Hedge funds and other investment firms run by legendary investors like Israel Englander, Jeffrey Talpins and Ray Dalio are entrusted to manage billions of dollars of accredited investors’ money because they are without peer in the resources they use to identify the best investments for their chosen investment horizon. Moreover, they are more willing to invest a greater amount of their resources in small-cap stocks than big brokerage houses, and this is often where they generate their outperformance, which is why we pay particular attention to their best ideas in this space.

Energy Fuels Inc. (NYSE:UUUU) investors should pay attention to an increase in support from the world’s most elite money managers recently. Our calculations also showed that UUUU isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 25.7% through September 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s take a look at the fresh hedge fund action surrounding Energy Fuels Inc. (NYSE:UUUU).

What does smart money think about Energy Fuels Inc. (NYSE:UUUU)?

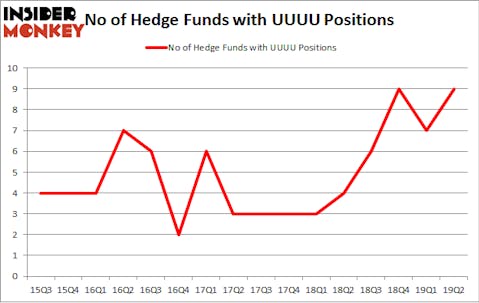

At Q2’s end, a total of 9 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 29% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards UUUU over the last 16 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Prescott Group Capital Management held the most valuable stake in Energy Fuels Inc. (NYSE:UUUU), which was worth $5.8 million at the end of the second quarter. On the second spot was Empyrean Capital Partners which amassed $4.1 million worth of shares. Moreover, Passport Capital, CQS Cayman LP, and Rubric Capital Management were also bullish on Energy Fuels Inc. (NYSE:UUUU), allocating a large percentage of their portfolios to this stock.

As one would reasonably expect, specific money managers have jumped into Energy Fuels Inc. (NYSE:UUUU) headfirst. Passport Capital, managed by John Burbank, initiated the most valuable position in Energy Fuels Inc. (NYSE:UUUU). Passport Capital had $3.1 million invested in the company at the end of the quarter. David Rosen’s Rubric Capital Management also made a $1.2 million investment in the stock during the quarter. The other funds with brand new UUUU positions are Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital and D. E. Shaw’s D E Shaw.

Let’s check out hedge fund activity in other stocks similar to Energy Fuels Inc. (NYSE:UUUU). These stocks are Craft Brew Alliance Inc (NASDAQ:BREW), ACM Research, Inc. (NASDAQ:ACMR), OptiNose, Inc. (NASDAQ:OPTN), and North American Construction Group Ltd. (NYSE:NOA). This group of stocks’ market valuations are closest to UUUU’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BREW | 12 | 20822 | 1 |

| ACMR | 7 | 6161 | 5 |

| OPTN | 6 | 7127 | 3 |

| NOA | 9 | 46970 | 1 |

| Average | 8.5 | 20270 | 2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 8.5 hedge funds with bullish positions and the average amount invested in these stocks was $20 million. That figure was $16 million in UUUU’s case. Craft Brew Alliance Inc (NASDAQ:BREW) is the most popular stock in this table. On the other hand OptiNose, Inc. (NASDAQ:OPTN) is the least popular one with only 6 bullish hedge fund positions. Energy Fuels Inc. (NYSE:UUUU) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately UUUU wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on UUUU were disappointed as the stock returned -38.3% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Disclosure: None. This article was originally published at Insider Monkey.