Investing in hedge funds can bring large profits, but it’s not for everybody, since hedge funds are available only for high-net-worth individuals. They generate significant returns for investors to justify their large fees and they allocate a lot of time and employ complex research processes to determine the best stocks to invest in. A particularly interesting group of stocks that hedge funds like is the small-caps. The huge amount of capital does not allow hedge funds to invest a lot in small-caps, but our research showed that their most popular small-cap ideas are less efficiently priced and generate stronger returns than their large- and mega-cap picks and the broader market. That is why we pay special attention to the hedge fund activity in the small-cap space. Nevertheless, it is also possible to find underpriced large-cap stocks by following the hedge funds’ moves.

ChannelAdvisor Corporation (NYSE:ECOM) shares haven’t seen a lot of action during the second quarter. Overall, hedge fund sentiment was unchanged. The stock was in 14 hedge funds’ portfolios at the end of June. At the end of this article we will also compare ECOM to other stocks including Safeguard Scientifics, Inc (NYSE:SFE), Athersys, Inc. (NASDAQ:ATHX), and Orrstown Financial Services, Inc. (NASDAQ:ORRF) to get a better sense of its popularity.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

If you’d ask most investors, hedge funds are perceived as underperforming, old investment vehicles of years past. While there are more than 8000 funds with their doors open at the moment, Our experts hone in on the crème de la crème of this group, about 750 funds. These hedge fund managers handle the lion’s share of the hedge fund industry’s total capital, and by tailing their first-class equity investments, Insider Monkey has brought to light a few investment strategies that have historically defeated the S&P 500 index. Insider Monkey’s flagship hedge fund strategy outpaced the S&P 500 index by around 5 percentage points annually since its inception in May 2014. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 25.7% since February 2017 (through September 30th) even though the market was up more than 33% during the same period. We just shared a list of 10 short targets in our latest quarterly update .

Cliff Asness of AQR Capital Management

In addition to following the biggest hedge funds for investment ideas, we also share stock pitches from conferences, investor letters and other sources like this one where the fund manager is talking about two under the radar 1000% return potential stocks: first one in internet infrastructure and the second in the heart of advertising market. We use hedge fund buy/sell signals to determine whether to conduct in-depth analysis of these stock ideas which take days. Now we’re going to view the recent hedge fund action regarding ChannelAdvisor Corporation (NYSE:ECOM).

What have hedge funds been doing with ChannelAdvisor Corporation (NYSE:ECOM)?

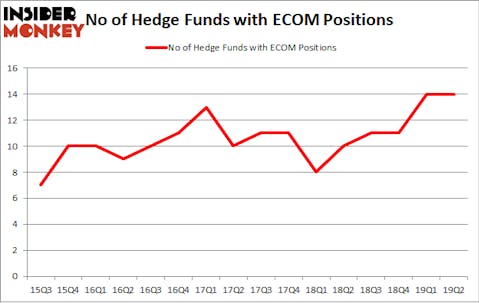

Heading into the third quarter of 2019, a total of 14 of the hedge funds tracked by Insider Monkey were long this stock, a change of 0% from the first quarter of 2019. Below, you can check out the change in hedge fund sentiment towards ECOM over the last 16 quarters. With hedgies’ positions undergoing their usual ebb and flow, there exists an “upper tier” of key hedge fund managers who were boosting their stakes significantly (or already accumulated large positions).

The largest stake in ChannelAdvisor Corporation (NYSE:ECOM) was held by Altai Capital, which reported holding $23.6 million worth of stock at the end of March. It was followed by Archon Capital Management with a $7.5 million position. Other investors bullish on the company included D E Shaw, Renaissance Technologies, and AQR Capital Management.

Due to the fact that ChannelAdvisor Corporation (NYSE:ECOM) has experienced falling interest from the aggregate hedge fund industry, it’s safe to say that there were a few hedgies who were dropping their positions entirely last quarter. Interestingly, J. Carlo Cannell’s Cannell Capital sold off the largest stake of all the hedgies watched by Insider Monkey, worth an estimated $5.9 million in stock, and Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital was right behind this move, as the fund cut about $1 million worth. These transactions are intriguing to say the least, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s also examine hedge fund activity in other stocks similar to ChannelAdvisor Corporation (NYSE:ECOM). These stocks are Safeguard Scientifics, Inc (NYSE:SFE), Athersys, Inc. (NASDAQ:ATHX), Orrstown Financial Services, Inc. (NASDAQ:ORRF), and Evelo Biosciences, Inc. (NASDAQ:EVLO). This group of stocks’ market caps are similar to ECOM’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SFE | 6 | 30575 | 1 |

| ATHX | 5 | 2007 | -1 |

| ORRF | 3 | 10783 | -1 |

| EVLO | 2 | 8054 | 0 |

| Average | 4 | 12855 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 4 hedge funds with bullish positions and the average amount invested in these stocks was $13 million. That figure was $44 million in ECOM’s case. Safeguard Scientifics, Inc (NYSE:SFE) is the most popular stock in this table. On the other hand Evelo Biosciences, Inc. (NASDAQ:EVLO) is the least popular one with only 2 bullish hedge fund positions. Compared to these stocks ChannelAdvisor Corporation (NYSE:ECOM) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on ECOM as the stock returned 6.5% during Q3 and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.