As we already know from media reports and hedge fund investor letters, many hedge funds lost money in fourth quarter, blaming macroeconomic conditions and unpredictable events that hit several sectors, with technology among them. Nevertheless, most investors decided to stick to their bullish theses and their long-term focus allows us to profit from the recent declines. In particular, let’s take a look at what hedge funds think about Logitech International SA (NASDAQ:LOGI) in this article.

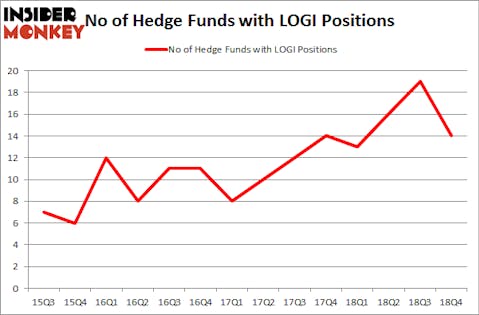

Logitech International SA (NASDAQ:LOGI) investors should pay attention to a decrease in hedge fund interest in recent months. LOGI was in 14 hedge funds’ portfolios at the end of the fourth quarter of 2018. There were 19 hedge funds in our database with LOGI positions at the end of the previous quarter. Our calculations also showed that LOGI isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 20.7% year to date (through March 12th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 32 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s view the latest hedge fund action encompassing Logitech International SA (NASDAQ:LOGI).

What does the smart money think about Logitech International SA (NASDAQ:LOGI)?

At the end of the fourth quarter, a total of 14 of the hedge funds tracked by Insider Monkey were long this stock, a change of -26% from the previous quarter. By comparison, 13 hedge funds held shares or bullish call options in LOGI a year ago. With the smart money’s positions undergoing their usual ebb and flow, there exists a few key hedge fund managers who were increasing their holdings significantly (or already accumulated large positions).

More specifically, Renaissance Technologies was the largest shareholder of Logitech International SA (NASDAQ:LOGI), with a stake worth $82.1 million reported as of the end of September. Trailing Renaissance Technologies was Two Sigma Advisors, which amassed a stake valued at $27.7 million. Blue Mountain Capital, Marshall Wace LLP, and Columbus Circle Investors were also very fond of the stock, giving the stock large weights in their portfolios.

Seeing as Logitech International SA (NASDAQ:LOGI) has faced declining sentiment from the entirety of the hedge funds we track, it’s safe to say that there were a few hedgies who were dropping their entire stakes last quarter. Interestingly, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital sold off the largest stake of all the hedgies watched by Insider Monkey, comprising about $62 million in stock. Matthew Hulsizer’s fund, PEAK6 Capital Management, also cut its stock, about $1.8 million worth. These transactions are interesting, as aggregate hedge fund interest fell by 5 funds last quarter.

Let’s go over hedge fund activity in other stocks similar to Logitech International SA (NASDAQ:LOGI). We will take a look at Haemonetics Corporation (NYSE:HAE), AngloGold Ashanti Limited (NYSE:AU), Affiliated Managers Group, Inc. (NYSE:AMG), and Genpact Limited (NYSE:G). All of these stocks’ market caps resemble LOGI’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HAE | 20 | 566902 | -2 |

| AU | 12 | 322457 | 2 |

| AMG | 27 | 505230 | -5 |

| G | 22 | 428841 | 1 |

| Average | 20.25 | 455858 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20.25 hedge funds with bullish positions and the average amount invested in these stocks was $456 million. That figure was $161 million in LOGI’s case. Affiliated Managers Group, Inc. (NYSE:AMG) is the most popular stock in this table. On the other hand AngloGold Ashanti Limited (NYSE:AU) is the least popular one with only 12 bullish hedge fund positions. Logitech International SA (NASDAQ:LOGI) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 15 most popular stocks among hedge funds returned 21.3% through April 8th and outperformed the S&P 500 ETF (SPY) by more than 5 percentage points. A few hedge funds were also right about betting on LOGI as the stock returned 30.2% and outperformed the market as well. You can see the entire list of these shrewd hedge funds here.

Disclosure: None. This article was originally published at Insider Monkey.