How do you pick the next stock to invest in? One way would be to spend days of research browsing through thousands of publicly traded companies. However, an easier way is to look at the stocks that smart money investors are collectively bullish on. Hedge funds and other institutional investors usually invest large amounts of capital and have to conduct due diligence while choosing their next pick. They don’t always get it right, but, on average, their stock picks historically generated strong returns after adjusting for known risk factors. With this in mind, let’s take a look at the recent hedge fund activity surrounding Colony Credit Real Estate, Inc. (NYSE:CLNC).

Colony Credit Real Estate, Inc. (NYSE:CLNC) investors should pay attention to an increase in support from the world’s most elite money managers lately. Our calculations also showed that CLNC isn’t among the 30 most popular stocks among hedge funds (view the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Today there are several methods stock market investors have at their disposal to analyze stocks. A pair of the most underrated methods are hedge fund and insider trading activity. We have shown that, historically, those who follow the top picks of the elite fund managers can beat the broader indices by a superb margin (see the details here).

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to take a peek at the fresh hedge fund action surrounding Colony Credit Real Estate, Inc. (NYSE:CLNC).

What have hedge funds been doing with Colony Credit Real Estate, Inc. (NYSE:CLNC)?

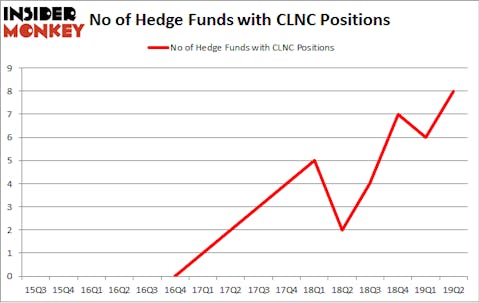

At Q2’s end, a total of 8 of the hedge funds tracked by Insider Monkey were long this stock, a change of 33% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards CLNC over the last 16 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, HBK Investments, managed by David Costen Haley, holds the number one position in Colony Credit Real Estate, Inc. (NYSE:CLNC). HBK Investments has a $12.8 million position in the stock, comprising 0.2% of its 13F portfolio. The second most bullish fund manager is Weiss Asset Management, managed by Andrew Weiss, which holds a $2.8 million position; the fund has 0.2% of its 13F portfolio invested in the stock. Other professional money managers that hold long positions contain Renaissance Technologies, Dmitry Balyasny’s Balyasny Asset Management and Ken Griffin’s Citadel Investment Group.

With a general bullishness amongst the heavyweights, key hedge funds have been driving this bullishness. Renaissance Technologies created the most valuable position in Colony Credit Real Estate, Inc. (NYSE:CLNC). Renaissance Technologies had $2 million invested in the company at the end of the quarter. Israel Englander’s Millennium Management also initiated a $0.6 million position during the quarter. The only other fund with a new position in the stock is Steve Cohen’s Point72 Asset Management.

Let’s now take a look at hedge fund activity in other stocks similar to Colony Credit Real Estate, Inc. (NYSE:CLNC). We will take a look at Ladder Capital Corp (NYSE:LADR), Tenet Healthcare Corporation (NYSE:THC), Groupon Inc (NASDAQ:GRPN), and Acushnet Holdings Corp. (NYSE:GOLF). This group of stocks’ market caps match CLNC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LADR | 13 | 33091 | -2 |

| THC | 30 | 669380 | 6 |

| GRPN | 24 | 391895 | -2 |

| GOLF | 11 | 22113 | -2 |

| Average | 19.5 | 279120 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19.5 hedge funds with bullish positions and the average amount invested in these stocks was $279 million. That figure was $21 million in CLNC’s case. Tenet Healthcare Corporation (NYSE:THC) is the most popular stock in this table. On the other hand Acushnet Holdings Corp. (NYSE:GOLF) is the least popular one with only 11 bullish hedge fund positions. Compared to these stocks Colony Credit Real Estate, Inc. (NYSE:CLNC) is even less popular than GOLF. Hedge funds dodged a bullet by taking a bearish stance towards CLNC. Our calculations showed that the top 20 most popular hedge fund stocks returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately CLNC wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); CLNC investors were disappointed as the stock returned -3.8% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far in 2019.

Disclosure: None. This article was originally published at Insider Monkey.