The latest 13F reporting period has come and gone, and Insider Monkey have plowed through 823 13F filings that hedge funds and well-known value investors are required to file by the SEC. The 13F filings show the funds’ and investors’ portfolio positions as of June 30th, when the S&P 500 Index was trading around the 3100 level. Since the end of March, investors decided to bet on the economic recovery and a stock market rebound. S&P 500 Index returned more than 50% since its bottom. In this article you are going to find out whether hedge funds thought General Dynamics Corporation (NYSE:GD) was a good investment heading into the third quarter and how the stock traded in comparison to the top hedge fund picks.

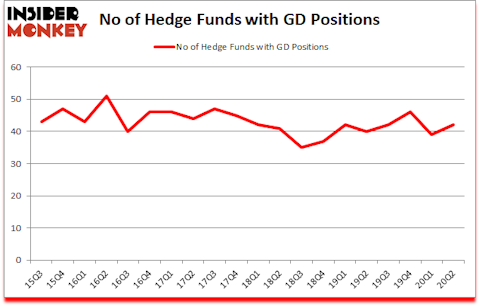

General Dynamics Corporation (NYSE:GD) was in 42 hedge funds’ portfolios at the end of June. The all time high for this statistics is 51. GD has seen an increase in enthusiasm from smart money in recent months. There were 39 hedge funds in our database with GD positions at the end of the first quarter. Our calculations also showed that GD isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s monthly stock picks returned 101% since March 2017 and outperformed the S&P 500 ETFs by more than 56 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Lee Ainslie of Maverick Capital

At Insider Monkey we scour multiple sources to uncover the next great investment idea. For example, legal marijuana is one of the fastest growing industries right now, so we are checking out stock pitches like “the Starbucks of cannabis” to identify the next tenbagger. We go through lists like the 10 most profitable companies in the world to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Hedge fund sentiment towards Tesla reached its all time high at the end of 2019 and Tesla shares more than tripled this year. We are trying to identify other EV revolution winners, so if you have any good ideas send us an email. Now let’s take a gander at the recent hedge fund action encompassing General Dynamics Corporation (NYSE:GD).

How have hedgies been trading General Dynamics Corporation (NYSE:GD)?

At the end of June, a total of 42 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 8% from the first quarter of 2020. By comparison, 40 hedge funds held shares or bullish call options in GD a year ago. With hedge funds’ sentiment swirling, there exists a select group of notable hedge fund managers who were increasing their holdings meaningfully (or already accumulated large positions).

The largest stake in General Dynamics Corporation (NYSE:GD) was held by Longview Asset Management, which reported holding $4814.5 million worth of stock at the end of September. It was followed by Farallon Capital with a $172.1 million position. Other investors bullish on the company included AQR Capital Management, Citadel Investment Group, and Markel Gayner Asset Management. In terms of the portfolio weights assigned to each position Longview Asset Management allocated the biggest weight to General Dynamics Corporation (NYSE:GD), around 96.77% of its 13F portfolio. Axel Capital Management is also relatively very bullish on the stock, setting aside 14.63 percent of its 13F equity portfolio to GD.

As industrywide interest jumped, key money managers have been driving this bullishness. Abrams Bison Investments, managed by Gavin M. Abrams, initiated the most outsized position in General Dynamics Corporation (NYSE:GD). Abrams Bison Investments had $49 million invested in the company at the end of the quarter. Anand Parekh’s Alyeska Investment Group also made a $40.2 million investment in the stock during the quarter. The following funds were also among the new GD investors: Dmitry Balyasny’s Balyasny Asset Management, Anna Nikolayevsky’s Axel Capital Management, and Frank Brosens’s Taconic Capital.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as General Dynamics Corporation (NYSE:GD) but similarly valued. We will take a look at Vodafone Group Plc (NASDAQ:VOD), National Grid plc (NYSE:NGG), Ferrari N.V. (NYSE:RACE), Koninklijke Philips NV (NYSE:PHG), Ambev SA (NYSE:ABEV), UBS Group AG (NYSE:UBS), and Baidu, Inc. (NASDAQ:BIDU). This group of stocks’ market caps are closest to GD’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| VOD | 16 | 726090 | 2 |

| NGG | 2 | 430749 | -4 |

| RACE | 25 | 1361698 | -4 |

| PHG | 6 | 83694 | -5 |

| ABEV | 13 | 517659 | 4 |

| UBS | 16 | 302408 | 1 |

| BIDU | 49 | 2993009 | 0 |

| Average | 18.1 | 916472 | -0.9 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18.1 hedge funds with bullish positions and the average amount invested in these stocks was $916 million. That figure was $5492 million in GD’s case. Baidu, Inc. (NASDAQ:BIDU) is the most popular stock in this table. On the other hand National Grid plc (NYSE:NGG) is the least popular one with only 2 bullish hedge fund positions. General Dynamics Corporation (NYSE:GD) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for GD is 75.3. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 33% in 2020 through the end of August and beat the market by 23.2 percentage points. Unfortunately GD wasn’t nearly as popular as these 10 stocks and hedge funds that were betting on GD were disappointed as the stock returned 0.7% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 10 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Follow General Dynamics Corp (NYSE:GD)

Follow General Dynamics Corp (NYSE:GD)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.