Our extensive research has shown that imitating the smart money can generate significant returns for retail investors, which is why we track nearly 750 active prominent money managers and analyze their quarterly 13F filings. The stocks that are heavily bought by hedge funds historically outperformed the market, though there is no shortage of high profile failures like hedge funds’ 2018 losses in Facebook and Apple. Let’s take a closer look at what the funds we track think about Columbia Property Trust Inc (NYSE:CXP) in this article.

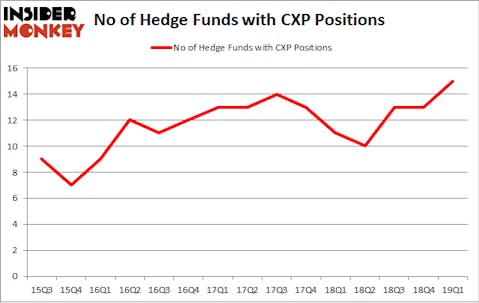

Columbia Property Trust Inc (NYSE:CXP) was in 15 hedge funds’ portfolios at the end of March. CXP investors should pay attention to an increase in enthusiasm from smart money recently. There were 13 hedge funds in our database with CXP positions at the end of the previous quarter. Our calculations also showed that cxp isn’t among the 30 most popular stocks among hedge funds.

At the moment there are several metrics shareholders can use to appraise stocks. A pair of the most under-the-radar metrics are hedge fund and insider trading interest. We have shown that, historically, those who follow the top picks of the elite hedge fund managers can outclass the market by a significant margin (see the details here).

Let’s check out the latest hedge fund action regarding Columbia Property Trust Inc (NYSE:CXP).

What does smart money think about Columbia Property Trust Inc (NYSE:CXP)?

At Q1’s end, a total of 15 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 15% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards CXP over the last 15 quarters. With hedgies’ positions undergoing their usual ebb and flow, there exists a few notable hedge fund managers who were upping their stakes substantially (or already accumulated large positions).

More specifically, Renaissance Technologies was the largest shareholder of Columbia Property Trust Inc (NYSE:CXP), with a stake worth $26.9 million reported as of the end of March. Trailing Renaissance Technologies was Millennium Management, which amassed a stake valued at $12.3 million. Elliott Management, Citadel Investment Group, and Balyasny Asset Management were also very fond of the stock, giving the stock large weights in their portfolios.

As aggregate interest increased, key hedge funds have been driving this bullishness. Elliott Management, managed by Paul Singer, initiated the biggest position in Columbia Property Trust Inc (NYSE:CXP). Elliott Management had $11.2 million invested in the company at the end of the quarter. Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital also initiated a $7.5 million position during the quarter. The other funds with new positions in the stock are Jeffrey Furber’s AEW Capital Management, Matthew Tewksbury’s Stevens Capital Management, and Minhua Zhang’s Weld Capital Management.

Let’s now take a look at hedge fund activity in other stocks similar to Columbia Property Trust Inc (NYSE:CXP). We will take a look at Fulton Financial Corp (NASDAQ:FULT), American States Water Co (NYSE:AWR), Brookfield Business Partners L.P. (NYSE:BBU), and Piedmont Office Realty Trust, Inc. (NYSE:PDM). This group of stocks’ market values resemble CXP’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FULT | 16 | 20134 | 4 |

| AWR | 15 | 70324 | 3 |

| BBU | 5 | 14305 | 1 |

| PDM | 13 | 147126 | -1 |

| Average | 12.25 | 62972 | 1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12.25 hedge funds with bullish positions and the average amount invested in these stocks was $63 million. That figure was $83 million in CXP’s case. Fulton Financial Corp (NASDAQ:FULT) is the most popular stock in this table. On the other hand Brookfield Business Partners L.P. (NYSE:BBU) is the least popular one with only 5 bullish hedge fund positions. Columbia Property Trust Inc (NYSE:CXP) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately CXP wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on CXP were disappointed as the stock returned 0% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.