Coronavirus is probably the #1 concern in investors’ minds right now. It should be. On February 27th we published this article and predicted that a US recession is imminent and US stocks will go down by at least 20% in the next 3-6 months. We also told you to short the market ETFs and buy long-term bonds. Investors who agreed with us and replicated these trades are up double digits whereas the market is down double digits.

Is Lululemon Athletica inc. (NASDAQ:LULU) a good place to invest some of your money right now? We can gain invaluable insight to help us answer that question by studying the investment trends of top investors, who employ world-class Ivy League graduates, who are given immense resources and industry contacts to put their financial expertise to work. The top picks of these firms have historically outperformed the market when we account for known risk factors, making them very valuable investment ideas.

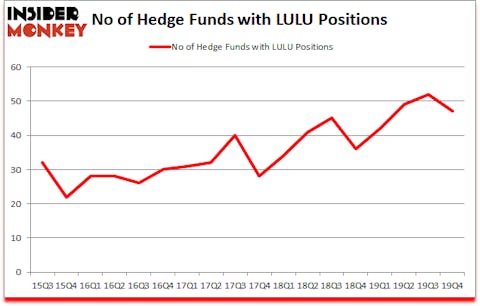

Lululemon Athletica inc. (NASDAQ:LULU) investors should pay attention to a decrease in activity from the world’s largest hedge funds lately. LULU was in 47 hedge funds’ portfolios at the end of the fourth quarter of 2019. There were 52 hedge funds in our database with LULU positions at the end of the previous quarter. Our calculations also showed that LULU isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video below for Q3 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research was able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by more than 41 percentage points since March 2017 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 35.3% through March 3rd. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

David E. Shaw of D.E. Shaw

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences, and and go through short-term trade recommendations like this one. We even check out the recommendations of services with hard to believe track records. In January, we recommended a long position in one of the most shorted stocks in the market, and that stock returned more than 50% despite the large losses in the market since our recommendation. Keeping this in mind we’re going to go over the fresh hedge fund action encompassing Lululemon Athletica inc. (NASDAQ:LULU).

What does smart money think about Lululemon Athletica inc. (NASDAQ:LULU)?

At the end of the fourth quarter, a total of 47 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -10% from the third quarter of 2019. Below, you can check out the change in hedge fund sentiment towards LULU over the last 18 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists a select group of noteworthy hedge fund managers who were boosting their holdings substantially (or already accumulated large positions).

Among these funds, D E Shaw held the most valuable stake in Lululemon Athletica inc. (NASDAQ:LULU), which was worth $236.8 million at the end of the third quarter. On the second spot was AQR Capital Management which amassed $164.1 million worth of shares. Citadel Investment Group, Arrowstreet Capital, and Marshall Wace LLP were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Thames Capital Management allocated the biggest weight to Lululemon Athletica inc. (NASDAQ:LULU), around 2.58% of its 13F portfolio. Navellier & Associates is also relatively very bullish on the stock, dishing out 2.3 percent of its 13F equity portfolio to LULU.

Since Lululemon Athletica inc. (NASDAQ:LULU) has faced a decline in interest from hedge fund managers, it’s safe to say that there was a specific group of hedge funds that slashed their entire stakes by the end of the third quarter. Intriguingly, Gabriel Plotkin’s Melvin Capital Management dumped the largest position of all the hedgies monitored by Insider Monkey, totaling an estimated $154 million in stock, and Dmitry Balyasny’s Balyasny Asset Management was right behind this move, as the fund sold off about $42.5 million worth. These moves are interesting, as total hedge fund interest dropped by 5 funds by the end of the third quarter.

Let’s now take a look at hedge fund activity in other stocks similar to Lululemon Athletica inc. (NASDAQ:LULU). These stocks are Consolidated Edison, Inc. (NYSE:ED), Equity Residential (NYSE:EQR), TransDigm Group Incorporated (NYSE:TDG), and IQVIA Holdings, Inc. (NYSE:IQV). This group of stocks’ market values are closest to LULU’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ED | 26 | 1204354 | 2 |

| EQR | 30 | 308617 | 4 |

| TDG | 63 | 5538787 | 3 |

| IQV | 64 | 3822679 | -4 |

| Average | 45.75 | 2718609 | 1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 45.75 hedge funds with bullish positions and the average amount invested in these stocks was $2719 million. That figure was $1133 million in LULU’s case. IQVIA Holdings, Inc. (NYSE:IQV) is the most popular stock in this table. On the other hand Consolidated Edison, Inc. (NYSE:ED) is the least popular one with only 26 bullish hedge fund positions. Lululemon Athletica inc. (NASDAQ:LULU) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks lost 12.9% in 2020 through March 9th but still beat the market by 1.9 percentage points. Hedge funds were also right about betting on LULU, though not to the same extent, as the stock returned -13.8% during the first two months of 2020 (through March 9th) and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.