Legendary investors such as Jeffrey Talpins and Seth Klarman earn enormous amounts of money for themselves and their investors by doing in-depth research on small-cap stocks that big brokerage houses don’t publish. Small cap stocks -especially when they are screened well- can generate substantial outperformance versus a boring index fund. That’s why we analyze the activity of those elite funds in these small-cap stocks. In the following paragraphs, we analyze Huami Corporation (NYSE:HMI) from the perspective of those elite funds.

Hedge fund interest in Huami Corporation (NYSE:HMI) shares was flat at the end of last quarter. This is usually a negative indicator. At the end of this article we will also compare HMI to other stocks including Marine Products Corp. (NYSE:MPX), Schnitzer Steel Industries, Inc. (NASDAQ:SCHN), and Fortuna Silver Mines Inc. (NYSE:FSM) to get a better sense of its popularity.

To the average investor there are numerous formulas stock traders use to evaluate their stock investments. A duo of the most underrated formulas are hedge fund and insider trading signals. Our researchers have shown that, historically, those who follow the top picks of the best investment managers can outclass the S&P 500 by a healthy margin (see the details here).

We’re going to view the fresh hedge fund action regarding Huami Corporation (NYSE:HMI).

What have hedge funds been doing with Huami Corporation (NYSE:HMI)?

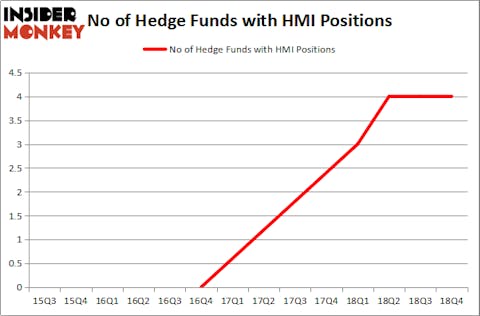

At the end of the fourth quarter, a total of 4 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from one quarter earlier. On the other hand, there were a total of 3 hedge funds with a bullish position in HMI a year ago. With the smart money’s positions undergoing their usual ebb and flow, there exists a select group of notable hedge fund managers who were upping their stakes meaningfully (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Tairen Capital, managed by Larry Chen and Terry Zhang, holds the largest position in Huami Corporation (NYSE:HMI). Tairen Capital has a $2.5 million position in the stock, comprising 0.9% of its 13F portfolio. The second most bullish fund manager is Renaissance Technologies, managed by Jim Simons, which holds a $1.7 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Remaining members of the smart money that hold long positions encompass Israel Englander’s Millennium Management, and Paul Marshall and Ian Wace’s Marshall Wace LLP.

We view hedge fund activity in the stock unfavorable, but in this case there was only a single hedge fund selling its entire position: Symmetry Peak Management. One hedge fund selling its entire position doesn’t always imply a bearish intent. Theoretically a hedge fund may decide to sell a promising position in order to invest the proceeds in a more promising idea. However, we don’t think this is the case in this case because only one of the 800+ hedge funds tracked by Insider Monkey identified as a viable investment and initiated a position in the stock (that fund was Marshall Wace LLP).

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Huami Corporation (NYSE:HMI) but similarly valued. These stocks are Marine Products Corp. (NYSE:MPX), Schnitzer Steel Industries, Inc. (NASDAQ:SCHN), Fortuna Silver Mines Inc. (NYSE:FSM), and Comtech Telecommunications Corp. (NASDAQ:CMTL). This group of stocks’ market values are similar to HMI’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MPX | 6 | 20972 | 1 |

| SCHN | 18 | 41036 | -1 |

| FSM | 15 | 42158 | 4 |

| CMTL | 14 | 97683 | 0 |

| Average | 13.25 | 50462 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.25 hedge funds with bullish positions and the average amount invested in these stocks was $50 million. That figure was $4 million in HMI’s case. Schnitzer Steel Industries, Inc. (NASDAQ:SCHN) is the most popular stock in this table. On the other hand Marine Products Corp. (NYSE:MPX) is the least popular one with only 6 bullish hedge fund positions. Compared to these stocks Huami Corporation (NYSE:HMI) is even less popular than MPX. Hedge funds clearly dropped the ball on HMI as the stock delivered strong returns, though hedge funds’ consensus picks still generated respectable returns. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. A small number of hedge funds were also right about betting on HMI as the stock returned 28.2% and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.