Before we spend countless hours researching a company, we like to analyze what insiders, hedge funds and billionaire investors think of the stock first. This is a necessary first step in our investment process because our research has shown that the elite investors’ consensus returns have been exceptional. In the following paragraphs, we find out what the billionaire investors and hedge funds think of Southern First Bancshares, Inc. (NASDAQ:SFST).

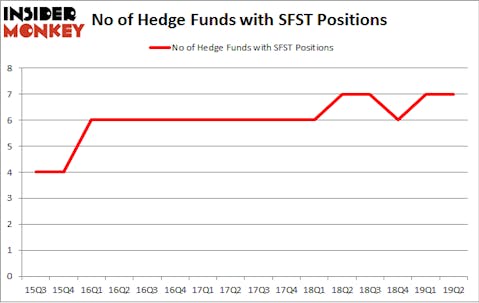

Southern First Bancshares, Inc. (NASDAQ:SFST) shares haven’t seen a lot of action during the second quarter. Overall, hedge fund sentiment was unchanged. The stock was in 7 hedge funds’ portfolios at the end of June. At the end of this article we will also compare SFST to other stocks including Cellular Biomedicine Group, Inc. (NASDAQ:CBMG), Republic First Bancorp, Inc. (NASDAQ:FRBK), and SunOpta, Inc. (NASDAQ:STKL) to get a better sense of its popularity.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

To most investors, hedge funds are viewed as unimportant, outdated investment tools of years past. While there are more than 8000 funds trading at present, We look at the upper echelon of this group, about 750 funds. Most estimates calculate that this group of people direct most of all hedge funds’ total asset base, and by shadowing their best stock picks, Insider Monkey has found many investment strategies that have historically outperformed the S&P 500 index. Insider Monkey’s flagship hedge fund strategy outstripped the S&P 500 index by around 5 percentage points annually since its inception in May 2014. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 25.7% since February 2017 (through September 30th) even though the market was up more than 33% during the same period. We just shared a list of 10 short targets in our latest quarterly update .

In addition to following the biggest hedge funds for investment ideas, we also share stock pitches from conferences, investor letters and other sources like this one where the fund manager is talking about two under the radar 1000% return potential stocks: first one in internet infrastructure and the second in the heart of advertising market. We use hedge fund buy/sell signals to determine whether to conduct in-depth analysis of these stock ideas which take days. We’re going to take a peek at the fresh hedge fund action encompassing Southern First Bancshares, Inc. (NASDAQ:SFST).

How are hedge funds trading Southern First Bancshares, Inc. (NASDAQ:SFST)?

At Q2’s end, a total of 7 of the hedge funds tracked by Insider Monkey were long this stock, a change of 0% from one quarter earlier. By comparison, 7 hedge funds held shares or bullish call options in SFST a year ago. With the smart money’s positions undergoing their usual ebb and flow, there exists a select group of notable hedge fund managers who were upping their stakes substantially (or already accumulated large positions).

More specifically, Mendon Capital Advisors was the largest shareholder of Southern First Bancshares, Inc. (NASDAQ:SFST), with a stake worth $10.5 million reported as of the end of March. Trailing Mendon Capital Advisors was Castine Capital Management, which amassed a stake valued at $9.6 million. Elizabeth Park Capital Management, Renaissance Technologies, and EJF Capital were also very fond of the stock, giving the stock large weights in their portfolios.

Earlier we told you that the aggregate hedge fund interest in the stock was unchanged and we view this as a negative development. Even though there weren’t any hedge funds dumping their holdings during the second quarter, there weren’t any hedge funds initiating brand new positions. This indicates that hedge funds, at the very best, perceive this stock as dead money and they haven’t identified any viable catalysts that can attract investor attention.

Let’s also examine hedge fund activity in other stocks similar to Southern First Bancshares, Inc. (NASDAQ:SFST). These stocks are Cellular Biomedicine Group, Inc. (NASDAQ:CBMG), Republic First Bancorp, Inc. (NASDAQ:FRBK), SunOpta, Inc. (NASDAQ:STKL), and The First Bancorp, Inc. (NASDAQ:FNLC). This group of stocks’ market caps resemble SFST’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CBMG | 1 | 11123 | -1 |

| FRBK | 6 | 4889 | 0 |

| STKL | 14 | 112503 | 3 |

| FNLC | 1 | 5979 | 0 |

| Average | 5.5 | 33624 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 5.5 hedge funds with bullish positions and the average amount invested in these stocks was $34 million. That figure was $38 million in SFST’s case. SunOpta, Inc. (NASDAQ:STKL) is the most popular stock in this table. On the other hand Cellular Biomedicine Group, Inc. (NASDAQ:CBMG) is the least popular one with only 1 bullish hedge fund positions. Southern First Bancshares, Inc. (NASDAQ:SFST) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately SFST wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on SFST were disappointed as the stock returned 1.8% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Disclosure: None. This article was originally published at Insider Monkey.