The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. We have processed the filings of the more than 700 world-class investment firms that we track and now have access to the collective wisdom contained in these filings, which are based on their June 28 holdings, data that is available nowhere else. Should you consider Brown-Forman Corporation (NYSE:BF) for your portfolio? We’ll look to this invaluable collective wisdom for the answer.

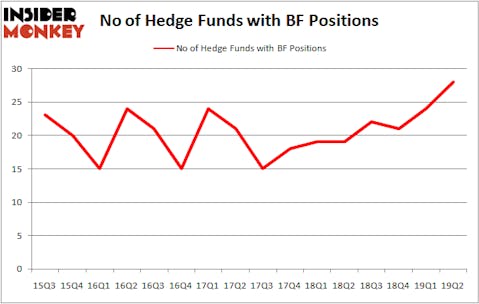

Brown-Forman Corporation (NYSE:BF) has seen an increase in activity from the world’s largest hedge funds lately. Our calculations also showed that BF isn’t among the 30 most popular stocks among hedge funds.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 25.7% through September 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s view the latest hedge fund action regarding Brown-Forman Corporation (NYSE:BF).

Hedge fund activity in Brown-Forman Corporation (NYSE:BF)

Heading into the third quarter of 2019, a total of 28 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 17% from the first quarter of 2019. By comparison, 19 hedge funds held shares or bullish call options in BF a year ago. With hedge funds’ capital changing hands, there exists a select group of key hedge fund managers who were increasing their stakes meaningfully (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Gardner Russo & Gardner, managed by Tom Russo, holds the biggest position in Brown-Forman Corporation (NYSE:BF). Gardner Russo & Gardner has a $216.9 million position in the stock, comprising 1.6% of its 13F portfolio. The second largest stake is held by Gardner Russo & Gardner, led by Tom Russo, holding a $105 million position; the fund has 0.8% of its 13F portfolio invested in the stock. Some other members of the smart money that hold long positions comprise D. E. Shaw’s D E Shaw, Tom Gayner’s Markel Gayner Asset Management and Mario Gabelli’s GAMCO Investors.

With a general bullishness amongst the heavyweights, key money managers have been driving this bullishness. Maverick Capital, managed by Lee Ainslie, created the biggest position in Brown-Forman Corporation (NYSE:BF). Maverick Capital had $6.2 million invested in the company at the end of the quarter. Greg Poole’s Echo Street Capital Management also made a $4.6 million investment in the stock during the quarter. The following funds were also among the new BF investors: Perella Weinberg Partners, John Overdeck and David Siegel’s Two Sigma Advisors, and Ben Levine, Andrew Manuel and Stefan Renold’s LMR Partners.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Brown-Forman Corporation (NYSE:BF) but similarly valued. These stocks are First Data Corporation (NYSE:FDC), SBA Communications Corporation (NASDAQ:SBAC), TransDigm Group Incorporated (NYSE:TDG), and IHS Markit Ltd. (NYSE:INFO). This group of stocks’ market values are similar to BF’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FDC | 56 | 3664439 | -1 |

| SBAC | 31 | 1594237 | 2 |

| TDG | 48 | 5078289 | -4 |

| INFO | 28 | 998482 | -2 |

| Average | 40.75 | 2833862 | -1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 40.75 hedge funds with bullish positions and the average amount invested in these stocks was $2834 million. That figure was $698 million in BF’s case. First Data Corporation (NYSE:FDC) is the most popular stock in this table. On the other hand IHS Markit Ltd. (NYSE:INFO) is the least popular one with only 28 bullish hedge fund positions. Compared to these stocks Brown-Forman Corporation (NYSE:BF) is even less popular than INFO. Hedge funds clearly dropped the ball on BF as the stock delivered strong returns, though hedge funds’ consensus picks still generated respectable returns. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. A small number of hedge funds were also right about betting on BF as the stock returned 8.9% during the third quarter and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.