At the end of February we announced the arrival of the first US recession since 2009 and we predicted that the market will decline by at least 20% in (see why hell is coming). We reversed our stance on March 25th after seeing unprecedented fiscal and monetary stimulus unleashed by the Fed and the Congress. This is the perfect market for stock pickers, now that the stocks are fully valued again. In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. In this article, we will take a closer look at hedge fund sentiment towards Agios Pharmaceuticals Inc (NASDAQ:AGIO) at the end of the second quarter and determine whether the smart money was really smart about this stock.

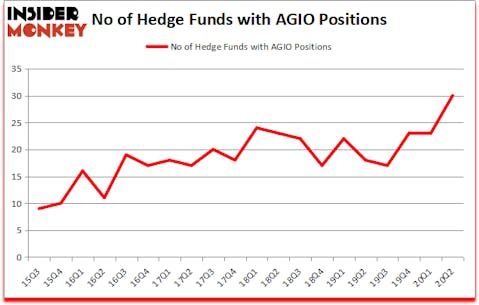

Is Agios Pharmaceuticals Inc (NASDAQ:AGIO) undervalued? The best stock pickers were buying. The number of bullish hedge fund bets increased by 7 in recent months. Agios Pharmaceuticals Inc (NASDAQ:AGIO) was in 30 hedge funds’ portfolios at the end of June. The all time high for this statistics is 24. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. Our calculations also showed that AGIO isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings and see the video for a quick look at the top 5 stocks). There were 23 hedge funds in our database with AGIO positions at the end of the first quarter.

Video: Watch our video about the top 5 most popular hedge fund stocks.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by 58 percentage points since March 2017 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Sander Gerber of Hudson Bay Capital

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, this “mom” trader turned $2000 into $2 million within 2 years. So, we are checking out her best trade idea of the month. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We go through lists like the 10 most profitable companies in the world to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. Now let’s take a gander at the key hedge fund action surrounding Agios Pharmaceuticals Inc (NASDAQ:AGIO).

How are hedge funds trading Agios Pharmaceuticals Inc (NASDAQ:AGIO)?

At second quarter’s end, a total of 30 of the hedge funds tracked by Insider Monkey were long this stock, a change of 30% from the first quarter of 2020. On the other hand, there were a total of 18 hedge funds with a bullish position in AGIO a year ago. With hedgies’ positions undergoing their usual ebb and flow, there exists a select group of noteworthy hedge fund managers who were increasing their stakes significantly (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Samuel Isaly’s OrbiMed Advisors has the number one position in Agios Pharmaceuticals Inc (NASDAQ:AGIO), worth close to $92.4 million, amounting to 1.3% of its total 13F portfolio. Coming in second is Farallon Capital, founded by Thomas Steyer, holding a $66.9 million position; 0.5% of its 13F portfolio is allocated to the company. Remaining hedge funds and institutional investors that hold long positions contain Kris Jenner, Gordon Bussard, Graham McPhail’s Rock Springs Capital Management, Eli Casdin’s Casdin Capital and Joseph Edelman’s Perceptive Advisors. In terms of the portfolio weights assigned to each position Casdin Capital allocated the biggest weight to Agios Pharmaceuticals Inc (NASDAQ:AGIO), around 3.39% of its 13F portfolio. Integral Health Asset Management is also relatively very bullish on the stock, setting aside 2.4 percent of its 13F equity portfolio to AGIO.

As aggregate interest increased, some big names were leading the bulls’ herd. Polar Capital, managed by Brian Ashford-Russell and Tim Woolley, created the most outsized position in Agios Pharmaceuticals Inc (NASDAQ:AGIO). Polar Capital had $8 million invested in the company at the end of the quarter. Ken Greenberg and David Kim’s Ghost Tree Capital also initiated a $6.2 million position during the quarter. The following funds were also among the new AGIO investors: Michael Gelband’s ExodusPoint Capital, Krishen Sud’s Sivik Global Healthcare, and Sander Gerber’s Hudson Bay Capital Management.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Agios Pharmaceuticals Inc (NASDAQ:AGIO) but similarly valued. We will take a look at Tapestry, Inc. (NYSE:TPR), Simpson Manufacturing Co, Inc. (NYSE:SSD), Alamos Gold Inc (NYSE:AGI), DouYu International Holdings Limited (NASDAQ:DOYU), Momo Inc (NASDAQ:MOMO), Cogent Communications Holdings Inc. (NASDAQ:CCOI), and Parsons Corporation (NYSE:PSN). This group of stocks’ market caps match AGIO’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TPR | 39 | 533337 | 2 |

| SSD | 21 | 200223 | -5 |

| AGI | 16 | 399028 | -3 |

| DOYU | 15 | 77638 | 0 |

| MOMO | 34 | 586169 | 9 |

| CCOI | 28 | 464857 | 1 |

| PSN | 15 | 81243 | 0 |

| Average | 24 | 334642 | 0.6 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 24 hedge funds with bullish positions and the average amount invested in these stocks was $335 million. That figure was $460 million in AGIO’s case. Tapestry, Inc. (NYSE:TPR) is the most popular stock in this table. On the other hand DouYu International Holdings Limited (NASDAQ:DOYU) is the least popular one with only 15 bullish hedge fund positions. Agios Pharmaceuticals Inc (NASDAQ:AGIO) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for AGIO is 71.3. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 23.8% in 2020 through September 14th and beat the market by 17.6 percentage points. Unfortunately AGIO wasn’t nearly as popular as these 10 stocks and hedge funds that were betting on AGIO were disappointed as the stock returned -28.1% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 10 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Follow Agios Pharmaceuticals Inc. (NASDAQ:AGIO)

Follow Agios Pharmaceuticals Inc. (NASDAQ:AGIO)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.