“Since 2006, value stocks (IVE vs IVW) have underperformed 11 of the 13 calendar years and when they beat growth, it wasn’t by much. Cumulatively, through this week, it has been a 122% differential (up 52% for value vs up 174% for growth). This appears to be the longest and most severe drought for value investors since data collection began. It will go our way eventually as there are too many people paying far too much for today’s darlings, both public and private. Further, the ten-year yield of 2.5% (pre-tax) isn’t attractive nor is real estate. We believe the value part of the global equity market is the only place to earn solid risk adjusted returns and we believe those returns will be higher than normal,” said Vilas Fund in its Q1 investor letter. We aren’t sure whether value stocks outperform growth, but we follow hedge fund investor letters to understand where the markets and stocks might be going. That’s why we believe it would be worthwhile to take a look at the hedge fund sentiment on Repligen Corporation (NASDAQ:RGEN) in order to identify whether reputable and successful top money managers continue to believe in its potential.

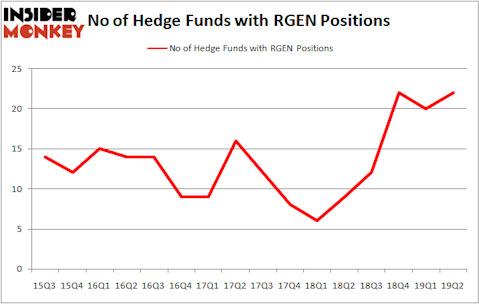

Repligen Corporation (NASDAQ:RGEN) has experienced an increase in hedge fund sentiment of late. Our calculations also showed that RGEN isn’t among the 30 most popular stocks among hedge funds (view the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

At the moment there are numerous indicators investors employ to analyze stocks. A duo of the most useful indicators are hedge fund and insider trading activity. We have shown that, historically, those who follow the best picks of the best money managers can outperform the market by a solid margin (see the details here).

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s take a glance at the recent hedge fund action regarding Repligen Corporation (NASDAQ:RGEN).

How are hedge funds trading Repligen Corporation (NASDAQ:RGEN)?

Heading into the third quarter of 2019, a total of 22 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 10% from the first quarter of 2019. By comparison, 9 hedge funds held shares or bullish call options in RGEN a year ago. With hedgies’ positions undergoing their usual ebb and flow, there exists a few notable hedge fund managers who were increasing their holdings meaningfully (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Joel Ramin’s 12 West Capital Management has the number one position in Repligen Corporation (NASDAQ:RGEN), worth close to $44.3 million, corresponding to 3.3% of its total 13F portfolio. On 12 West Capital Management’s heels is Steve Cohen of Point72 Asset Management, with a $20.5 million position; 0.1% of its 13F portfolio is allocated to the stock. Other members of the smart money that hold long positions consist of D. E. Shaw’s D E Shaw, Andrew Sandler’s Sandler Capital Management and Pasco Alfaro / Richard Tumure’s Miura Global Management.

With a general bullishness amongst the heavyweights, key hedge funds have jumped into Repligen Corporation (NASDAQ:RGEN) headfirst. 12 West Capital Management, managed by Joel Ramin, established the most valuable position in Repligen Corporation (NASDAQ:RGEN). 12 West Capital Management had $44.3 million invested in the company at the end of the quarter. Andrew Sandler’s Sandler Capital Management also made a $17.5 million investment in the stock during the quarter. The following funds were also among the new RGEN investors: Pasco Alfaro / Richard Tumure’s Miura Global Management, Paul Marshall and Ian Wace’s Marshall Wace LLP, and Matthew Hulsizer’s PEAK6 Capital Management.

Let’s go over hedge fund activity in other stocks similar to Repligen Corporation (NASDAQ:RGEN). We will take a look at Tempur Sealy International Inc. (NYSE:TPX), The Brink’s Company (NYSE:BCO), IBERIABANK Corporation (NASDAQ:IBKC), and BlackBerry Limited (NYSE:BB). This group of stocks’ market values resemble RGEN’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TPX | 33 | 1480589 | 4 |

| BCO | 27 | 460932 | 2 |

| IBKC | 25 | 192698 | -1 |

| BB | 25 | 540194 | 2 |

| Average | 27.5 | 668603 | 1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 27.5 hedge funds with bullish positions and the average amount invested in these stocks was $669 million. That figure was $168 million in RGEN’s case. Tempur Sealy International Inc. (NYSE:TPX) is the most popular stock in this table. On the other hand IBERIABANK Corporation (NASDAQ:IBKC) is the least popular one with only 25 bullish hedge fund positions. Compared to these stocks Repligen Corporation (NASDAQ:RGEN) is even less popular than IBKC. Hedge funds dodged a bullet by taking a bearish stance towards RGEN. Our calculations showed that the top 20 most popular hedge fund stocks returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately RGEN wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); RGEN investors were disappointed as the stock returned -10.8% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far in 2019.

Disclosure: None. This article was originally published at Insider Monkey.