Is Golden Ocean Group Ltd (NASDAQ:GOGL) a good stock to buy right now? We at Insider Monkey like to examine what billionaires and hedge funds think of a company before doing days of research on it. Given their 2 and 20 payment structure, hedge funds have more incentives and resources than the average investor. The funds have access to expert networks and get tips from industry insiders. They also have numerous Ivy League graduates and MBAs. Like everyone else, hedge funds perform miserably at times, but their consensus picks have historically outperformed the market after risk adjustments.

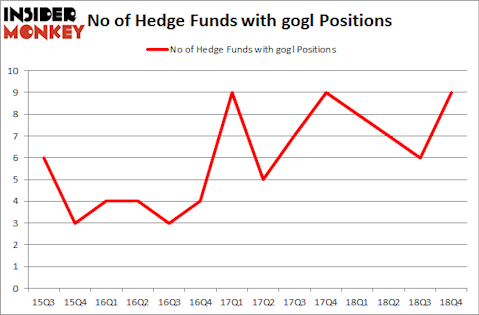

Golden Ocean Group Ltd (NASDAQ:GOGL) was in 9 hedge funds’ portfolios at the end of the fourth quarter of 2018. GOGL investors should be aware of an increase in activity from the world’s largest hedge funds of late. There were 6 hedge funds in our database with GOGL positions at the end of the previous quarter. Our calculations also showed that gogl isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.5% through March 12, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to analyze the key hedge fund action encompassing Golden Ocean Group Ltd (NASDAQ:GOGL).

What does the smart money think about Golden Ocean Group Ltd (NASDAQ:GOGL)?

At the end of the fourth quarter, a total of 9 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 50% from the previous quarter. The graph below displays the number of hedge funds with bullish position in GOGL over the last 14 quarters. With hedge funds’ capital changing hands, there exists a few notable hedge fund managers who were adding to their holdings significantly (or already accumulated large positions).

More specifically, Platinum Asset Management was the largest shareholder of Golden Ocean Group Ltd (NASDAQ:GOGL), with a stake worth $125.6 million reported as of the end of December. Trailing Platinum Asset Management was Marshall Wace LLP, which amassed a stake valued at $18.7 million. Renaissance Technologies, Arrowstreet Capital, and Millennium Management were also very fond of the stock, giving the stock large weights in their portfolios.

As one would reasonably expect, key money managers were leading the bulls’ herd. Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, created the most valuable position in Golden Ocean Group Ltd (NASDAQ:GOGL). Arrowstreet Capital had $2 million invested in the company at the end of the quarter. Joel Greenblatt’s Gotham Asset Management also initiated a $0.1 million position during the quarter. The other funds with brand new GOGL positions are Michael Platt and William Reeves’s BlueCrest Capital Mgmt., Matthew Hulsizer’s PEAK6 Capital Management, and Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Golden Ocean Group Ltd (NASDAQ:GOGL) but similarly valued. We will take a look at BioCryst Pharmaceuticals, Inc. (NASDAQ:BCRX), Talos Energy, Inc. (NYSE:TALO), Marten Transport, Ltd (NASDAQ:MRTN), and Cray Inc. (NASDAQ:CRAY). This group of stocks’ market valuations match GOGL’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BCRX | 18 | 371303 | -2 |

| TALO | 13 | 52918 | -1 |

| MRTN | 17 | 44100 | 3 |

| CRAY | 14 | 62131 | 1 |

| Average | 15.5 | 132613 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15.5 hedge funds with bullish positions and the average amount invested in these stocks was $133 million. That figure was $157 million in GOGL’s case. BioCryst Pharmaceuticals, Inc. (NASDAQ:BCRX) is the most popular stock in this table. On the other hand Talos Energy, Inc. (NYSE:TALO) is the least popular one with only 13 bullish hedge fund positions. Compared to these stocks Golden Ocean Group Ltd (NASDAQ:GOGL) is even less popular than TALO. Hedge funds dodged a bullet by taking a bearish stance towards GOGL. Our calculations showed that the top 15 most popular hedge fund stocks returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately GOGL wasn’t nearly as popular as these 15 stock (hedge fund sentiment was very bearish); GOGL investors were disappointed as the stock returned -9% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.