Before we spend days researching a stock idea we like to take a look at how hedge funds and billionaire investors recently traded that stock. The S&P 500 Index ETF (SPY) lost 2.6% in the first two months of the second quarter. Ten out of 11 industry groups in the S&P 500 Index lost value in May. The average return of a randomly picked stock in the index was even worse (-3.6%). This means you (or a monkey throwing a dart) have less than an even chance of beating the market by randomly picking a stock. On the other hand, the top 20 most popular S&P 500 stocks among hedge funds not only generated positive returns but also outperformed the index by about 3 percentage points through May 30th. In this article, we will take a look at what hedge funds think about Sportsman’s Warehouse Holdings Inc (NASDAQ:SPWH).

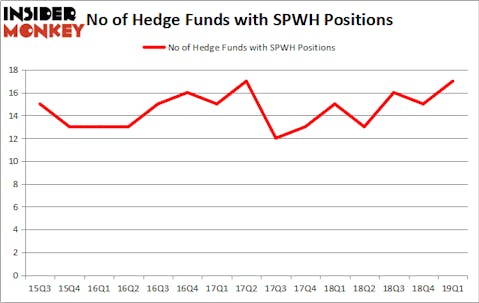

Is Sportsman’s Warehouse Holdings Inc (NASDAQ:SPWH) going to take off soon? Money managers are becoming more confident. The number of long hedge fund bets increased by 2 lately. Our calculations also showed that SPWH isn’t among the 30 most popular stocks among hedge funds. SPWH was in 17 hedge funds’ portfolios at the end of March. There were 15 hedge funds in our database with SPWH positions at the end of the previous quarter.

In the eyes of most traders, hedge funds are perceived as slow, outdated financial tools of yesteryear. While there are over 8000 funds with their doors open at present, We look at the masters of this club, approximately 750 funds. It is estimated that this group of investors watch over most of the smart money’s total asset base, and by following their inimitable equity investments, Insider Monkey has unsheathed numerous investment strategies that have historically outstripped the market. Insider Monkey’s flagship hedge fund strategy outstripped the S&P 500 index by around 5 percentage points annually since its inception in May 2014 through June 18th. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 28.2% since February 2017 (through June 18th) even though the market was up nearly 30% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 8.2% in a month whereas our long picks outperformed the market by 2.5 percentage points in this volatile 5 week period (our long picks also beat the market by 15 percentage points so far this year).

Let’s analyze the key hedge fund action regarding Sportsman’s Warehouse Holdings Inc (NASDAQ:SPWH).

How are hedge funds trading Sportsman’s Warehouse Holdings Inc (NASDAQ:SPWH)?

At the end of the first quarter, a total of 17 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 13% from the fourth quarter of 2018. On the other hand, there were a total of 15 hedge funds with a bullish position in SPWH a year ago. With hedgies’ positions undergoing their usual ebb and flow, there exists a few key hedge fund managers who were upping their holdings substantially (or already accumulated large positions).

The largest stake in Sportsman’s Warehouse Holdings Inc (NASDAQ:SPWH) was held by Cannell Capital, which reported holding $10.6 million worth of stock at the end of March. It was followed by Arbiter Partners Capital Management with a $7.3 million position. Other investors bullish on the company included Scion Asset Management, D E Shaw, and Springbok Capital.

Now, key hedge funds were breaking ground themselves. Manatuck Hill Partners, managed by Mark Broach, established the largest position in Sportsman’s Warehouse Holdings Inc (NASDAQ:SPWH). Manatuck Hill Partners had $1.2 million invested in the company at the end of the quarter. Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital also made a $0.5 million investment in the stock during the quarter. The other funds with brand new SPWH positions are Philippe Laffont’s Coatue Management and John Overdeck and David Siegel’s Two Sigma Advisors.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Sportsman’s Warehouse Holdings Inc (NASDAQ:SPWH) but similarly valued. We will take a look at SB One Bancorp (NASDAQ:SBBX), DHX Media Ltd (NASDAQ:DHXM), Brasilagro Cia Brasileira De Propriedades Agricolas (NYSE:LND), and OncoCyte Corporation (NYSE:OCX). This group of stocks’ market values resemble SPWH’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SBBX | 5 | 17646 | 1 |

| DHXM | 4 | 59802 | -1 |

| LND | 1 | 43 | 0 |

| OCX | 7 | 34448 | 6 |

| Average | 4.25 | 27985 | 1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 4.25 hedge funds with bullish positions and the average amount invested in these stocks was $28 million. That figure was $35 million in SPWH’s case. OncoCyte Corporation (NYSE:OCX) is the most popular stock in this table. On the other hand Brasilagro Cia Brasileira De Propriedades Agricolas (NYSE:LND) is the least popular one with only 1 bullish hedge fund positions. Compared to these stocks Sportsman’s Warehouse Holdings Inc (NASDAQ:SPWH) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately SPWH wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on SPWH were disappointed as the stock returned -21.7% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market in Q2.

Disclosure: None. This article was originally published at Insider Monkey.