Before we spend countless hours researching a company, we’d like to analyze what insiders, hedge funds and billionaire investors think of the stock first. We would like to do so because our research has shown that the elite investors’ consensus returns have been exceptional. In the following paragraphs, we find out what the billionaire investors and hedge funds think of Fortive Corporation (NYSE:FTV).

Is Fortive Corporation (NYSE:FTV) a cheap investment right now? Money managers are taking a bearish view. The number of long hedge fund bets shrunk by 5 in recent months. Our calculations also showed that FTV isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 20.7% year to date (through March 12th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 32 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to view the key hedge fund action encompassing Fortive Corporation (NYSE:FTV).

How are hedge funds trading Fortive Corporation (NYSE:FTV)?

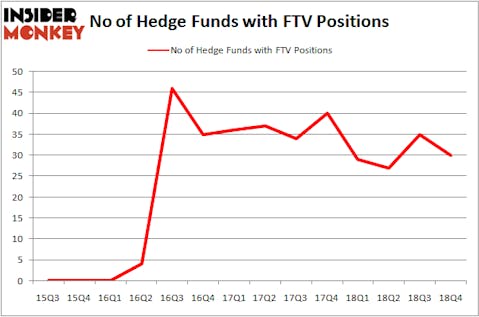

At the end of the fourth quarter, a total of 30 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -14% from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in FTV over the last 14 quarters. With the smart money’s sentiment swirling, there exists an “upper tier” of notable hedge fund managers who were boosting their stakes significantly (or already accumulated large positions).

More specifically, Adage Capital Management was the largest shareholder of Fortive Corporation (NYSE:FTV), with a stake worth $93.2 million reported as of the end of September. Trailing Adage Capital Management was Gates Capital Management, which amassed a stake valued at $53.8 million. Select Equity Group, Luminus Management, and OZ Management were also very fond of the stock, giving the stock large weights in their portfolios.

Because Fortive Corporation (NYSE:FTV) has experienced falling interest from hedge fund managers, it’s easy to see that there were a few funds who were dropping their positions entirely last quarter. It’s worth mentioning that Andrew Hahn’s Ursa Fund Management sold off the biggest stake of the 700 funds followed by Insider Monkey, totaling close to $1562 million in call options, and Daniel S. Och’s OZ Management was right behind this move, as the fund cut about $510.7 million worth. These bearish behaviors are important to note, as aggregate hedge fund interest fell by 5 funds last quarter.

Let’s check out hedge fund activity in other stocks similar to Fortive Corporation (NYSE:FTV). These stocks are The Hershey Company (NYSE:HSY), Pioneer Natural Resources Company (NYSE:PXD), Ingersoll-Rand Plc (NYSE:IR), and T. Rowe Price Group, Inc. (NASDAQ:TROW). This group of stocks’ market valuations resemble FTV’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HSY | 33 | 691268 | 4 |

| PXD | 62 | 2388164 | 4 |

| IR | 43 | 1477676 | 1 |

| TROW | 22 | 290370 | 5 |

| Average | 40 | 1211870 | 3.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 40 hedge funds with bullish positions and the average amount invested in these stocks was $1212 million. That figure was $405 million in FTV’s case. Pioneer Natural Resources Company (NYSE:PXD) is the most popular stock in this table. On the other hand T. Rowe Price Group, Inc. (NASDAQ:TROW) is the least popular one with only 22 bullish hedge fund positions. Fortive Corporation (NYSE:FTV) is not the least popular stock in this group but hedge fund interest is still below average. Given Fortive’s strong 2019 performance hedge funds clearly dropped the ball on this stock. Luckily their other large-cap stock picks performed well. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. A handful of hedge funds were also right about betting on Fortive as the stock returned 22.1% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.