Hedge funds and other investment firms run by legendary investors like Israel Englander, Jeffrey Talpins and Ray Dalio are entrusted to manage billions of dollars of accredited investors’ money because they are without peer in the resources they use to identify the best investments for their chosen investment horizon. Moreover, they are more willing to invest a greater amount of their resources in small-cap stocks than big brokerage houses, and this is often where they generate their outperformance, which is why we pay particular attention to their best ideas in this space.

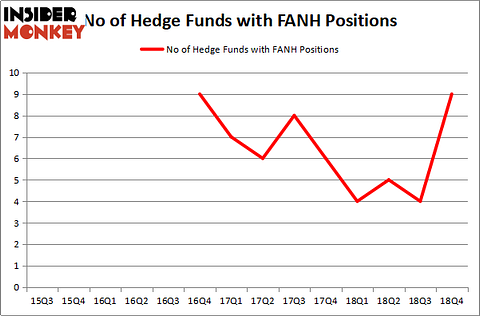

Is Fanhua Inc. (NASDAQ:FANH) ready to rally soon? The smart money is taking an optimistic view. The number of long hedge fund positions rose by 5 recently. Our calculations also showed that FANH isn’t among the 30 most popular stocks among hedge funds. FANH was in 9 hedge funds’ portfolios at the end of the fourth quarter of 2018. There were 4 hedge funds in our database with FANH holdings at the end of the previous quarter.

If you’d ask most stock holders, hedge funds are assumed to be underperforming, outdated financial vehicles of years past. While there are more than 8000 funds in operation today, Our experts hone in on the crème de la crème of this club, around 750 funds. These investment experts manage bulk of all hedge funds’ total asset base, and by observing their unrivaled stock picks, Insider Monkey has figured out various investment strategies that have historically outrun the broader indices. Insider Monkey’s flagship hedge fund strategy beat the S&P 500 index by nearly 5 percentage points a year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

Let’s review the recent hedge fund action surrounding Fanhua Inc. (NASDAQ:FANH).

How are hedge funds trading Fanhua Inc. (NASDAQ:FANH)?

At the end of the fourth quarter, a total of 9 of the hedge funds tracked by Insider Monkey were long this stock, a change of 125% from the previous quarter. On the other hand, there were a total of 4 hedge funds with a bullish position in FANH a year ago. With hedgies’ capital changing hands, there exists a few key hedge fund managers who were increasing their stakes considerably (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital has the largest position in Fanhua Inc. (NASDAQ:FANH), worth close to $7.3 million, corresponding to less than 0.1%% of its total 13F portfolio. Coming in second is AQR Capital Management, managed by Cliff Asness, which holds a $1.5 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Remaining peers that hold long positions consist of Jim Simons’s Renaissance Technologies, Ken Griffin’s Citadel Investment Group and Paul Marshall and Ian Wace’s Marshall Wace LLP.

With a general bullishness amongst the heavyweights, key money managers were leading the bulls’ herd. Renaissance Technologies, managed by Jim Simons, initiated the most outsized position in Fanhua Inc. (NASDAQ:FANH). Renaissance Technologies had $1.4 million invested in the company at the end of the quarter. Ken Griffin’s Citadel Investment Group also made a $1.2 million investment in the stock during the quarter. The other funds with new positions in the stock are Paul Marshall and Ian Wace’s Marshall Wace LLP, Israel Englander’s Millennium Management, and Ernest Chow and Jonathan Howe’s Sensato Capital Management.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Fanhua Inc. (NASDAQ:FANH) but similarly valued. We will take a look at Cadence Bancorporation (NYSE:CADE), Qudian Inc. (NYSE:QD), Gentherm Inc (NASDAQ:THRM), and Independent Bank Group Inc (NASDAQ:IBTX). This group of stocks’ market valuations are similar to FANH’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CADE | 18 | 117882 | -1 |

| QD | 15 | 14376 | 9 |

| THRM | 17 | 80419 | 4 |

| IBTX | 13 | 98991 | 2 |

| Average | 15.75 | 77917 | 3.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15.75 hedge funds with bullish positions and the average amount invested in these stocks was $78 million. That figure was $14 million in FANH’s case. Cadence Bancorporation (NYSE:CADE) is the most popular stock in this table. On the other hand Independent Bank Group Inc (NASDAQ:IBTX) is the least popular one with only 13 bullish hedge fund positions. Compared to these stocks Fanhua Inc. (NASDAQ:FANH) is even less popular than IBTX. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. A small number of hedge funds were also right about betting on FANH, though not to the same extent, as the stock returned 18.7% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.