Out of thousands of stocks that are currently traded on the market, it is difficult to identify those that will really generate strong returns. Hedge funds and institutional investors spend millions of dollars on analysts with MBAs and PhDs, who are industry experts and well connected to other industry and media insiders on top of that. Individual investors can piggyback the hedge funds employing these talents and can benefit from their vast resources and knowledge in that way. We analyze quarterly 13F filings of nearly 750 hedge funds and, by looking at the smart money sentiment that surrounds a stock, we can determine whether it has the potential to beat the market over the long-term. Therefore, let’s take a closer look at what smart money thinks about Jabil Inc. (NYSE:JBL).

Jabil Inc. (NYSE:JBL) investors should pay attention to an increase in enthusiasm from smart money of late. Our calculations also showed that JBL isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the eyes of most investors, hedge funds are perceived as unimportant, old financial tools of the past. While there are more than 8000 funds with their doors open at the moment, Our experts hone in on the aristocrats of this group, about 750 funds. Most estimates calculate that this group of people watch over bulk of the hedge fund industry’s total capital, and by keeping an eye on their highest performing picks, Insider Monkey has unsheathed various investment strategies that have historically outpaced the S&P 500 index. Insider Monkey’s flagship short hedge fund strategy outstripped the S&P 500 short ETFs by around 20 percentage points per year since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

Paul Marshall of Marshall Wace

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. Let’s take a gander at the latest hedge fund action regarding Jabil Inc. (NYSE:JBL).

How have hedgies been trading Jabil Inc. (NYSE:JBL)?

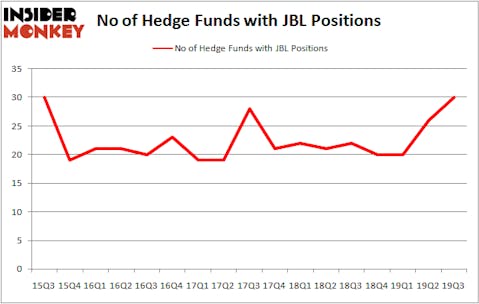

Heading into the fourth quarter of 2019, a total of 30 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 15% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards JBL over the last 17 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists an “upper tier” of noteworthy hedge fund managers who were adding to their stakes substantially (or already accumulated large positions).

Among these funds, AQR Capital Management held the most valuable stake in Jabil Inc. (NYSE:JBL), which was worth $158.8 million at the end of the third quarter. On the second spot was Citadel Investment Group which amassed $42.7 million worth of shares. Millennium Management, Adage Capital Management, and Renaissance Technologies were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Shellback Capital allocated the biggest weight to Jabil Inc. (NYSE:JBL), around 0.55% of its portfolio. Diametric Capital is also relatively very bullish on the stock, dishing out 0.33 percent of its 13F equity portfolio to JBL.

As industrywide interest jumped, specific money managers were breaking ground themselves. Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, created the biggest position in Jabil Inc. (NYSE:JBL). Arrowstreet Capital had $27.6 million invested in the company at the end of the quarter. Minhua Zhang’s Weld Capital Management also initiated a $1.2 million position during the quarter. The other funds with new positions in the stock are Matthew Tewksbury’s Stevens Capital Management, Paul Marshall and Ian Wace’s Marshall Wace, and Ben Levine, Andrew Manuel and Stefan Renold’s LMR Partners.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Jabil Inc. (NYSE:JBL) but similarly valued. These stocks are BWX Technologies Inc (NYSE:BWXT), Ingredion Inc (NYSE:INGR), Cloudflare, Inc. (NYSE:NET), and Suzano S.A. (NYSE:SUZ). This group of stocks’ market valuations resemble JBL’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BWXT | 21 | 58972 | 2 |

| INGR | 27 | 343195 | 6 |

| NET | 33 | 144754 | 33 |

| SUZ | 4 | 36039 | 2 |

| Average | 21.25 | 145740 | 10.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21.25 hedge funds with bullish positions and the average amount invested in these stocks was $146 million. That figure was $438 million in JBL’s case. Cloudflare, Inc. (NYSE:NET) is the most popular stock in this table. On the other hand Suzano S.A. (NYSE:SUZ) is the least popular one with only 4 bullish hedge fund positions. Jabil Inc. (NYSE:JBL) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Hedge funds were also right about betting on JBL, though not to the same extent, as the stock returned 8.8% during the first two months of the fourth quarter and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.