Keeping this in mind, let’s analyze whether Ball Corporation (NYSE:BLL) is a good investment right now by following the lead of some of the best investors in the world and piggybacking their ideas. There’s no better way to get these firms’ immense resources and analytical capabilities working for us than to follow their lead into their best ideas. While not all of these picks will be winners, our research shows that these picks historically outperformed the market when we factor in known risk factors.

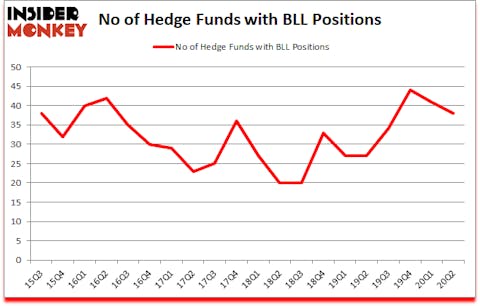

Ball Corporation (NYSE:BLL) has experienced a decrease in support from the world’s most elite money managers in recent months. Ball Corporation (NYSE:BLL) was in 38 hedge funds’ portfolios at the end of the second quarter of 2020. The all time high for this statistics is 44. There were 41 hedge funds in our database with BLL holdings at the end of March. Our calculations also showed that BLL isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

To the average investor there are numerous indicators market participants can use to appraise publicly traded companies. Some of the less known indicators are hedge fund and insider trading activity. We have shown that, historically, those who follow the top picks of the best money managers can beat their index-focused peers by a superb amount (see the details here).

Richard Chilton of Chilton Investment Company

At Insider Monkey we scour multiple sources to uncover the next great investment idea. For example, lithium mining is one of the fastest growing industries right now, so we are checking out stock pitches like this emerging lithium stock. We go through lists like the 10 most profitable companies in the world to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website to get excerpts of these letters in your inbox. Keeping this in mind let’s take a look at the recent hedge fund action encompassing Ball Corporation (NYSE:BLL).

Hedge fund activity in Ball Corporation (NYSE:BLL)

At second quarter’s end, a total of 38 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -7% from the first quarter of 2020. By comparison, 27 hedge funds held shares or bullish call options in BLL a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Chilton Investment Company, managed by Richard Chilton, holds the largest position in Ball Corporation (NYSE:BLL). Chilton Investment Company has a $221.3 million position in the stock, comprising 7.3% of its 13F portfolio. On Chilton Investment Company’s heels is Iridian Asset Management, led by David Cohen and Harold Levy, holding a $144.1 million position; 3.2% of its 13F portfolio is allocated to the company. Other hedge funds and institutional investors that are bullish contain Greg Poole’s Echo Street Capital Management, Richard Merage’s MIG Capital and D. E. Shaw’s D E Shaw. In terms of the portfolio weights assigned to each position SAYA Management allocated the biggest weight to Ball Corporation (NYSE:BLL), around 7.57% of its 13F portfolio. Chilton Investment Company is also relatively very bullish on the stock, designating 7.31 percent of its 13F equity portfolio to BLL.

Judging by the fact that Ball Corporation (NYSE:BLL) has experienced declining sentiment from the smart money, logic holds that there was a specific group of funds who were dropping their entire stakes in the second quarter. Interestingly, Steve Cohen’s Point72 Asset Management dumped the biggest position of the “upper crust” of funds tracked by Insider Monkey, worth about $11.1 million in stock, and Paul Marshall and Ian Wace’s Marshall Wace LLP was right behind this move, as the fund dumped about $9.2 million worth. These bearish behaviors are important to note, as total hedge fund interest was cut by 3 funds in the second quarter.

Let’s check out hedge fund activity in other stocks similar to Ball Corporation (NYSE:BLL). We will take a look at Kellogg Company (NYSE:K), Incyte Corporation (NASDAQ:INCY), Tencent Music Entertainment Group (NYSE:TME), Liberty Broadband Corp (NASDAQ:LBRDA), Liberty Broadband Corp (NASDAQ:LBRDK), Best Buy Co., Inc. (NYSE:BBY), and State Street Corporation (NYSE:STT). This group of stocks’ market valuations are closest to BLL’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| K | 33 | 418366 | -4 |

| INCY | 29 | 4432332 | -11 |

| TME | 30 | 538341 | 5 |

| LBRDA | 22 | 718343 | -4 |

| LBRDK | 58 | 3372154 | 13 |

| BBY | 33 | 1062886 | -4 |

| STT | 36 | 668259 | 2 |

| Average | 34.4 | 1601526 | -0.4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 34.4 hedge funds with bullish positions and the average amount invested in these stocks was $1602 million. That figure was $768 million in BLL’s case. Liberty Broadband Corp (NASDAQ:LBRDK) is the most popular stock in this table. On the other hand Liberty Broadband Corp (NASDAQ:LBRDA) is the least popular one with only 22 bullish hedge fund positions. Ball Corporation (NYSE:BLL) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for BLL is 50.1. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 23% in 2020 through October 30th and still beat the market by 20.1 percentage points. Hedge funds were also right about betting on BLL as the stock returned 28.3% since the end of Q2 (through 10/30) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Ball Corp (NYSE:BALL)

Follow Ball Corp (NYSE:BALL)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.