Looking for stocks with high upside potential? Just follow the big players within the hedge fund industry. Why should you do so? Let’s take a brief look at what statistics have to say about hedge funds’ stock picking abilities to illustrate. The Standard and Poor’s 500 Index returned approximately 12.1% in 2019 (through May 30th). Conversely, hedge funds’ 20 preferred S&P 500 stocks generated a return of 18.7% during the same period, with the majority of these stock picks outperforming the broader market benchmark. Coincidence? It might happen to be so, but it is unlikely. Our research covering the last 18 years indicates that hedge funds’ stock picks generate superior risk-adjusted returns. That’s why we believe it is wise to check hedge fund activity before you invest your time or your savings on a stock like ICON Public Limited Company (NASDAQ:ICLR).

Is ICON Public Limited Company (NASDAQ:ICLR) a healthy stock for your portfolio? Money managers are taking an optimistic view. The number of long hedge fund bets rose by 4 in recent months. Our calculations also showed that ICLR isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to review the recent hedge fund action encompassing ICON Public Limited Company (NASDAQ:ICLR).

How have hedgies been trading ICON Public Limited Company (NASDAQ:ICLR)?

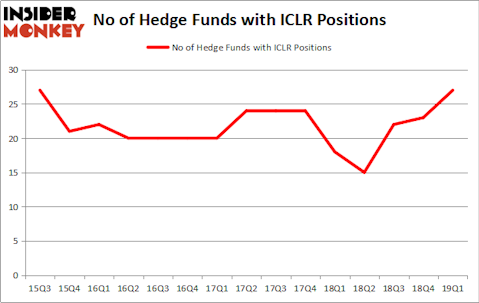

At the end of the first quarter, a total of 27 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 17% from the fourth quarter of 2018. The graph below displays the number of hedge funds with bullish position in ICLR over the last 15 quarters. With hedgies’ sentiment swirling, there exists an “upper tier” of notable hedge fund managers who were increasing their holdings substantially (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Renaissance Technologies, managed by Jim Simons, holds the number one position in ICON Public Limited Company (NASDAQ:ICLR). Renaissance Technologies has a $303.4 million position in the stock, comprising 0.3% of its 13F portfolio. Sitting at the No. 2 spot is Millennium Management, managed by Israel Englander, which holds a $114.4 million position; 0.2% of its 13F portfolio is allocated to the stock. Remaining hedge funds and institutional investors that hold long positions encompass Steve Cohen’s Point72 Asset Management, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital and Arthur B Cohen and Joseph Healey’s Healthcor Management LP.

Consequently, key hedge funds were leading the bulls’ herd. Point72 Asset Management, managed by Steve Cohen, created the largest position in ICON Public Limited Company (NASDAQ:ICLR). Point72 Asset Management had $82.9 million invested in the company at the end of the quarter. Arthur B Cohen and Joseph Healey’s Healthcor Management LP also initiated a $55.8 million position during the quarter. The other funds with brand new ICLR positions are Benjamin A. Smith’s Laurion Capital Management, Israel Englander’s Millennium Management, and Dmitry Balyasny’s Balyasny Asset Management.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as ICON Public Limited Company (NASDAQ:ICLR) but similarly valued. We will take a look at Bright Horizons Family Solutions Inc (NYSE:BFAM), Masimo Corporation (NASDAQ:MASI), CDK Global Inc (NASDAQ:CDK), and Service Corporation International (NYSE:SCI). This group of stocks’ market caps match ICLR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BFAM | 18 | 294100 | 2 |

| MASI | 34 | 485427 | 1 |

| CDK | 23 | 548582 | -2 |

| SCI | 20 | 527994 | 3 |

| Average | 23.75 | 464026 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23.75 hedge funds with bullish positions and the average amount invested in these stocks was $464 million. That figure was $809 million in ICLR’s case. Masimo Corporation (NASDAQ:MASI) is the most popular stock in this table. On the other hand Bright Horizons Family Solutions Inc (NYSE:BFAM) is the least popular one with only 18 bullish hedge fund positions. ICON Public Limited Company (NASDAQ:ICLR) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on ICLR as the stock returned 3.4% during the same period and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.