“Market volatility has picked up again over the past few weeks. Headlines highlight risks regarding interest rates, the Fed, China, house prices, auto sales, trade wars, and more. Uncertainty abounds. But doesn’t it always? I have no view on whether the recent volatility will continue for a while, or whether the market will be back at all-time highs before we know it. I remain focused on preserving and growing our capital, and continue to believe that the best way to do so is via a value-driven, concentrated, patient approach. I shun consensus holdings, rich valuations, and market fads, in favor of solid, yet frequently off-the-beaten-path, businesses run by excellent, aligned management teams, purchased at deep discounts to intrinsic value,” are the words of Maran Capital’s Dan Roller. His stock picks have been beating the S&P 500 Index handily. We pay attention to what hedge funds are doing in a particular stock before considering a potential investment because it works for us. So let’s take a glance at the smart money sentiment towards CAI International Inc (NYSE:CAI) and see how it was affected.

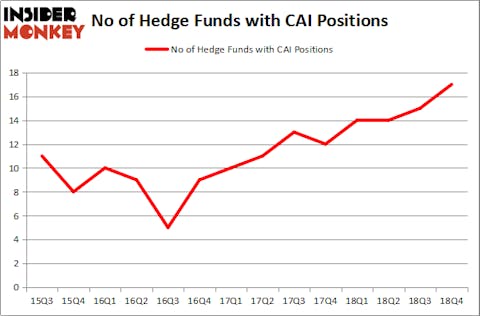

Is CAI International Inc (NYSE:CAI) worth your attention right now? The best stock pickers are becoming more confident. The number of long hedge fund positions inched up by 2 recently. Our calculations also showed that CAI isn’t among the 30 most popular stocks among hedge funds. CAI was in 17 hedge funds’ portfolios at the end of December. There were 15 hedge funds in our database with CAI holdings at the end of the previous quarter.

In the eyes of most shareholders, hedge funds are viewed as slow, old financial tools of years past. While there are greater than 8000 funds trading at the moment, Our experts choose to focus on the bigwigs of this group, about 750 funds. These hedge fund managers command the majority of the smart money’s total capital, and by watching their highest performing investments, Insider Monkey has determined many investment strategies that have historically outpaced Mr. Market. Insider Monkey’s flagship hedge fund strategy defeated the S&P 500 index by nearly 5 percentage points per annum since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

We’re going to take a look at the recent hedge fund action encompassing CAI International Inc (NYSE:CAI).

What have hedge funds been doing with CAI International Inc (NYSE:CAI)?

At Q4’s end, a total of 17 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 13% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in CAI over the last 14 quarters. With the smart money’s sentiment swirling, there exists a select group of key hedge fund managers who were adding to their stakes meaningfully (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Park West Asset Management, managed by Peter S. Park, holds the number one position in CAI International Inc (NYSE:CAI). Park West Asset Management has a $35.6 million position in the stock, comprising 1.8% of its 13F portfolio. The second largest stake is held by Mangrove Partners, managed by Nathaniel August, which holds a $16.8 million position; the fund has 2.2% of its 13F portfolio invested in the stock. Remaining hedge funds and institutional investors that hold long positions include Chuck Royce’s Royce & Associates, Andrew Weiss’s Weiss Asset Management and Jerome L. Simon’s Lonestar Capital Management.

As industrywide interest jumped, key hedge funds were breaking ground themselves. Park West Asset Management, managed by Peter S. Park, initiated the largest call position in CAI International Inc (NYSE:CAI). Park West Asset Management had $4.6 million invested in the company at the end of the quarter. Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital also initiated a $0.7 million position during the quarter. The following funds were also among the new CAI investors: Jim Simons’s Renaissance Technologies, Thomas Bailard’s Bailard Inc, and Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as CAI International Inc (NYSE:CAI) but similarly valued. These stocks are Resources Connection, Inc. (NASDAQ:RECN), Golden Entertainment Inc (NASDAQ:GDEN), Old Line Bancshares, Inc. (MD) (NASDAQ:OLBK), and Venator Materials PLC (NYSE:VNTR). This group of stocks’ market values match CAI’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RECN | 13 | 37849 | 0 |

| GDEN | 12 | 117180 | -5 |

| OLBK | 9 | 49764 | 2 |

| VNTR | 16 | 74101 | -3 |

| Average | 12.5 | 69724 | -1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12.5 hedge funds with bullish positions and the average amount invested in these stocks was $70 million. That figure was $103 million in CAI’s case. Venator Materials PLC (NYSE:VNTR) is the most popular stock in this table. On the other hand Old Line Bancshares, Inc. (MD) (NASDAQ:OLBK) is the least popular one with only 9 bullish hedge fund positions. Compared to these stocks CAI International Inc (NYSE:CAI) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately CAI wasn’t nearly as popular as these 15 stock and hedge funds that were betting on CAI were disappointed as the stock returned 8.9% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.