE:CMI) headfirst. Renaissance Technologies, established the biggest position in Cummins Inc. (NYSE:CMI). Renaissance Technologies had $20.4 million invested in the company at the end of the quarter. Benjamin A. Smith’s Laurion Capital Management also initiated a $12.9 million position during the quarter. The following funds were also among the new CMI investors: Michael Kharitonov and Jon David McAuliffe’s Voleon Capital, Ronald Hua’s Qtron Investments, and Michael Gelband’s ExodusPoint Capital.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Cummins Inc. (NYSE:CMI) but similarly valued. These stocks are Coca-Cola European Partners plc (NYSE:CCEP), CRH PLC (NYSE:CRH), WEC Energy Group, Inc. (NYSE:WEC), and Spotify Technology S.A. (NYSE:SPOT). This group of stocks’ market valuations are closest to CMI’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CCEP | 10 | 133381 | -3 |

| CRH | 7 | 78961 | 2 |

| WEC | 13 | 392685 | -2 |

| SPOT | 42 | 1748170 | -11 |

| Average | 18 | 588299 | -3.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18 hedge funds with bullish positions and the average amount invested in these stocks was $588 million. That figure was $1127 million in CMI’s case. Spotify Technology S.A. (NYSE:SPOT) is the most popular stock in this table. On the other hand CRH PLC (NYSE:CRH) is the least popular one with only 7 bullish hedge fund positions. Compared to these stocks Cummins Inc. (NYSE:CMI) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately CMI wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on CMI were disappointed as the stock returned -4.2% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market in Q3.

Disclosure: None. This article was originally published at Insider Monkey.