How do you pick the next stock to invest in? One way would be to spend days of research browsing through thousands of publicly traded companies. However, an easier way is to look at the stocks that smart money investors are collectively bullish on. Hedge funds and other institutional investors usually invest large amounts of capital and have to conduct due diligence while choosing their next pick. They don’t always get it right, but, on average, their stock picks historically generated strong returns after adjusting for known risk factors. With this in mind, let’s take a look at the recent hedge fund activity surrounding Five Below Inc (NASDAQ:FIVE).

Hedge fund interest in Five Below Inc (NASDAQ:FIVE) shares was flat at the end of last quarter. This is usually a negative indicator. At the end of this article we will also compare FIVE to other stocks including Proofpoint Inc (NASDAQ:PFPT), SL Green Realty Corp (NYSE:SLG), and HD Supply Holdings Inc (NASDAQ:HDS) to get a better sense of its popularity. Our calculations also showed that Five Below isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Unlike this former hedge fund manager who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s take a gander at the latest hedge fund action encompassing Five Below Inc (NASDAQ:FIVE).

What have hedge funds been doing with Five Below Inc (NASDAQ:FIVE)?

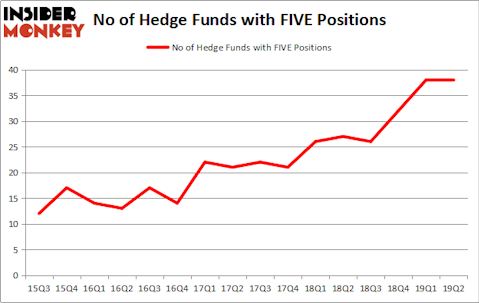

At the end of the second quarter, a total of 38 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from the first quarter of 2019. Below, you can check out the change in hedge fund sentiment towards FIVE over the last 16 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists an “upper tier” of key hedge fund managers who were boosting their holdings considerably (or already accumulated large positions).

Among these funds, Millennium Management held the most valuable stake in Five Below Inc (NASDAQ:FIVE), which was worth $79.9 million at the end of the second quarter. On the second spot was Renaissance Technologies which amassed $64.8 million worth of shares. Moreover, Junto Capital Management, Point72 Asset Management, and Hitchwood Capital Management were also bullish on Five Below Inc (NASDAQ:FIVE), allocating a large percentage of their portfolios to this stock.

Judging by the fact that Five Below Inc (NASDAQ:FIVE) has witnessed falling interest from hedge fund managers, it’s safe to say that there exists a select few hedge funds that slashed their full holdings in the second quarter. It’s worth mentioning that Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital dumped the largest stake of the “upper crust” of funds watched by Insider Monkey, comprising close to $12.3 million in call options. Benjamin A. Smith’s fund, Laurion Capital Management, also dropped its call options, about $2.5 million worth. These bearish behaviors are important to note, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s go over hedge fund activity in other stocks similar to Five Below Inc (NASDAQ:FIVE). We will take a look at Proofpoint Inc (NASDAQ:PFPT), SL Green Realty Corp (NYSE:SLG), HD Supply Holdings Inc (NASDAQ:HDS), and Cable One Inc (NYSE:CABO). This group of stocks’ market values are closest to FIVE’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PFPT | 36 | 566584 | 3 |

| SLG | 15 | 276468 | -4 |

| HDS | 30 | 893946 | 0 |

| CABO | 15 | 479257 | -3 |

| Average | 24 | 554064 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 24 hedge funds with bullish positions and the average amount invested in these stocks was $554 million. That figure was $550 million in FIVE’s case. Proofpoint Inc (NASDAQ:PFPT) is the most popular stock in this table. On the other hand SL Green Realty Corp (NYSE:SLG) is the least popular one with only 15 bullish hedge fund positions. Compared to these stocks Five Below Inc (NASDAQ:FIVE) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on FIVE, though not to the same extent, as the stock returned 5.1% during the third quarter and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.