Coronavirus is probably the #1 concern in investors’ minds right now. It should be. On February 27th we published this article and predicted that US stocks will go down by at least 20% in the next 3-6 months. We also told you to short the market ETFs and buy long-term bonds. Investors who agreed with us and replicated these trades are up double digits whereas the market is down double digits. In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. Our extensive research has shown that imitating the smart money can generate significant returns for retail investors, which is why we track nearly 835 active prominent money managers and analyze their quarterly 13F filings. The stocks that are heavily bought by hedge funds historically outperformed the market, though there is no shortage of high profile failures like hedge funds’ 2018 losses in Facebook and Apple. Let’s take a closer look at what the funds we track think about CarMax Inc (NYSE:KMX) in this article.

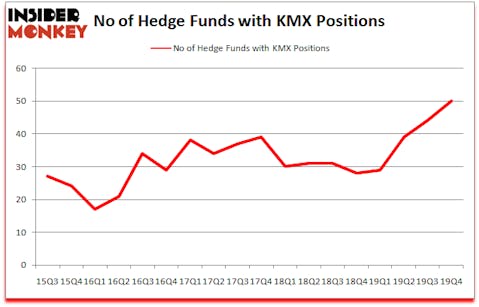

Is CarMax Inc (NYSE:KMX) ready to rally soon? Investors who are in the know are taking an optimistic view. The number of long hedge fund bets inched up by 6 recently. Our calculations also showed that KMX isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video below for Q3 rankings). KMX was in 50 hedge funds’ portfolios at the end of December. There were 44 hedge funds in our database with KMX holdings at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the 21st century investor’s toolkit there are numerous metrics stock market investors put to use to evaluate their holdings. A duo of the less utilized metrics are hedge fund and insider trading sentiment. We have shown that, historically, those who follow the top picks of the best hedge fund managers can beat the broader indices by a very impressive margin (see the details here).

Tom Gayner of Markel Gayner Asset Management

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences, and and go through short-term trade recommendations like this one. We even check out the recommendations of services with hard to believe track records. In January, we recommended a long position in one of the most shorted stocks in the market, and that stock returned more than 50% despite the large losses in the market since our recommendation. With all of this in mind let’s take a gander at the new hedge fund action encompassing CarMax Inc (NYSE:KMX).

What have hedge funds been doing with CarMax Inc (NYSE:KMX)?

Heading into the first quarter of 2020, a total of 50 of the hedge funds tracked by Insider Monkey were long this stock, a change of 14% from the third quarter of 2019. The graph below displays the number of hedge funds with bullish position in KMX over the last 18 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in CarMax Inc (NYSE:KMX) was held by Akre Capital Management, which reported holding $591.6 million worth of stock at the end of September. It was followed by Markel Gayner Asset Management with a $430.7 million position. Other investors bullish on the company included D E Shaw, Palestra Capital Management, and Giverny Capital. In terms of the portfolio weights assigned to each position LFL Advisers allocated the biggest weight to CarMax Inc (NYSE:KMX), around 18.63% of its 13F portfolio. Silver Heights Capital Management is also relatively very bullish on the stock, setting aside 16.33 percent of its 13F equity portfolio to KMX.

Now, some big names have jumped into CarMax Inc (NYSE:KMX) headfirst. Marshall Wace LLP, managed by Paul Marshall and Ian Wace, established the largest position in CarMax Inc (NYSE:KMX). Marshall Wace LLP had $17.4 million invested in the company at the end of the quarter. Phill Gross and Robert Atchinson’s Adage Capital Management also initiated a $16.7 million position during the quarter. The other funds with new positions in the stock are Stephen J. Errico’s Locust Wood Capital Advisers, Steven Boyd’s Armistice Capital, and George McCabe’s Portolan Capital Management.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as CarMax Inc (NYSE:KMX) but similarly valued. These stocks are Yandex NV (NASDAQ:YNDX), NetApp Inc. (NASDAQ:NTAP), Xylem Inc (NYSE:XYL), and Broadridge Financial Solutions, Inc. (NYSE:BR). All of these stocks’ market caps resemble KMX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| YNDX | 38 | 1167896 | -1 |

| NTAP | 27 | 687495 | 1 |

| XYL | 21 | 555354 | 1 |

| BR | 35 | 343414 | 4 |

| Average | 30.25 | 688540 | 1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 30.25 hedge funds with bullish positions and the average amount invested in these stocks was $689 million. That figure was $1872 million in KMX’s case. Yandex NV (NASDAQ:YNDX) is the most popular stock in this table. On the other hand Xylem Inc (NYSE:XYL) is the least popular one with only 21 bullish hedge fund positions. Compared to these stocks CarMax Inc (NYSE:KMX) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks lost 12.9% in 2020 through March 9th but still managed to beat the market by 1.9 percentage points. Hedge funds were also right about betting on KMX, though not to the same extent, as the stock returned -14.2% during the first quarter (through March 9th) and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.