Before putting in our own effort and resources into finding a good investment, we can quickly utilize hedge fund expertise to give us a quick glimpse of whether that stock could make for a good addition to our portfolios. The odds are not exactly stacked in investors’ favor when it comes to beating the market, as evidenced by the fact that less than 49% of the stocks in the S&P 500 did so during the 12-month period ending October 30. The stats were even worse in recent years when most of the advances in the market were due to large gains by FAANG stocks. However, one bright side for individual investors was the strong performance of hedge funds’ top consensus picks. This year hedge funds’ top 30 stock picks outperformed the S&P 500 Index by 4 percentage points through the middle of November. Thus, we can see that the tireless research and efforts of hedge funds to identify winning stocks can work to our advantage when we know how to use the data. While not all of their picks will be winners, our odds are much better following their best stock picks than trying to go it alone.

Sportsman’s Warehouse Holdings Inc (NASDAQ:SPWH) has seen an increase in hedge fund sentiment recently. Our calculations also showed that SPWH isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to take a peek at the recent hedge fund action regarding Sportsman’s Warehouse Holdings Inc (NASDAQ:SPWH).

What does the smart money think about Sportsman’s Warehouse Holdings Inc (NASDAQ:SPWH)?

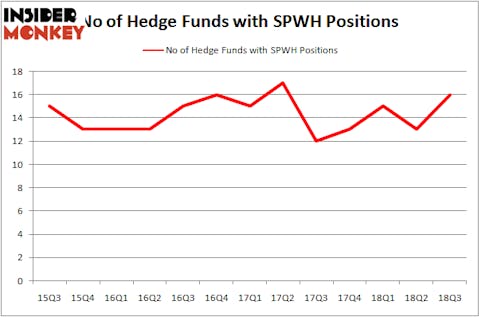

At Q3’s end, a total of 16 of the hedge funds tracked by Insider Monkey were long this stock, a change of 23% from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in SPWH over the last 13 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Arbiter Partners Capital Management held the most valuable stake in Sportsman’s Warehouse Holdings Inc (NASDAQ:SPWH), which was worth $13.2 million at the end of the third quarter. On the second spot was Cannell Capital which amassed $9 million worth of shares. Moreover, Citadel Investment Group, D E Shaw, and Skylands Capital were also bullish on Sportsman’s Warehouse Holdings Inc (NASDAQ:SPWH), allocating a large percentage of their portfolios to this stock.

As industrywide interest jumped, some big names were leading the bulls’ herd. North Fourth Asset Management, managed by Anthony Joseph Vaccarino, established the most outsized position in Sportsman’s Warehouse Holdings Inc (NASDAQ:SPWH). North Fourth Asset Management had $1.4 million invested in the company at the end of the quarter. Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital also initiated a $1.3 million position during the quarter. The other funds with brand new SPWH positions are Peter Muller’s PDT Partners, Mike Vranos’s Ellington, and Roger Ibbotson’s Zebra Capital Management.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Sportsman’s Warehouse Holdings Inc (NASDAQ:SPWH) but similarly valued. These stocks are Trident Acquisitions Corp. (NASDAQ:TDAC), USD Partners LP (NYSE:USDP), Corvus Pharmaceuticals, Inc. (NASDAQ:CRVS), and Danaos Corporation (NYSE:DAC). This group of stocks’ market caps resemble SPWH’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TDAC | 8 | 50895 | 0 |

| USDP | 2 | 1701 | 0 |

| CRVS | 8 | 79388 | 1 |

| DAC | 1 | 341 | 0 |

| Average | 4.75 | 33081 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 4.75 hedge funds with bullish positions and the average amount invested in these stocks was $33 million. That figure was $34 million in SPWH’s case. Trident Acquisitions Corp. (NASDAQ:TDAC) is the most popular stock in this table. On the other hand Danaos Corporation (NYSE:DAC) is the least popular one with only 1 bullish hedge fund positions. Compared to these stocks Sportsman’s Warehouse Holdings Inc (NASDAQ:SPWH) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.