We are still in an overall bull market and many stocks that smart money investors were piling into surged through the end of November. Among them, Facebook and Microsoft ranked among the top 3 picks and these stocks gained 54% and 51% respectively. Hedge funds’ top 3 stock picks returned 41.7% this year and beat the S&P 500 ETFs by 14 percentage points. Investing in index funds guarantees you average returns, not superior returns. We are looking to generate superior returns for our readers. That’s why we believe it isn’t a waste of time to check out hedge fund sentiment before you invest in a stock like Cortexyme, Inc. (NASDAQ:CRTX).

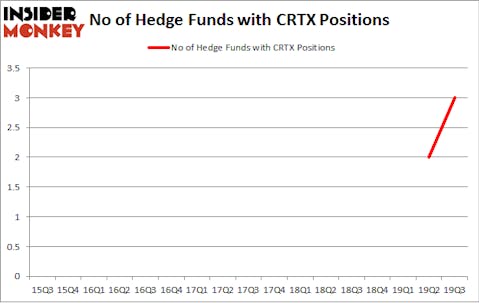

Cortexyme, Inc. (NASDAQ:CRTX) was in 3 hedge funds’ portfolios at the end of the third quarter of 2019. CRTX has seen an increase in enthusiasm from smart money of late. There were 2 hedge funds in our database with CRTX holdings at the end of the previous quarter. Our calculations also showed that CRTX isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Today there are plenty of formulas shareholders employ to assess publicly traded companies. Some of the less known formulas are hedge fund and insider trading sentiment. Our experts have shown that, historically, those who follow the best picks of the best fund managers can outperform the market by a superb amount (see the details here).

Oleg Nodelman of EcoR1 Capital

We leave no stone unturned when looking for the next great investment idea. For example Discover is offering this insane cashback card, so we look into shorting the stock. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We even check out this option genius’ weekly trade ideas. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock already gained 20 percent. With all of this in mind let’s review the recent hedge fund action encompassing Cortexyme, Inc. (NASDAQ:CRTX).

What have hedge funds been doing with Cortexyme, Inc. (NASDAQ:CRTX)?

At Q3’s end, a total of 3 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 50% from one quarter earlier. By comparison, 0 hedge funds held shares or bullish call options in CRTX a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, EcoR1 Capital, managed by Oleg Nodelman, holds the largest position in Cortexyme, Inc. (NASDAQ:CRTX). EcoR1 Capital has a $1.2 million position in the stock, comprising 0.2% of its 13F portfolio. Coming in second is Israel Englander of Millennium Management, with a $0.5 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. In terms of the portfolio weights assigned to each position EcoR1 Capital allocated the biggest weight to Cortexyme, Inc. (NASDAQ:CRTX), around 0.16% of its 13F portfolio. Millennium Management is also relatively very bullish on the stock, setting aside 0.0008 percent of its 13F equity portfolio to CRTX.

Consequently, some big names were breaking ground themselves. EcoR1 Capital, managed by Oleg Nodelman, created the most valuable position in Cortexyme, Inc. (NASDAQ:CRTX). EcoR1 Capital had $1.2 million invested in the company at the end of the quarter. Ken Griffin’s Citadel Investment Group also made a $0.3 million investment in the stock during the quarter.

Let’s check out hedge fund activity in other stocks similar to Cortexyme, Inc. (NASDAQ:CRTX). These stocks are Camden National Corporation (NASDAQ:CAC), Vericel Corporation (NASDAQ:VCEL), Cytokinetics, Incorporated (NASDAQ:CYTK), and Winmark Corporation (NASDAQ:WINA). This group of stocks’ market values are similar to CRTX’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CAC | 10 | 67925 | 0 |

| VCEL | 16 | 133611 | -1 |

| CYTK | 18 | 130436 | 4 |

| WINA | 9 | 95629 | 3 |

| Average | 13.25 | 106900 | 1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.25 hedge funds with bullish positions and the average amount invested in these stocks was $107 million. That figure was $2 million in CRTX’s case. Cytokinetics, Incorporated (NASDAQ:CYTK) is the most popular stock in this table. On the other hand Winmark Corporation (NASDAQ:WINA) is the least popular one with only 9 bullish hedge fund positions. Compared to these stocks Cortexyme, Inc. (NASDAQ:CRTX) is even less popular than WINA. Hedge funds dodged a bullet by taking a bearish stance towards CRTX. Our calculations showed that the top 20 most popular hedge fund stocks returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Unfortunately CRTX wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); CRTX investors were disappointed as the stock returned 5.3% during the fourth quarter (through the end of November) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 70 percent of these stocks already outperformed the market so far in Q4.

Disclosure: None. This article was originally published at Insider Monkey.