We at Insider Monkey have gone over 700 13F filings that hedge funds and prominent investors are required to file by the SEC The 13F filings show the funds’ and investors’ portfolio positions as of December 31st. In this article, we look at what those funds think of BJ’s Restaurants, Inc. (NASDAQ:BJRI) based on that data.

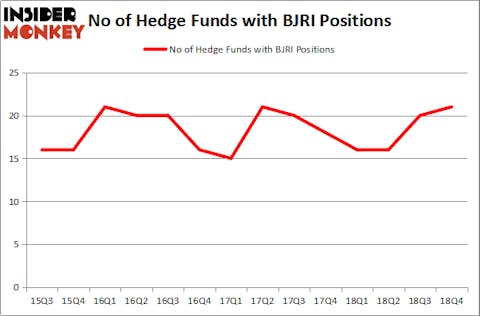

BJ’s Restaurants, Inc. (NASDAQ:BJRI) was in 21 hedge funds’ portfolios at the end of December. BJRI has experienced an increase in hedge fund sentiment in recent months. There were 20 hedge funds in our database with BJRI positions at the end of the previous quarter. Our calculations also showed that BJRI isn’t among the 30 most popular stocks among hedge funds.

Today there are plenty of methods investors have at their disposal to analyze publicly traded companies. A pair of the most underrated methods are hedge fund and insider trading activity. Our researchers have shown that, historically, those who follow the best picks of the best hedge fund managers can outpace the market by a significant amount (see the details here).

Let’s view the fresh hedge fund action surrounding BJ’s Restaurants, Inc. (NASDAQ:BJRI).

What have hedge funds been doing with BJ’s Restaurants, Inc. (NASDAQ:BJRI)?

At Q4’s end, a total of 21 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 5% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards BJRI over the last 14 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in BJ’s Restaurants, Inc. (NASDAQ:BJRI) was held by Millennium Management, which reported holding $22.7 million worth of stock at the end of December. It was followed by Arrowstreet Capital with a $20.3 million position. Other investors bullish on the company included Two Sigma Advisors, GLG Partners, and Marshall Wace LLP.

As aggregate interest increased, some big names have jumped into BJ’s Restaurants, Inc. (NASDAQ:BJRI) headfirst. Stormborn Capital Management, managed by Elise Di Vincenzo Crumbine, established the biggest position in BJ’s Restaurants, Inc. (NASDAQ:BJRI). Stormborn Capital Management had $3 million invested in the company at the end of the quarter. Benjamin A. Smith’s Laurion Capital Management also initiated a $0.5 million position during the quarter. The other funds with new positions in the stock are Matthew Tewksbury’s Stevens Capital Management, Brandon Haley’s Holocene Advisors, and David Harding’s Winton Capital Management.

Let’s also examine hedge fund activity in other stocks similar to BJ’s Restaurants, Inc. (NASDAQ:BJRI). We will take a look at Wageworks Inc (NYSE:WAGE), FB Financial Corporation (NYSE:FBK), Dril-Quip, Inc. (NYSE:DRQ), and Uniqure NV (NASDAQ:QURE). This group of stocks’ market valuations resemble BJRI’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WAGE | 13 | 83887 | 1 |

| FBK | 8 | 115538 | -2 |

| DRQ | 19 | 127024 | 1 |

| QURE | 17 | 279693 | -2 |

| Average | 14.25 | 151536 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14.25 hedge funds with bullish positions and the average amount invested in these stocks was $152 million. That figure was $145 million in BJRI’s case. Dril-Quip, Inc. (NYSE:DRQ) is the most popular stock in this table. On the other hand FB Financial Corporation (NYSE:FBK) is the least popular one with only 8 bullish hedge fund positions. Compared to these stocks BJ’s Restaurants, Inc. (NASDAQ:BJRI) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately BJRI wasn’t nearly as popular as these 15 stock and hedge funds that were betting on BJRI were disappointed as the stock returned -10% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.