We hate to say this but, we told you so. On February 27th we published an article with the title Recession is Imminent: We Need A Travel Ban NOW and predicted a US recession when the S&P 500 Index was trading at the 3150 level. We also told you to short the market and buy long-term Treasury bonds. Our article also called for a total international travel ban. While we were warning you, President Trump minimized the threat and failed to act promptly. As a result of his inaction, we will now experience a deeper recession (see why hell is coming).

In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. Keeping this in mind let’s see whether Alexander’s, Inc. (NYSE:ALX) represents a good buying opportunity at the moment. Let’s quickly check the hedge fund interest towards the company. Hedge fund firms constantly search out bright intellectuals and highly-experienced employees and throw away millions of dollars on satellite photos and other research activities, so it is no wonder why they tend to generate millions in profits each year. It is also true that some hedge fund players fail inconceivably on some occasions, but net net their stock picks have been generating superior risk-adjusted returns on average over the years.

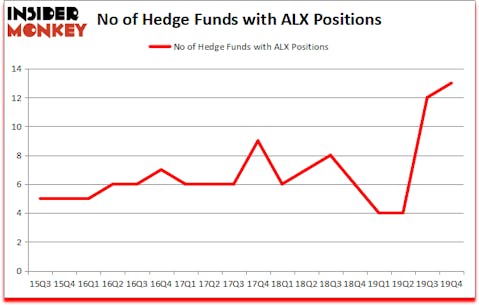

Is Alexander’s, Inc. (NYSE:ALX) a buy right now? The best stock pickers are betting on the stock. The number of bullish hedge fund positions moved up by 1 in recent months. Our calculations also showed that ALX isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video at the end of this article for Q3 rankings).

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research was able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by more than 41 percentage points since March 2017 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 35.3% through March 3rd. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Paul Tudor Jones of Tudor Investment Corp

We leave no stone unturned when looking for the next great investment idea. For example, Federal Reserve and other Central Banks are tripping over each other to print more money. As a result, we believe gold stocks will outperform fixed income ETFs in the long-term. So we are checking out investment opportunities like this one. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Our best call in 2020 was shorting the market when S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. Now we’re going to view the recent hedge fund action surrounding Alexander’s, Inc. (NYSE:ALX).

What have hedge funds been doing with Alexander’s, Inc. (NYSE:ALX)?

At Q4’s end, a total of 13 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 8% from the third quarter of 2019. The graph below displays the number of hedge funds with bullish position in ALX over the last 18 quarters. With hedgies’ positions undergoing their usual ebb and flow, there exists an “upper tier” of noteworthy hedge fund managers who were adding to their holdings substantially (or already accumulated large positions).

The largest stake in Alexander’s, Inc. (NYSE:ALX) was held by Renaissance Technologies, which reported holding $44.5 million worth of stock at the end of September. It was followed by EMS Capital with a $31.7 million position. Other investors bullish on the company included Long Pond Capital, Millennium Management, and Citadel Investment Group. In terms of the portfolio weights assigned to each position EMS Capital allocated the biggest weight to Alexander’s, Inc. (NYSE:ALX), around 2.57% of its 13F portfolio. Long Pond Capital is also relatively very bullish on the stock, dishing out 0.7 percent of its 13F equity portfolio to ALX.

As aggregate interest increased, key hedge funds have jumped into Alexander’s, Inc. (NYSE:ALX) headfirst. Ellington, managed by Mike Vranos, initiated the most outsized position in Alexander’s, Inc. (NYSE:ALX). Ellington had $0.2 million invested in the company at the end of the quarter. Cliff Asness’s AQR Capital Management also made a $0.2 million investment in the stock during the quarter. The only other fund with a brand new ALX position is Paul Tudor Jones’s Tudor Investment Corp.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Alexander’s, Inc. (NYSE:ALX) but similarly valued. These stocks are Grupo Simec S.A.B. de C.V. (NYSE:SIM), Broadmark Realty Capital Inc. (NYSE:BRMK), Fresh Del Monte Produce Inc (NYSE:FDP), and Hailiang Education Group Inc. (NASDAQ:HLG). This group of stocks’ market values are closest to ALX’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SIM | 1 | 2589 | 0 |

| BRMK | 17 | 152022 | 2 |

| FDP | 11 | 42385 | 0 |

| HLG | 3 | 8048 | 0 |

| Average | 8 | 51261 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 8 hedge funds with bullish positions and the average amount invested in these stocks was $51 million. That figure was $115 million in ALX’s case. Broadmark Realty Capital Inc. (NYSE:BRMK) is the most popular stock in this table. On the other hand Grupo Simec S.A.B. de C.V. (NYSE:SIM) is the least popular one with only 1 bullish hedge fund positions. Alexander’s, Inc. (NYSE:ALX) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks lost 13.0% in 2020 through April 6th but still beat the market by 4.2 percentage points. Hedge funds were also right about betting on ALX as the stock returned -12.6% in 2020 (through April 6th) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.