Insider Monkey has processed numerous 13F filings of hedge funds and successful value investors to create an extensive database of hedge fund holdings. The 13F filings show the hedge funds’ and successful investors’ positions as of the end of the second quarter. You can find articles about an individual hedge fund’s trades on numerous financial news websites. However, in this article we will take a look at their collective moves over the last 5 years and analyze what the smart money thinks of US Foods Holding Corp. (NYSE:USFD) based on that data and determine whether they were really smart about the stock.

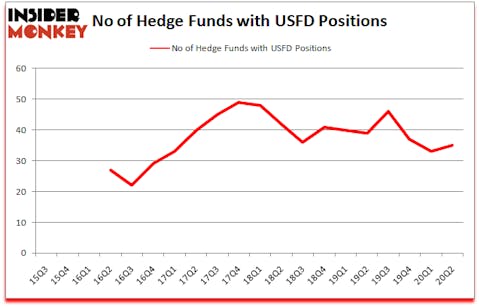

US Foods Holding Corp. (NYSE:USFD) has seen an increase in support from the world’s most elite money managers of late. US Foods Holding Corp. (NYSE:USFD) was in 35 hedge funds’ portfolios at the end of the second quarter of 2020. The all time high for this statistics is 49. There were 33 hedge funds in our database with USFD positions at the end of the first quarter. Our calculations also showed that USFD isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

In the eyes of most market participants, hedge funds are assumed to be worthless, outdated financial vehicles of years past. While there are more than 8000 funds trading today, Our experts hone in on the aristocrats of this group, around 850 funds. These investment experts handle most of the smart money’s total capital, and by paying attention to their inimitable investments, Insider Monkey has figured out a few investment strategies that have historically outrun Mr. Market. Insider Monkey’s flagship short hedge fund strategy outstripped the S&P 500 short ETFs by around 20 percentage points annually since its inception in March 2017. Our portfolio of short stocks lost 34% since February 2017 (through August 17th) even though the market was up 53% during the same period. We just shared a list of 8 short targets in our latest quarterly update .

Scott Ferguson of Sachem Head Capital

At Insider Monkey we scour multiple sources to uncover the next great investment idea. For example, Federal Reserve has been creating trillions of dollars electronically to keep the interest rates near zero. We believe this will lead to inflation and boost precious metals prices. So, we are checking out this junior gold mining stock. Legal marijuana is one of the fastest growing industries right now, so we are also checking out stock pitches like “the Starbucks of cannabis” to identify the next tenbagger. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We go through lists like the 10 most profitable companies in the world to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. Now we’re going to take a glance at the fresh hedge fund action regarding US Foods Holding Corp. (NYSE:USFD).

What does smart money think about US Foods Holding Corp. (NYSE:USFD)?

At Q2’s end, a total of 35 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 6% from the first quarter of 2020. The graph below displays the number of hedge funds with bullish position in USFD over the last 20 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Ricky Sandler’s Eminence Capital has the most valuable position in US Foods Holding Corp. (NYSE:USFD), worth close to $178.6 million, accounting for 1.8% of its total 13F portfolio. Sitting at the No. 2 spot is Scott Ferguson of Sachem Head Capital, with a $88.7 million position; 6.3% of its 13F portfolio is allocated to the company. Some other hedge funds and institutional investors with similar optimism comprise D. E. Shaw’s D E Shaw, John Overdeck and David Siegel’s Two Sigma Advisors and Ken Griffin’s Citadel Investment Group. In terms of the portfolio weights assigned to each position Cloverdale Capital Management allocated the biggest weight to US Foods Holding Corp. (NYSE:USFD), around 8.22% of its 13F portfolio. Sachem Head Capital is also relatively very bullish on the stock, earmarking 6.32 percent of its 13F equity portfolio to USFD.

Now, specific money managers have jumped into US Foods Holding Corp. (NYSE:USFD) headfirst. King Street Capital, managed by Brian J. Higgins, initiated the most outsized position in US Foods Holding Corp. (NYSE:USFD). King Street Capital had $31.6 million invested in the company at the end of the quarter. David Brown’s Hawk Ridge Management also initiated a $28.2 million position during the quarter. The other funds with new positions in the stock are Will Cook’s Sunriver Management, Traci Lerner’s Chescapmanager LLC, and Kamyar Khajavi’s MIK Capital.

Let’s now review hedge fund activity in other stocks similar to US Foods Holding Corp. (NYSE:USFD). We will take a look at Devon Energy Corporation (NYSE:DVN), MAXIMUS, Inc. (NYSE:MMS), Nomad Foods Limited (NYSE:NOMD), Landstar System, Inc. (NASDAQ:LSTR), II-VI, Inc. (NASDAQ:IIVI), CAE, Inc. (NYSE:CAE), and Noble Energy, Inc. (NASDAQ:NBL). This group of stocks’ market values match USFD’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DVN | 45 | 403872 | 3 |

| MMS | 26 | 158400 | 0 |

| NOMD | 34 | 437867 | 0 |

| LSTR | 23 | 207278 | 1 |

| IIVI | 28 | 176363 | 8 |

| CAE | 14 | 106251 | -6 |

| NBL | 38 | 364034 | 3 |

| Average | 29.7 | 264866 | 1.3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 29.7 hedge funds with bullish positions and the average amount invested in these stocks was $265 million. That figure was $562 million in USFD’s case. Devon Energy Corporation (NYSE:DVN) is the most popular stock in this table. On the other hand CAE, Inc. (NYSE:CAE) is the least popular one with only 14 bullish hedge fund positions. US Foods Holding Corp. (NYSE:USFD) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for USFD is 62.3. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 33% in 2020 through the end of August and still beat the market by 23.2 percentage points. Hedge funds were also right about betting on USFD as the stock returned 23.5% since Q2 and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Us Foods Holding Corp. (NYSE:USFD)

Follow Us Foods Holding Corp. (NYSE:USFD)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.