Hedge funds run by legendary names like George Soros and David Tepper make billions of dollars a year for themselves and their super-rich accredited investors (you’ve got to have a minimum of $1 million liquid to invest in a hedge fund) by spending enormous resources on analyzing and uncovering data about small-cap stocks that the big brokerage houses don’t follow. Small caps are where they can generate significant outperformance. That’s why we pay special attention to hedge fund activity in these stocks.

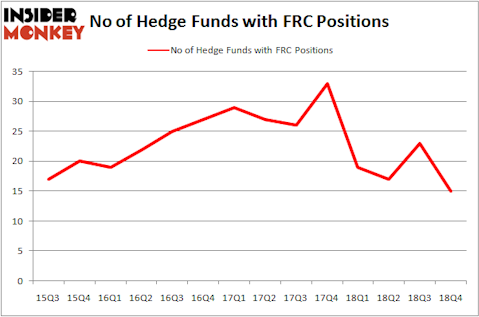

First Republic Bank (NYSE:FRC) was in 15 hedge funds’ portfolios at the end of the fourth quarter of 2018. FRC shareholders have witnessed a decrease in activity from the world’s largest hedge funds in recent months. There were 23 hedge funds in our database with FRC positions at the end of the previous quarter. Our calculations also showed that FRC isn’t among the 30 most popular stocks among hedge funds. Hedge fund sentiment towards the stock is at its lowest level since 2015.

In the 21st century investor’s toolkit there are a multitude of indicators shareholders put to use to assess their holdings. A pair of the best indicators are hedge fund and insider trading sentiment. Our experts have shown that, historically, those who follow the top picks of the top fund managers can outclass the broader indices by a very impressive margin (see the details here).

We’re going to take a look at the latest hedge fund action regarding First Republic Bank (NYSE:FRC).

Hedge fund activity in First Republic Bank (NYSE:FRC)

At the end of the fourth quarter, a total of 15 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -35% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in FRC over the last 14 quarters. With hedge funds’ sentiment swirling, there exists an “upper tier” of noteworthy hedge fund managers who were upping their stakes considerably (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Robert Joseph Caruso’s Select Equity Group has the largest position in First Republic Bank (NYSE:FRC), worth close to $288.7 million, corresponding to 2.2% of its total 13F portfolio. The second largest stake is held by Diamond Hill Capital, led by Ric Dillon, holding a $238.7 million position; the fund has 1.4% of its 13F portfolio invested in the stock. Some other professional money managers that are bullish comprise Ken Fisher’s Fisher Asset Management, Noam Gottesman’s GLG Partners and Dmitry Balyasny’s Balyasny Asset Management.

Due to the fact that First Republic Bank (NYSE:FRC) has witnessed declining sentiment from the entirety of the hedge funds we track, logic holds that there is a sect of funds who sold off their full holdings by the end of the third quarter. Interestingly, Ben Levine, Andrew Manuel and Stefan Renold’s LMR Partners said goodbye to the largest investment of all the hedgies followed by Insider Monkey, totaling an estimated $39.1 million in stock, and Benjamin A. Smith’s Laurion Capital Management was right behind this move, as the fund cut about $23.5 million worth. These moves are interesting, as total hedge fund interest fell by 8 funds by the end of the third quarter.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as First Republic Bank (NYSE:FRC) but similarly valued. These stocks are International Flavors & Fragrances Inc (NYSE:IFF), Loews Corporation (NYSE:L), Waters Corporation (NYSE:WAT), and Best Buy Co., Inc. (NYSE:BBY). This group of stocks’ market caps are closest to FRC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| IFF | 21 | 166189 | -1 |

| L | 21 | 314064 | -3 |

| WAT | 32 | 894358 | 9 |

| BBY | 23 | 630609 | -4 |

| Average | 24.25 | 501305 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 24.25 hedge funds with bullish positions and the average amount invested in these stocks was $501 million. That figure was $600 million in FRC’s case. Waters Corporation (NYSE:WAT) is the most popular stock in this table. On the other hand International Flavors & Fragrances Inc (NYSE:IFF) is the least popular one with only 21 bullish hedge fund positions. Compared to these stocks First Republic Bank (NYSE:FRC) is even less popular than IFF. Hedge funds clearly dropped the ball on FRC as the stock performed well in 2019. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Only a few hedge funds were also right about betting on FRC, though not to the same extent, as the stock returned 13.9% and outperformed the market as well. You can see the entire list of these shrewd hedge funds here.

Disclosure: None. This article was originally published at Insider Monkey.