The Insider Monkey team has completed processing the quarterly 13F filings for the December quarter submitted by the hedge funds and other money managers included in our extensive database. Most hedge fund investors endured a torrid quarter, which certainly propelled them to adjust their equity holdings so as to maintain the desired risk profile. As a result, the relevancy of these public filings and their content is indisputable, as they may reveal numerous high-potential stocks. The following article will discuss the smart money sentiment towards MAG Silver Corporation (NYSE:MAG).

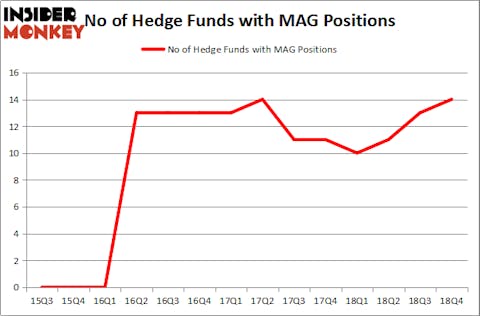

MAG Silver Corporation (NYSE:MAG) has seen an increase in hedge fund sentiment of late. MAG was in 14 hedge funds’ portfolios at the end of December. There were 13 hedge funds in our database with MAG positions at the end of the previous quarter. Our calculations also showed that MAG isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 20.7% year to date (through March 12th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 32 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s take a glance at the recent hedge fund action encompassing MAG Silver Corporation (NYSE:MAG).

What have hedge funds been doing with MAG Silver Corporation (NYSE:MAG)?

At the end of the fourth quarter, a total of 14 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 8% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards MAG over the last 14 quarters. With hedgies’ positions undergoing their usual ebb and flow, there exists an “upper tier” of noteworthy hedge fund managers who were upping their holdings considerably (or already accumulated large positions).

Among these funds, Sprott Asset Management held the most valuable stake in MAG Silver Corporation (NYSE:MAG), which was worth $10.6 million at the end of the fourth quarter. On the second spot was Sun Valley Gold which amassed $6.5 million worth of shares. Moreover, D E Shaw, Vertex One Asset Management, and Royce & Associates were also bullish on MAG Silver Corporation (NYSE:MAG), allocating a large percentage of their portfolios to this stock.

Now, key money managers were breaking ground themselves. Marshall Wace LLP, managed by Paul Marshall and Ian Wace, established the most valuable position in MAG Silver Corporation (NYSE:MAG). Marshall Wace LLP had $1.2 million invested in the company at the end of the quarter. Michael Platt and William Reeves’s BlueCrest Capital Mgmt. also initiated a $0.1 million position during the quarter.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as MAG Silver Corporation (NYSE:MAG) but similarly valued. We will take a look at Newpark Resources Inc (NYSE:NR), Intra-Cellular Therapies Inc (NASDAQ:ITCI), istar Inc (NYSE:STAR), and Nexgen Energy Ltd. (NYSE:NXE). This group of stocks’ market values resemble MAG’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NR | 10 | 31545 | -4 |

| ITCI | 15 | 57803 | -1 |

| STAR | 8 | 68468 | 0 |

| NXE | 7 | 8432 | 1 |

| Average | 10 | 41562 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 10 hedge funds with bullish positions and the average amount invested in these stocks was $42 million. That figure was $35 million in MAG’s case. Intra-Cellular Therapies Inc (NASDAQ:ITCI) is the most popular stock in this table. On the other hand Nexgen Energy Ltd. (NYSE:NXE) is the least popular one with only 7 bullish hedge fund positions. MAG Silver Corporation (NYSE:MAG) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on MAG, though not to the same extent, as the stock returned 23.7% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.