Is J.B. Hunt Transport Services, Inc. (NASDAQ:JBHT) a good investment right now? We check hedge fund and billionaire investor sentiment before delving into hours of research. Hedge funds spend millions of dollars on Ivy League graduates, expert networks, and get tips from investment bankers and industry insiders. Sure they sometimes fail miserably, but their consensus stock picks historically outperformed the market after adjusting for known risk factors.

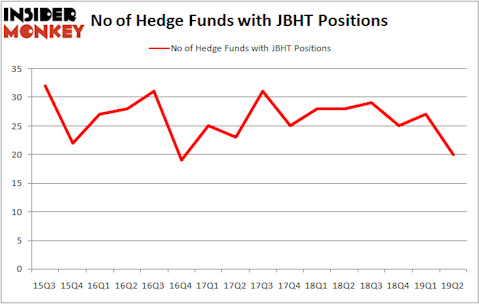

Is J.B. Hunt Transport Services, Inc. (NASDAQ:JBHT) worth your attention right now? Investors who are in the know are taking a pessimistic view. The number of long hedge fund bets were trimmed by 7 lately. Our calculations also showed that JBHT isn’t among the 30 most popular stocks among hedge funds (view the video below). JBHT was in 20 hedge funds’ portfolios at the end of June. There were 27 hedge funds in our database with JBHT holdings at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s analyze the fresh hedge fund action encompassing J.B. Hunt Transport Services, Inc. (NASDAQ:JBHT).

Hedge fund activity in J.B. Hunt Transport Services, Inc. (NASDAQ:JBHT)

At the end of the second quarter, a total of 20 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -26% from the first quarter of 2019. On the other hand, there were a total of 28 hedge funds with a bullish position in JBHT a year ago. With hedgies’ positions undergoing their usual ebb and flow, there exists a few key hedge fund managers who were adding to their holdings considerably (or already accumulated large positions).

James Dondero of Highland Capital Management

More specifically, Two Sigma Advisors was the largest shareholder of J.B. Hunt Transport Services, Inc. (NASDAQ:JBHT), with a stake worth $63.1 million reported as of the end of March. Trailing Two Sigma Advisors was Park Presidio Capital, which amassed a stake valued at $50.3 million. Echo Street Capital Management, D E Shaw, and Renaissance Technologies were also very fond of the stock, giving the stock large weights in their portfolios.

Seeing as J.B. Hunt Transport Services, Inc. (NASDAQ:JBHT) has witnessed a decline in interest from hedge fund managers, it’s safe to say that there is a sect of funds that slashed their positions entirely by the end of the second quarter. Interestingly, Doug Gordon, Jon Hilsabeck and Don Jabro’s Shellback Capital sold off the largest investment of the 750 funds followed by Insider Monkey, totaling close to $6.6 million in stock, and Cristan Blackman’s Empirical Capital Partners was right behind this move, as the fund said goodbye to about $6.1 million worth. These transactions are intriguing to say the least, as aggregate hedge fund interest fell by 7 funds by the end of the second quarter.

Let’s also examine hedge fund activity in other stocks similar to J.B. Hunt Transport Services, Inc. (NASDAQ:JBHT). These stocks are Tradeweb Markets Inc. (NASDAQ:TW), Reinsurance Group of America Inc (NYSE:RGA), Invesco Ltd. (NYSE:IVZ), and Carvana Co. (NYSE:CVNA). This group of stocks’ market valuations are closest to JBHT’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TW | 37 | 489651 | 37 |

| RGA | 26 | 473703 | 3 |

| IVZ | 20 | 210595 | -4 |

| CVNA | 45 | 1801168 | 4 |

| Average | 32 | 743779 | 10 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 32 hedge funds with bullish positions and the average amount invested in these stocks was $744 million. That figure was $230 million in JBHT’s case. Carvana Co. (NYSE:CVNA) is the most popular stock in this table. On the other hand Invesco Ltd. (NYSE:IVZ) is the least popular one with only 20 bullish hedge fund positions. Compared to these stocks J.B. Hunt Transport Services, Inc. (NASDAQ:JBHT) is even less popular than IVZ. Hedge funds clearly dropped the ball on JBHT as the stock delivered strong returns, though hedge funds’ consensus picks still generated respectable returns. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. A small number of hedge funds were also right about betting on JBHT as the stock returned 21.4% during the third quarter and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.