Is The Chefs Warehouse, Inc (NASDAQ:CHEF) a good bet right now? We like to analyze hedge fund sentiment before doing days of in-depth research. We do so because hedge funds and other elite investors have numerous Ivy League graduates, expert network advisers, and supply chain tipsters working or consulting for them. There is not a shortage of news stories covering failed hedge fund investments and it is a fact that hedge funds’ picks don’t beat the market 100% of the time, but their consensus picks have historically done very well and have outperformed the market after adjusting for risk.

The Chefs Warehouse, Inc (NASDAQ:CHEF) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 10 hedge funds’ portfolios at the end of December. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Endurance International Group Holdings Inc (NASDAQ:EIGI), New Mountain Finance Corp. (NYSE:NMFC), and Tronox Holdings plc (NYSE:TROX) to gather more data points.

To most shareholders, hedge funds are seen as slow, outdated financial tools of the past. While there are greater than 8000 funds trading at the moment, Our researchers look at the masters of this club, around 750 funds. These investment experts orchestrate most of all hedge funds’ total asset base, and by tailing their best equity investments, Insider Monkey has formulated a few investment strategies that have historically outpaced the market. Insider Monkey’s flagship hedge fund strategy outpaced the S&P 500 index by nearly 5 percentage points per year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

Let’s analyze the new hedge fund action surrounding The Chefs Warehouse, Inc (NASDAQ:CHEF).

How have hedgies been trading The Chefs Warehouse, Inc (NASDAQ:CHEF)?

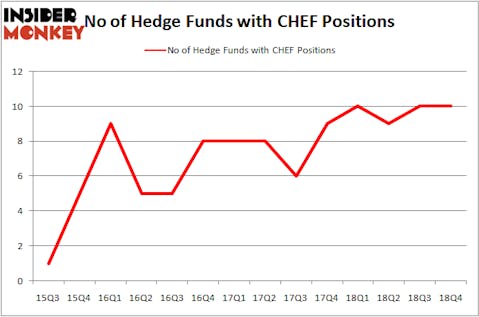

At Q4’s end, a total of 10 of the hedge funds tracked by Insider Monkey were long this stock, a change of 0% from the second quarter of 2018. Below, you can check out the change in hedge fund sentiment towards CHEF over the last 14 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Renaissance Technologies, managed by Jim Simons, holds the most valuable position in The Chefs Warehouse, Inc (NASDAQ:CHEF). Renaissance Technologies has a $33 million position in the stock, comprising less than 0.1%% of its 13F portfolio. The second largest stake is held by Richard Driehaus of Driehaus Capital, with a $12.6 million position; the fund has 0.5% of its 13F portfolio invested in the stock. Remaining members of the smart money with similar optimism comprise Principal Global Investors’s Columbus Circle Investors, Peter Muller’s PDT Partners and Joel Greenblatt’s Gotham Asset Management.

Because The Chefs Warehouse, Inc (NASDAQ:CHEF) has faced a decline in interest from the aggregate hedge fund industry, it’s safe to say that there lies a certain “tier” of hedge funds who were dropping their full holdings heading into Q3. Interestingly, Peter Schliemann’s Rutabaga Capital Management dropped the largest stake of the “upper crust” of funds tracked by Insider Monkey, comprising close to $2 million in stock, and D. E. Shaw’s D E Shaw was right behind this move, as the fund said goodbye to about $1.8 million worth. These moves are important to note, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as The Chefs Warehouse, Inc (NASDAQ:CHEF) but similarly valued. These stocks are Endurance International Group Holdings Inc (NASDAQ:EIGI), New Mountain Finance Corp. (NYSE:NMFC), Tronox Holdings plc (NYSE:TROX), and Easterly Government Properties Inc (NYSE:DEA). This group of stocks’ market caps are closest to CHEF’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EIGI | 18 | 113243 | 3 |

| NMFC | 11 | 15280 | -1 |

| TROX | 26 | 144390 | -4 |

| DEA | 5 | 121754 | -3 |

| Average | 15 | 98667 | -1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15 hedge funds with bullish positions and the average amount invested in these stocks was $99 million. That figure was $50 million in CHEF’s case. Tronox Holdings plc (NYSE:TROX) is the most popular stock in this table. On the other hand Easterly Government Properties Inc (NYSE:DEA) is the least popular one with only 5 bullish hedge fund positions. The Chefs Warehouse, Inc (NASDAQ:CHEF) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately CHEF wasn’t nearly as popular as these 15 stock (hedge fund sentiment was quite bearish); CHEF investors were disappointed as the stock returned -2.4% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.