We hate to say this but, we told you so. On February 27th we published an article with the title Recession is Imminent: We Need A Travel Ban NOW and predicted a US recession when the S&P 500 Index was trading at the 3150 level. We also told you to short the market and buy long-term Treasury bonds. Our article also called for a total international travel ban. While we were warning you, President Trump minimized the threat and failed to act promptly. As a result of his inaction, we will now experience a deeper recession.

In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. Although the masses and most of the financial media blame hedge funds for their exorbitant fee structure and disappointing performance, these investors have proved to have great stock picking abilities over the years (that’s why their assets under management continue to swell). We believe hedge fund sentiment should serve as a crucial tool of an individual investor’s stock selection process, as it may offer great insights of how the brightest minds of the finance industry feel about specific stocks. After all, these people have access to smartest analysts and expensive data/information sources that individual investors can’t match. So should one consider investing in Consolidated Edison, Inc. (NYSE:ED)? The smart money sentiment can provide an answer to this question.

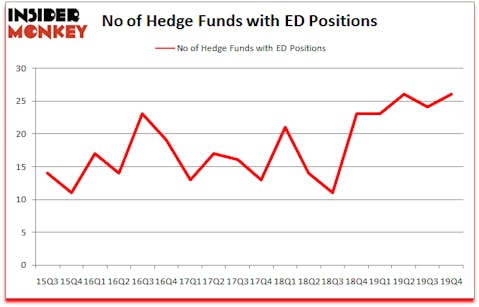

Consolidated Edison, Inc. (NYSE:ED) has seen an increase in hedge fund sentiment lately. Our calculations also showed that ED isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video below for Q3 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s monthly stock picks returned 72.9% since March 2017 and outperformed the S&P 500 ETFs by more than 41 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Clint Carlson of Carlson Capital

We leave no stone unturned when looking for the next great investment idea. For example we recently identified a stock that trades 25% below the net cash on its balance sheet. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences, and go through short-term trade recommendations like this one. We even check out the recommendations of services with hard to believe track records. Our best call in 2020 was shorting the market when S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. With all of this in mind let’s take a gander at the new hedge fund action surrounding Consolidated Edison, Inc. (NYSE:ED).

Hedge fund activity in Consolidated Edison, Inc. (NYSE:ED)

At the end of the fourth quarter, a total of 26 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 8% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards ED over the last 18 quarters. With hedgies’ sentiment swirling, there exists an “upper tier” of noteworthy hedge fund managers who were adding to their stakes significantly (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Cliff Asness’s AQR Capital Management has the number one position in Consolidated Edison, Inc. (NYSE:ED), worth close to $470.2 million, accounting for 0.5% of its total 13F portfolio. The second largest stake is held by Renaissance Technologies, holding a $362.5 million position; the fund has 0.3% of its 13F portfolio invested in the stock. Some other peers that hold long positions comprise D. E. Shaw’s D E Shaw, Michael Gelband’s ExodusPoint Capital and Clint Carlson’s Carlson Capital. In terms of the portfolio weights assigned to each position ExodusPoint Capital allocated the biggest weight to Consolidated Edison, Inc. (NYSE:ED), around 1.58% of its 13F portfolio. Carlson Capital is also relatively very bullish on the stock, earmarking 0.78 percent of its 13F equity portfolio to ED.

Now, some big names were breaking ground themselves. Carlson Capital, managed by Clint Carlson, created the most outsized position in Consolidated Edison, Inc. (NYSE:ED). Carlson Capital had $43.1 million invested in the company at the end of the quarter. Greg Poole’s Echo Street Capital Management also made a $12 million investment in the stock during the quarter. The other funds with new positions in the stock are Donald Sussman’s Paloma Partners, Qing Li’s Sciencast Management, and Ryan Tolkin (CIO)’s Schonfeld Strategic Advisors.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Consolidated Edison, Inc. (NYSE:ED) but similarly valued. We will take a look at Equity Residential (NYSE:EQR), TransDigm Group Incorporated (NYSE:TDG), IQVIA Holdings, Inc. (NYSE:IQV), and Public Service Enterprise Group Incorporated (NYSE:PEG). This group of stocks’ market valuations resemble ED’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EQR | 30 | 308617 | 4 |

| TDG | 63 | 5538787 | 3 |

| IQV | 64 | 3822679 | -4 |

| PEG | 31 | 987064 | 11 |

| Average | 47 | 2664287 | 3.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 47 hedge funds with bullish positions and the average amount invested in these stocks was $2664 million. That figure was $1204 million in ED’s case. IQVIA Holdings, Inc. (NYSE:IQV) is the most popular stock in this table. On the other hand Equity Residential (NYSE:EQR) is the least popular one with only 30 bullish hedge fund positions. Compared to these stocks Consolidated Edison, Inc. (NYSE:ED) is even less popular than EQR. Hedge funds clearly dropped the ball on ED as the stock delivered strong returns, though hedge funds’ consensus picks still generated respectable returns. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks lost 11.7% in 2020 through March 11th but still beat the market by 3.1 percentage points. A small number of hedge funds were also right about betting on ED as the stock returned -3.6% during the same time period and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.