Hedge funds and other investment firms run by legendary investors like Israel Englander, Jeffrey Talpins and Ray Dalio are entrusted to manage billions of dollars of accredited investors’ money because they are without peer in the resources they use to identify the best investments for their chosen investment horizon. Moreover, they are more willing to invest a greater amount of their resources in small-cap stocks than big brokerage houses, and this is often where they generate their outperformance, which is why we pay particular attention to their best ideas in this space.

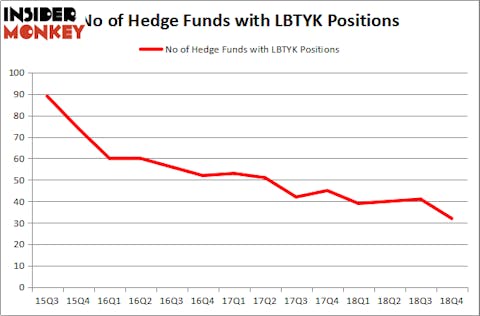

Is Liberty Global Plc (NASDAQ:LBTYK) ready to rally soon? The best stock pickers are getting less bullish. The number of long hedge fund bets shrunk by 9 lately. Our calculations also showed that LBTYK isn’t among the 30 most popular stocks among hedge funds. LBTYK was in 32 hedge funds’ portfolios at the end of December. There were 41 hedge funds in our database with LBTYK holdings at the end of the previous quarter.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.5% through March 12, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to take a peek at the fresh hedge fund action regarding Liberty Global Plc (NASDAQ:LBTYK).

What have hedge funds been doing with Liberty Global Plc (NASDAQ:LBTYK)?

At the end of the fourth quarter, a total of 32 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -22% from one quarter earlier. On the other hand, there were a total of 39 hedge funds with a bullish position in LBTYK a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Boykin Curry’s Eagle Capital Management has the largest position in Liberty Global Plc (NASDAQ:LBTYK), worth close to $782.8 million, corresponding to 3.2% of its total 13F portfolio. On Eagle Capital Management’s heels is Seth Klarman of Baupost Group, with a $613.9 million position; the fund has 5.3% of its 13F portfolio invested in the stock. Other peers with similar optimism contain John H. Scully’s SPO Advisory Corp, Warren Buffett’s Berkshire Hathaway and Michael Pausic’s Foxhaven Asset Management.

Because Liberty Global Plc (NASDAQ:LBTYK) has experienced falling interest from the aggregate hedge fund industry, it’s safe to say that there exists a select few fund managers who sold off their entire stakes heading into Q3. Interestingly, Lou Simpson’s SQ Advisors said goodbye to the largest position of the 700 funds followed by Insider Monkey, comprising an estimated $171.9 million in stock. Sharlyn C. Heslam’s fund, Stockbridge Partners, also dropped its stock, about $91.9 million worth. These transactions are intriguing to say the least, as aggregate hedge fund interest fell by 9 funds heading into Q3.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Liberty Global Plc (NASDAQ:LBTYK) but similarly valued. These stocks are Splunk Inc (NASDAQ:SPLK), Avangrid, Inc. (NYSE:AGR), Fifth Third Bancorp (NASDAQ:FITB), and KeyCorp (NYSE:KEY). All of these stocks’ market caps match LBTYK’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SPLK | 25 | 466083 | -14 |

| AGR | 13 | 347814 | -5 |

| FITB | 31 | 775233 | 7 |

| KEY | 33 | 383374 | -8 |

| Average | 25.5 | 493126 | -5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 25.5 hedge funds with bullish positions and the average amount invested in these stocks was $493 million. That figure was $2958 million in LBTYK’s case. KeyCorp (NYSE:KEY) is the most popular stock in this table. On the other hand Avangrid, Inc. (NYSE:AGR) is the least popular one with only 13 bullish hedge fund positions. Liberty Global Plc (NASDAQ:LBTYK) is not the most popular stock in this group but hedge fund interest is still above average. However, overall hedge fund sentiment towards LBTYK has been on a downward path since 2015. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Only a few hedge funds were also right about betting on Liberty Global as the stock returned 22.9% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.