Our extensive research has shown that imitating the smart money can generate significant returns for retail investors, which is why we track nearly 750 active prominent money managers and analyze their quarterly 13F filings. The stocks that are heavily bought by hedge funds historically outperformed the market, though there is no shortage of high profile failures like hedge funds’ 2018 losses in Facebook and Apple. Let’s take a closer look at what the funds we track think about Cardlytics, Inc. (NASDAQ:CDLX) in this article.

Cardlytics, Inc. (NASDAQ:CDLX) investors should pay attention to an increase in hedge fund sentiment lately. Our calculations also showed that CDLX isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the 21st century investor’s toolkit there are dozens of metrics stock market investors employ to evaluate stocks. Two of the most useful metrics are hedge fund and insider trading activity. Our researchers have shown that, historically, those who follow the best picks of the best hedge fund managers can trounce the market by a superb margin (see the details here).

Richard Driehaus of Driehaus Capital

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We also rely on the best performing hedge funds‘ buy/sell signals. We’re going to take a gander at the new hedge fund action regarding Cardlytics, Inc. (NASDAQ:CDLX).

Hedge fund activity in Cardlytics, Inc. (NASDAQ:CDLX)

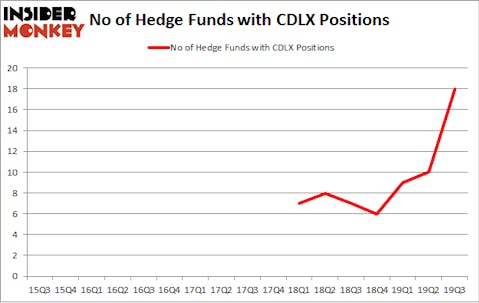

At Q3’s end, a total of 18 of the hedge funds tracked by Insider Monkey were long this stock, a change of 80% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards CDLX over the last 17 quarters. With the smart money’s capital changing hands, there exists a select group of noteworthy hedge fund managers who were adding to their stakes meaningfully (or already accumulated large positions).

The largest stake in Cardlytics, Inc. (NASDAQ:CDLX) was held by CAS Investment Partners, which reported holding $77.7 million worth of stock at the end of September. It was followed by Antipodean Advisors with a $21.8 million position. Other investors bullish on the company included 683 Capital Partners, Driehaus Capital, and Millennium Management. In terms of the portfolio weights assigned to each position Antipodean Advisors allocated the biggest weight to Cardlytics, Inc. (NASDAQ:CDLX), around 18.17% of its 13F portfolio. CAS Investment Partners is also relatively very bullish on the stock, designating 17.17 percent of its 13F equity portfolio to CDLX.

With a general bullishness amongst the heavyweights, specific money managers were leading the bulls’ herd. Intrinsic Edge Capital, managed by Mark Coe, created the most outsized position in Cardlytics, Inc. (NASDAQ:CDLX). Intrinsic Edge Capital had $5.2 million invested in the company at the end of the quarter. Jonathan Soros’s JS Capital also initiated a $4.2 million position during the quarter. The other funds with new positions in the stock are Renaissance Technologies, Andrew Bellas’s General Equity Partners, and Seymour Sy Kaufman and Michael Stark’s Crosslink Capital.

Let’s also examine hedge fund activity in other stocks similar to Cardlytics, Inc. (NASDAQ:CDLX). These stocks are NanoString Technologies Inc (NASDAQ:NSTG), Delek Logistics Partners LP (NYSE:DKL), Realogy Holdings Corp (NYSE:RLGY), and Hanger, Inc. (NYSE:HNGR). This group of stocks’ market valuations are similar to CDLX’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NSTG | 18 | 146085 | -2 |

| DKL | 1 | 2915 | 0 |

| RLGY | 23 | 302599 | -1 |

| HNGR | 15 | 113060 | -2 |

| Average | 14.25 | 141165 | -1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14.25 hedge funds with bullish positions and the average amount invested in these stocks was $141 million. That figure was $154 million in CDLX’s case. Realogy Holdings Corp (NYSE:RLGY) is the most popular stock in this table. On the other hand Delek Logistics Partners LP (NYSE:DKL) is the least popular one with only 1 bullish hedge fund positions. Cardlytics, Inc. (NASDAQ:CDLX) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Hedge funds were also right about betting on CDLX as the stock returned 67.2% during the fourth quarter (through the end of November) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.