We at Insider Monkey have gone over 700 13F filings that hedge funds and prominent investors are required to file by the SEC The 13F filings show the funds’ and investors’ portfolio positions as of December 31st. In this article, we look at what those funds think of CONSOL Energy Inc. (NYSE:CEIX) based on that data.

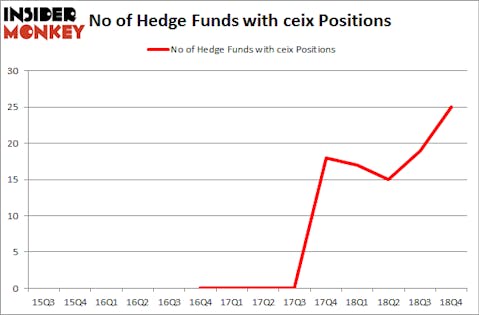

CONSOL Energy Inc. (NYSE:CEIX) was in 25 hedge funds’ portfolios at the end of December. CEIX shareholders have witnessed an increase in activity from the world’s largest hedge funds of late. There were 19 hedge funds in our database with CEIX positions at the end of the previous quarter. Our calculations also showed that ceix isn’t among the 30 most popular stocks among hedge funds.

In the eyes of most stock holders, hedge funds are seen as slow, outdated investment vehicles of years past. While there are greater than 8000 funds trading at present, Our researchers look at the moguls of this group, approximately 750 funds. These hedge fund managers control the lion’s share of the smart money’s total capital, and by tailing their matchless equity investments, Insider Monkey has figured out a number of investment strategies that have historically exceeded the S&P 500 index. Insider Monkey’s flagship hedge fund strategy outpaced the S&P 500 index by nearly 5 percentage points per year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

We’re going to go over the fresh hedge fund action surrounding CONSOL Energy Inc. (NYSE:CEIX).

Hedge fund activity in CONSOL Energy Inc. (NYSE:CEIX)

Heading into the first quarter of 2019, a total of 25 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 32% from one quarter earlier. On the other hand, there were a total of 17 hedge funds with a bullish position in CEIX a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Citadel Investment Group was the largest shareholder of CONSOL Energy Inc. (NYSE:CEIX), with a stake worth $33.8 million reported as of the end of December. Trailing Citadel Investment Group was Mountain Lake Investment Management, which amassed a stake valued at $16.4 million. Millennium Management, Winton Capital Management, and Anchor Bolt Capital were also very fond of the stock, giving the stock large weights in their portfolios.

As aggregate interest increased, some big names have jumped into CONSOL Energy Inc. (NYSE:CEIX) headfirst. Anchor Bolt Capital, managed by Robert Polak, assembled the biggest position in CONSOL Energy Inc. (NYSE:CEIX). Anchor Bolt Capital had $8.9 million invested in the company at the end of the quarter. David Einhorn’s Greenlight Capital also made a $4.4 million investment in the stock during the quarter. The other funds with brand new CEIX positions are Parvinder Thiara’s Athanor Capital, Minhua Zhang’s Weld Capital Management, and Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital.

Let’s now review hedge fund activity in other stocks similar to CONSOL Energy Inc. (NYSE:CEIX). These stocks are ScanSource, Inc. (NASDAQ:SCSC), ArcBest Corp (NASDAQ:ARCB), Teekay LNG Partners L.P. (NYSE:TGP), and Cheetah Mobile Inc (NYSE:CMCM). All of these stocks’ market caps are closest to CEIX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SCSC | 12 | 50297 | 4 |

| ARCB | 10 | 38491 | -4 |

| TGP | 8 | 19784 | 3 |

| CMCM | 4 | 5249 | -3 |

| Average | 8.5 | 28455 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 8.5 hedge funds with bullish positions and the average amount invested in these stocks was $28 million. That figure was $123 million in CEIX’s case. ScanSource, Inc. (NASDAQ:SCSC) is the most popular stock in this table. On the other hand Cheetah Mobile Inc (NYSE:CMCM) is the least popular one with only 4 bullish hedge fund positions. Compared to these stocks CONSOL Energy Inc. (NYSE:CEIX) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately CEIX wasn’t nearly as popular as these 15 stock and hedge funds that were betting on CEIX were disappointed as the stock returned 6.7% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.