Hedge funds are known to underperform the bull markets but that’s not because they are bad at investing. Truth be told, most hedge fund managers and other smaller players within this industry are very smart and skilled investors. Of course, they may also make wrong bets in some instances, but no one knows what the future holds and how market participants will react to the bountiful news that floods in each day. Hedge funds underperform because they are hedged. The Standard and Poor’s 500 Index ETFs returned approximately 27.5% through the end of November (including dividend payments). Conversely, hedge funds’ top 20 large-cap stock picks generated a return of 37.4% during the same period. An average long/short hedge fund returned only a fraction of this due to the hedges they implement and the large fees they charge. Our research covering the last 18 years indicates that investors can outperform the market by imitating hedge funds’ consensus stock picks rather than directly investing in hedge funds. That’s why we believe it isn’t a waste of time to check out hedge fund sentiment before you invest in a stock like Rent-A-Center Inc (NASDAQ:RCII).

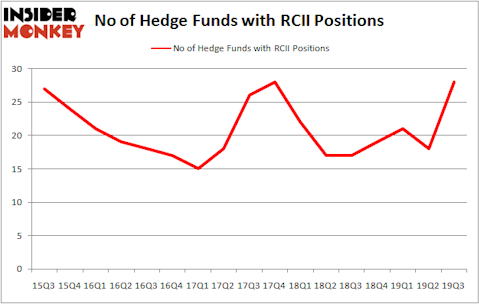

Rent-A-Center Inc (NASDAQ:RCII) investors should be aware of an increase in enthusiasm from smart money of late. Our calculations also showed that RCII isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the Russell 2000 ETFs by 40 percentage points since May 2014 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.8% through November 21, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. Let’s take a glance at the new hedge fund action encompassing Rent-A-Center Inc (NASDAQ:RCII).

What have hedge funds been doing with Rent-A-Center Inc (NASDAQ:RCII)?

At the end of the third quarter, a total of 28 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 56% from the second quarter of 2019. On the other hand, there were a total of 17 hedge funds with a bullish position in RCII a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Engaged Capital, managed by Glenn W. Welling, holds the largest position in Rent-A-Center Inc (NASDAQ:RCII). Engaged Capital has a $137.6 million position in the stock, comprising 18.7% of its 13F portfolio. Coming in second is Renaissance Technologies, which holds a $114.5 million position; 0.1% of its 13F portfolio is allocated to the company. Remaining professional money managers that are bullish encompass Ben Levine, Andrew Manuel and Stefan Renold’s LMR Partners, C. Jonathan Gattman’s Cloverdale Capital Management and David E. Shaw’s D E Shaw. In terms of the portfolio weights assigned to each position Engaged Capital allocated the biggest weight to Rent-A-Center Inc (NASDAQ:RCII), around 18.68% of its portfolio. Cloverdale Capital Management is also relatively very bullish on the stock, dishing out 13.27 percent of its 13F equity portfolio to RCII.

As aggregate interest increased, some big names have been driving this bullishness. Royce & Associates, managed by Chuck Royce, initiated the most outsized position in Rent-A-Center Inc (NASDAQ:RCII). Royce & Associates had $13.5 million invested in the company at the end of the quarter. Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital also made a $6.7 million investment in the stock during the quarter. The other funds with new positions in the stock are Paul Tudor Jones’s Tudor Investment Corp, Philippe Laffont’s Coatue Management, and Anand Parekh’s Alyeska Investment Group.

Let’s now take a look at hedge fund activity in other stocks similar to Rent-A-Center Inc (NASDAQ:RCII). These stocks are TPG Specialty Lending Inc (NYSE:TSLX), Alamo Group, Inc. (NYSE:ALG), TriMas Corp (NASDAQ:TRS), and Employers Holdings, Inc. (NYSE:EIG). This group of stocks’ market values are similar to RCII’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TSLX | 8 | 61787 | -2 |

| ALG | 10 | 216837 | 3 |

| TRS | 14 | 110541 | -1 |

| EIG | 14 | 76306 | -2 |

| Average | 11.5 | 116368 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 11.5 hedge funds with bullish positions and the average amount invested in these stocks was $116 million. That figure was $382 million in RCII’s case. TriMas Corp (NASDAQ:TRS) is the most popular stock in this table. On the other hand TPG Specialty Lending Inc (NYSE:TSLX) is the least popular one with only 8 bullish hedge fund positions. Compared to these stocks Rent-A-Center Inc (NASDAQ:RCII) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Unfortunately RCII wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on RCII were disappointed as the stock returned 0.9% during the first two months of the fourth quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 70 percent of these stocks already outperformed the market in Q4.

Disclosure: None. This article was originally published at Insider Monkey.